The Karnataka High Court has directed the state tax department to refund the GST Input Tax Credit (ITC), ruling that it cannot be denied solely due to the non-issuance of a credit note by the other party to the contract.

It was contended by the revenue department that the order of the Single Judge whereby the respondent taxpayer, Nam Estates Private Limited, which has been favoured with the refund decline orders on 6.0.02021 and its confirmation in the appeal order 30.09.2023 has been quashed.

Also, the taxpayer’s refund application on 5.7.2021 has been permitted, the applicants are been asked to refund the whole GST of Rs 2,53,58,268 within 8 weeks.

The Respondent entered into a contract with M/s Mavin Switch Gears and Control Private Limited for the supply, installation, and commissioning of gas-insulated Substations (GIS)/Conventional Substations and extra-high voltage transmission lines.

Against a bank guarantee provided by the supplier, an advance payment of Rs. 14,08,79,262 was made. Upon receipt of this payment, M/s Mavin Switch Gears and Control Private Limited issued a tax invoice on 01-08-2017, including GST of Rs. 2,53,58,268/- and declared this transaction in their GSTR-1 and GSTR-3B returns.

The supplier is unable to deliver the goods and services, resulting in the cancellation of the contract in March 2021. Therefore, the advance payment was recovered via encashing the bank guarantee. When the case was this, then the respondent submitted a refund application in Form RFD-01 dated 5-7-2021, asking for the refund of the GST amount filed to the tune of Rs 2,53,58,268.

The application has been reviewed by the assistant commissioner of commercial taxes and issued a notice (RFD-08) dated 27.08.2021, showing that the refund eligibility under section 54 of the CGST/SGST Act, 2017 was not specified based on the taxpayer’s submissions. Since no response was received from the taxpayer, a refund rejection order was passed and issued on 06-09-2021.

Respondent before the JCCT(Appeals)-1 has submitted a plea against the refund rejection order dated 6.9.2021. The appellate authority shows that the supplier, who was the taxpayer, was liable to issue the credit note for the cancelled contract and declare these in their tax return, adjusting the tax obligation. The appellate authority concluded that the taxpayer cannot be asked for a refund of SGST & CGST as the tax filed on the advance was the responsibility of the supplier.

AAG furnished that no refund could be granted as a case of the course until the need of Section 54 of Karnataka Goods and Service Tax Act, 2017, appears to be attractive at first blush. It was claimed by the respondent that the revenue cannot have lowered the refund on the ground that the credit note was not issued via the other party to the contract i.e the vendor on whom the duty to file the tax rested since the question issuing such a note shall not appear since goods were never delivered and that there was a violation of contract because of which it was abandoned and the price paid in advance was retrieved by encashing the bank guarantee.

Read Also:- Karnataka HC Upholds IT Dept’s Prosecution for Willful ITR Default

The division bench of Justice Krishna S Dixit and Justice G Basavaraja, while rejecting the petition, asked the appellant to refund the GST amount to the respondent taxpayer within 8 weeks, failing which they run the risk of contempt proceedings, and also they are obligated to file the interest at the regulatory admissible rate, which may be recovered on such payment, from the officials making mistakes.

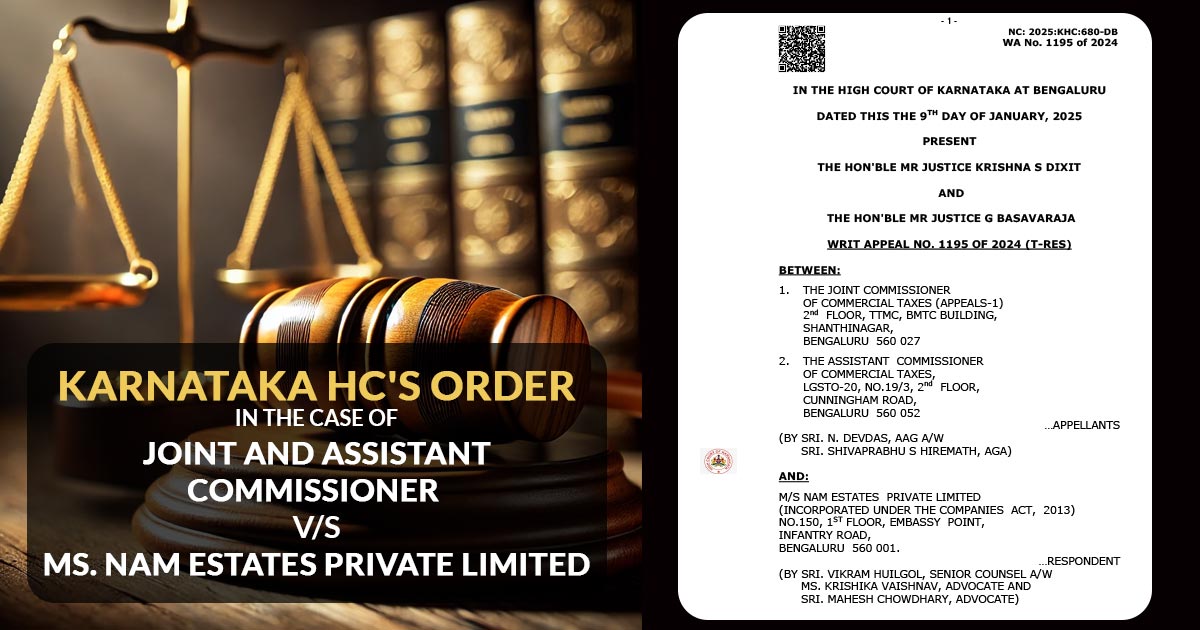

| Case Title | Joint and Assistant Commissioner v/s Ms. Nam Estates Private Limited |

| Citation | WA No. 1195 of 2024 |

| Date | 09.01.2025 |

| Counsel For Appellant | Sri. N. Devdas, Aag A/W Sri. Shivaprabhu S Hiremath, Aga |

| Counsel For Respondent | Sri. Vikram Huilgol, Senior Counsel A/w Ms. Krishika Vaishnav, Advocate and Sri. Mahesh Chowdhary, Advocate |

| Karnataka High Court | Read More |