The Karnataka High Court, in a ruling, has held in favour of M/s Safan Fasteners, setting aside the order of the tax department that restricted the Electronic Credit Ledger (ECL) of the company under Rule 86A of the Central Goods and Services Tax (CGST) Rules.

The court said that the measure was opted without allotting an obligatory pre-decisional hearing, therefore breaching the principles of natural justice.

The case is concerned with the decision of the Assistant Commissioner to restrict the GST Input Tax Credit (ITC) of Safan Fasteners based only on the reports from the legislation authorities without performing an independent inquiry or furnishing the company a chance to present its case.

The same method is been discovered by the court to be a borrowed satisfaction and does not have the required independent reasoning needed by the law.

Justice S.R. Krishna Kumar, presiding over the case, specified that while Rule 86A does not obligate a pre-decisional hearing, this mandate is assumed when measures secure influential civil outcomes. The order is invalid due to a lack of an independent reason to believe and failure to furnish a hearing.

The ruling requires tax authorities to mandatorily follow the due process, which ensures that the taxpayers are granted a fair chance to be heard before any unallowable measures are levied on their tax credits. It shows the significance of independent assessment by the tax officials instead of relying only on external reports.

Read Also: GST Credit Ledger Can’t Be Blocked Under Rule 86A Without a Valid Reason

The ruling is anticipated to have far-reaching implications for the GST administration laws, for ITC blocking. Tax professionals and businesses favour the decision as a reaffirmation of the fundamental rights of the taxpayers and a reminder to the authorities to practice their powers judiciously.

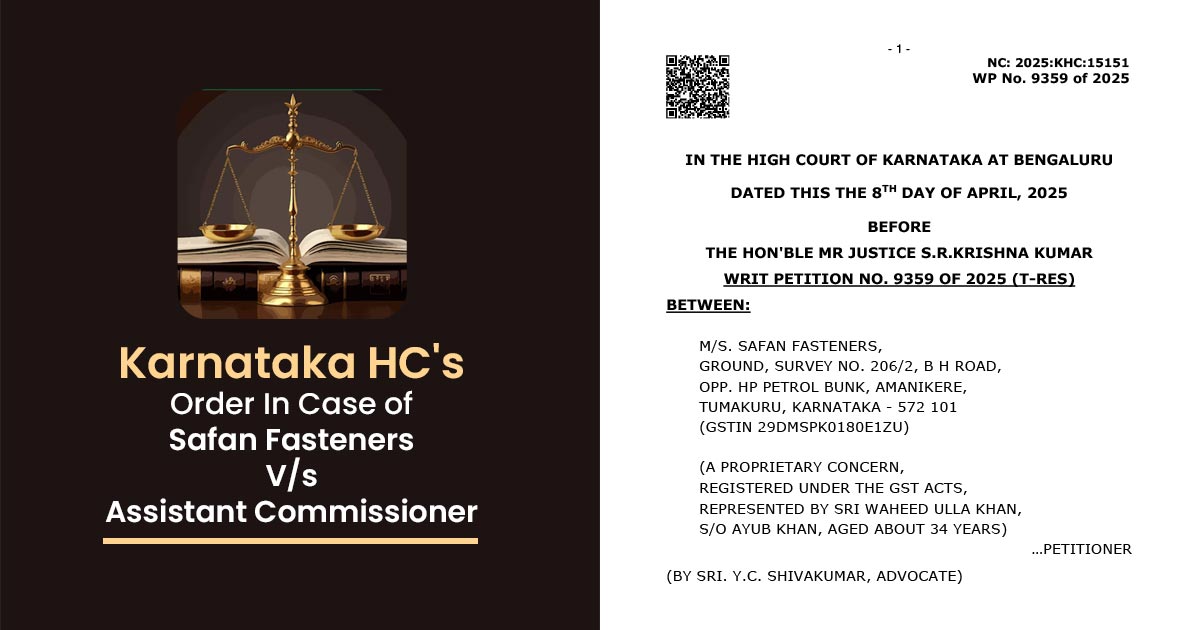

| Case Title | Safan Fasteners Vs Assistant Commissioner |

| R/Special Civil Application No. | Writ Petition No. 9359 of 2025 (T-Res) |

| Counsel For Appellant | Sri. Y.C. Shivakumar |

| Counsel For Respondent | Sri. Aravind V. Chavan for R1 and R3, Sri. K. Hemakumar |

| Karnataka High Court | Read Order |