It was cited by the Kerala High Court that financial grants furnished before the taxpayer for encircling daily functional expenses are not entitled as payment (consideration) for any services that the taxpayer may be furnishing and are not accountable to tax.

The Bench of Justice Gopinath P. observed that “The assessee has only received grants to meet its day-to-day expenses including salary, allowances etc. Such payment cannot be deemed to be a consideration for the alleged services rendered or for goods supplied by the assessee. The revenue has no case that the activity of the assessee falls within Scheduled-I”.

Read Also: Delhi HC Quashes GST Cancellation Order Due to Lack of Specifics in Show Cause Notice

The applicant is 99.99% owned by the Government of Kerala. It buys and supplies the IT hardware before the government and supports the schools based on the coordinates of the General Education Department. The functions of the taxpayers are funded via the Kerala Infrastructure Investment Fund Board (KIIFB), a statutory body under the Kerala government.

The order passed by the Additional/Joint Commissioner (3rd respondent), was contested under the taxpayer which carried that the taxpayer is obligated to file the Goods and Services Tax (GST) Rs 99,05,74,260. The order is on the foundation of the premise that the taxpayer is involved in a composite supply of goods and services before the schools and is obligated to file the GST.

It was furnished via the taxpayer that the transactions between the taxpayer and the Government and specific supported schools amount to the supply as cited in Section 7 of the CGST / SGST Acts. Hence no recommendation is there in the Show Cause Notice (SCN) or in the order that recommends that the taxpayer’s measure shall amount to an activity cited in Schedule I of the CGST Act.

It was marked under the bench that while the adjudicating authority took into consideration that the taxpayer is the owner of the goods he moves to mention that the ownership of the goods entrusts in the General Education Department. Such findings are the opposite.

The bench looked into section 7 of the CGST Act and observed that for the transactions that do not come into Schedule I, consideration is a significant ingredient in specifying that there is either a supply of goods or services. Nothing is there in the order that shall specify that the taxpayer has obtained any consideration from the government, the KIIFB, or the General Education Department as consideration for the supply of goods or services.

As per the bench, “The assessee has only received grants to meet its day-to-day expenses including salary, allowances etc. Such payment cannot be deemed to be a consideration for the alleged services rendered or for goods supplied by the assessee. The revenue has no case that the activity of the assessee falls within Scheduled-I.”

The bench in the aforesaid view has permitted the petition and quashes the order.

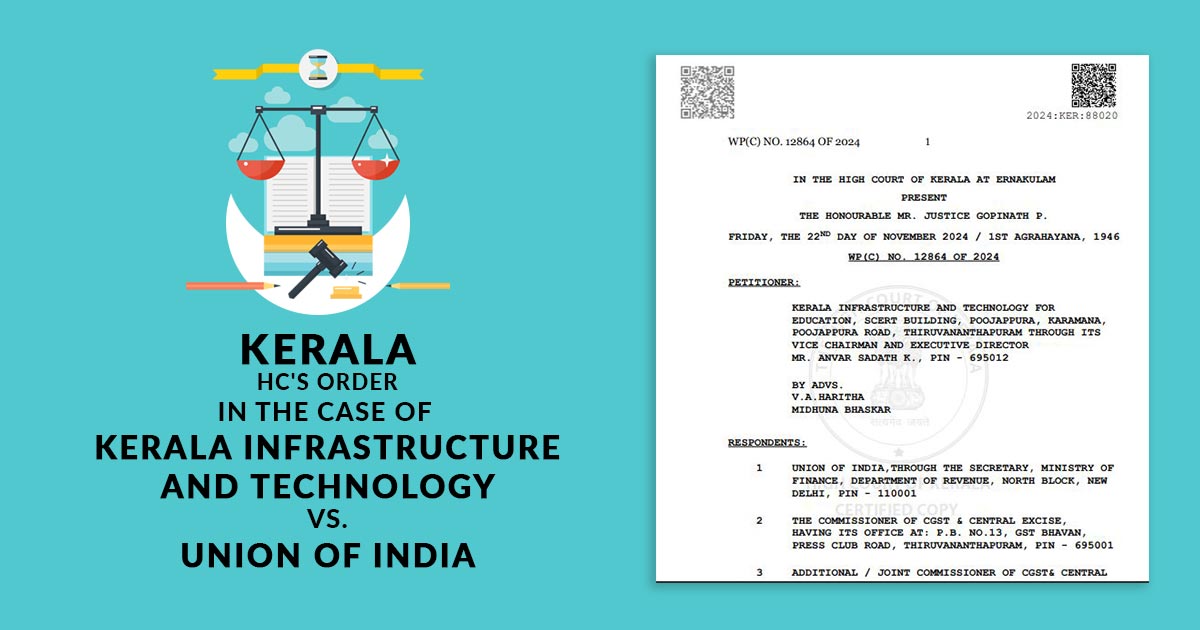

| Case Title | Kerala Infrastructure and Technology For Education vs. Union Of India |

| Citation | WP(C) NO. 12864 OF 2024 |

| Date | 22.11.2024 |

| Counsel for Petitioner | V.A. Haritha and Midhuna Bhaskar |

| Counsel for Respondent | P.G. Jayashankar |

| Kerala High Court | Read Order |