The Karnataka Appellate Authority for Advance Ruling (AAAR) held that no Goods and Services Tax (GST) can be imposed on additional surcharges paid by Open Access (OA) consumers to government-owned electricity suppliers.

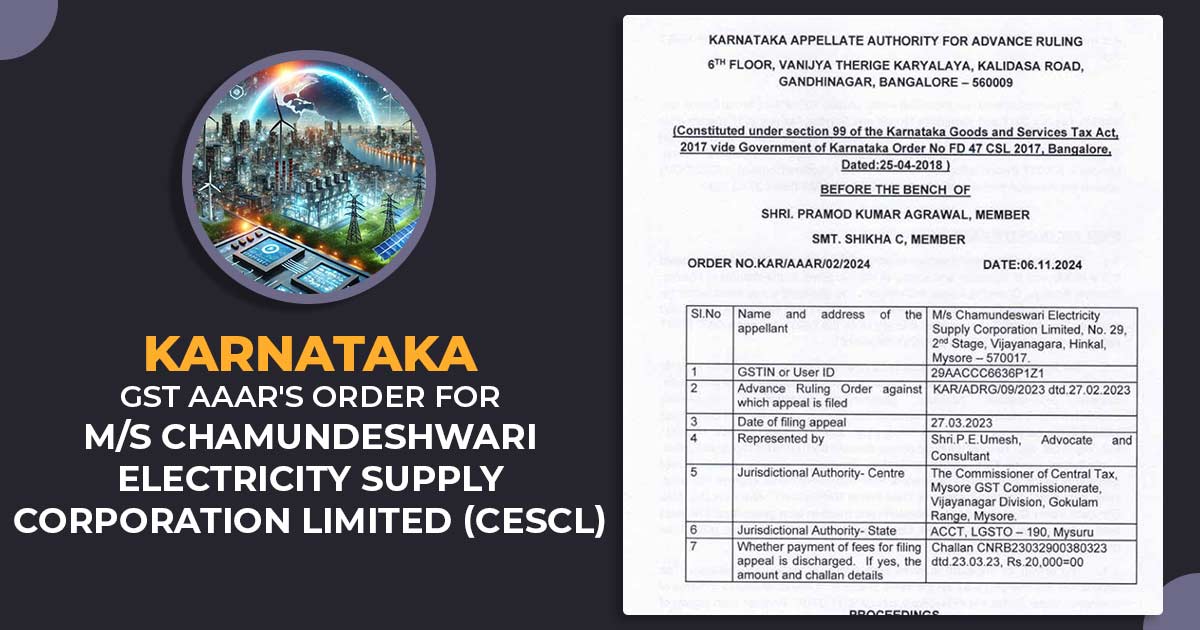

The application before the AAAR was filed via M/s Chamundeshwari Electricity Supply Corporation Limited (CESCL), a public sector company owned by the Government of Karnataka, committed to the distribution and supply of electricity in the districts of Mysore, Mandya, Kodagu, Chamarajanagar, and Hassan.

Also Read: What If Electricity Comes Under GST India?

CESCL is registered under the Central Goods and Services Tax Act, 2017 (CGST Act) and the Karnataka Goods and Services Tax Act, 2017 (KGST Act).

The additional surcharge is a regulatory levy u/s 42(4) of the Electricity Act, 2003, and is collected to recover stranded fixed costs made via electricity distribution companies like CESCL.

CESCL does not levy the GST on the supply of electrical energy and distribution of electricity, as these activities are waived under Sl. No. 104 of Notification No. 2/2017-CT(R) and Sl. No. 25 of GST Notification No. 12/2017-CT(R).

However, the company levies GST on diverse support services such as application fees, registration fees, meter testing charges, and installation charges, among others. The additional surcharge collected from OA Consumers is part of the tariff approved by the Karnataka Electricity Regulatory Commission (KERC) and is not a standalone charge.

OA consumers are the entities that purchase electricity from private generators instead of CESCL, invoking the open access clause under the power supply agreements (PSAs). CESCL is still liable to pay fixed costs to its power generators under Power Purchase Agreements (PPAs) when OA consumers choose to buy electricity from private generators.

Read Order:- Karnataka HC: GST Exemption Can’t Be Denied to Pilots Trainer for Forgetting GSTIN

CESCL to recover these stranded fixed costs imposes an additional surcharge on OA Consumers, as allowed u/s 42(4) of the Electricity Act, 2003, read with the Tariff Policy, 2016, the National Electricity Policy, and the Karnataka Electricity Regulatory Commission (KERC) Regulations.

Authority for Advance Ruling (AAR) in the preceding phase has carried that the additional surcharge collected via CESCL was a consideration to tolerate an act and hence levies to tax u/s 7(1) of the CGST Act. CESCL appealed this decision, claiming that the additional surcharge was not a consideration for any supply of goods or services but instead a recovery of stranded fixed costs obligated by law.

Recommended: Karnataka AAR: GST Levy on Extra Surcharges Under Electricity Act

The two-member Bench of the AAAR, Pramod Kumar Agrawal, and Shikha C noted that the additional surcharge imposed under the Electricity Act is ancillary to the principal supply of electricity, which is waived from GST under Notification No. 2/2017-CT(R) and Notification No. 12/2017-CT(R).

Also, AAAR referred to the CBIC GST Circular No. 178/10/2022-GST, which cited that payments like liquidated damages or penalties do not include consideration for tolerating an act unless there is an independent agreement to do so.

As per that AAAR set aside the ruling of AAR and carried that the additional surcharge collected by CESCL is waived from GST since it forms part of the tariff for the supply and distribution of electricity, which is waived under Notification No. 2/2017-CT(R) and Notification No. 12/2017-CT(R).

| Applicant Name | M/s Chamundeshwari Electricity Supply Corporation Limited |

| GSTIN of the applicant | 29AACCC6636P1Z1 |

| Date | 06.11.2024 |

| Represented | Shri P.E Umesh Advocate and Consultant |

| Karnataka GST AAAR | Read Order |