For both individuals and enterprises, filing Income tax returns is a yearly obligation. Even after having the digitalisation of the process, taxpayers are facing issues that can delay the submissions or cause intricacy. This trend will remain the same due to technical malfunctions on government portals and manual data entry errors.

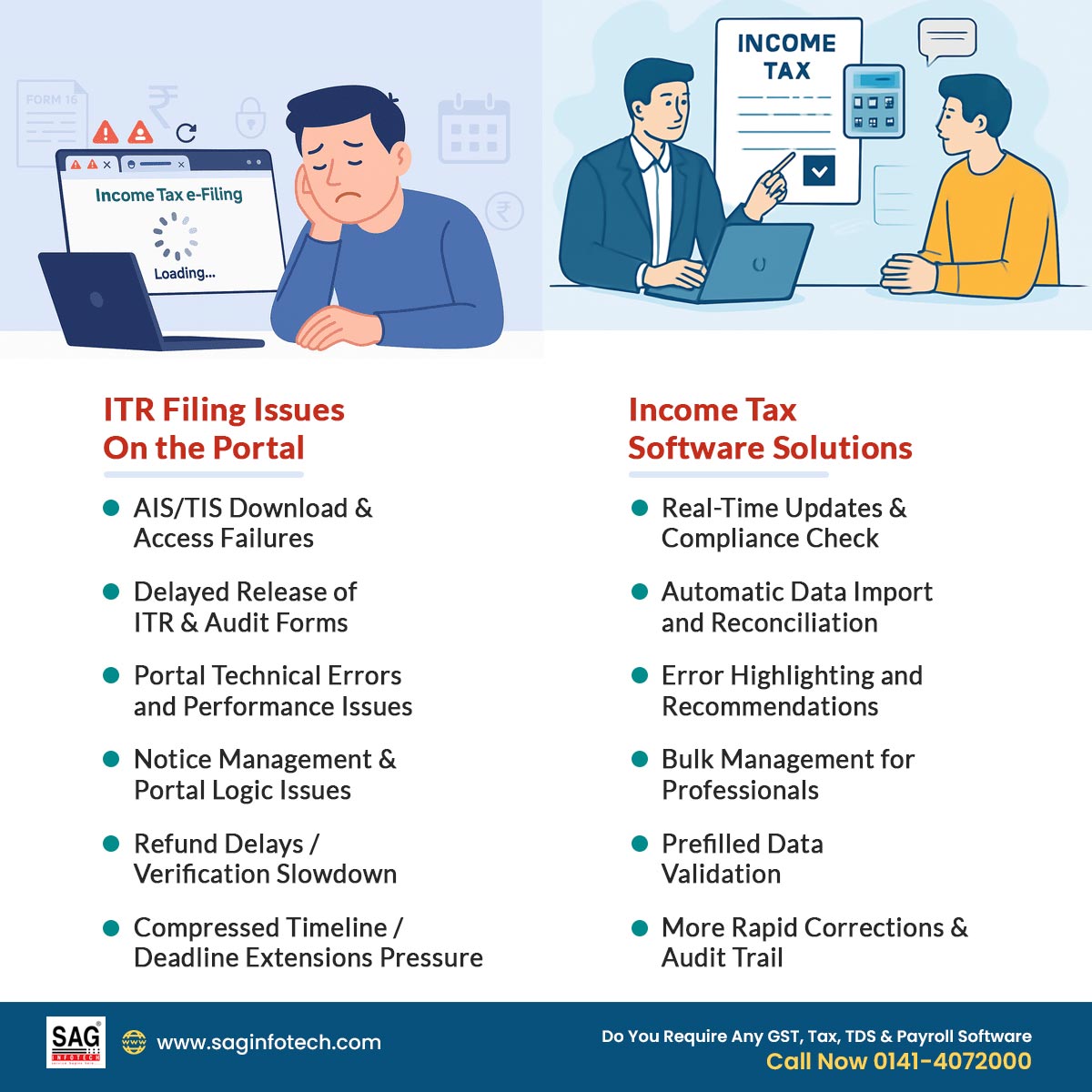

ITR Filing Issues On the Portal

Here are some major issues on the income tax portal that are faced by taxpayers:-

AIS/TIS Download & Access Failures

- As per the report, many taxpayers and Chartered Accountants (CAs) cannot download AIS or TIS from the portal. It may be the portal’s sluggishness, or it exhibits errors/”not available” messages.

- Confusion can arise from such mismatches concerning what income or deductions to report, the risk of notices, etc.

Delayed Release of ITR & Audit Forms

- Many ITR forms (ITR 5, 6, 7, etc.) and audit schedules were released belatedly, often only in July-August instead of early in the fiscal year. This reduces the time to prepare returns.

- Late availability of utilities/tools mandated to fill these forms leads to delays.

Portal Technical Errors and Performance Issues

- Error messages in utilities, issues uploading or downloading necessary documents.

- Slow loading times, page timeouts, failed logins, and session time-outs occur in peak periods.

- OTP / authentication issues (Aadhaar OTP, net-banking code, etc).

Notice Management & Portal Logic Issues

- Despite the lapse of due dates, some notices stay in the “For Your Action” tab.

- Through email notices u/s 143 3(1)(a) often send just an “intimation” though the detailed notice is not easy to find or is missing on the portal.

Refund Delays / Verification Slowdown

- Due to more stringent verification standards, incorrect or mismatched entries and delays in utility releases have resulted in slower refunds than in previous years.

Compressed Timeline / Deadline Extensions Pressure

- The increased pressure on tax professionals and taxpayers to reconcile data and accurately complete forms within a shorter timeframe.

- Many professional bodies are calling for an extension of the ITR filing due date due to the delays cited above (forms, utilities, data mismatches)

How Income Tax Software Solves Such Issues

As taxpayers face many errors during the income tax return filing process, below we explain how IT software helps manage these issues easily and accurately:-

Real-Time Updates & Compliance Check

- Many tax software integrate with TRACES and Income-Tax portal APIs.

- They fetch the latest AIS/TIS after corrections, so you don’t need to wait or re-download manually.

- Built-in rules assure that your ITR form selection and sections follow the latest Finance Act.

Automatic Data Import and Reconciliation

- Software can import AIS, TIS, and Form 26AS directly into the system.

- It shows mismatches (e.g., interest income showing extra in AIS vs bank statements).

- Assist you in reconciling quickly without checking manually line by line.

Error Highlighting and Recommendations

- If deductions or incomes are duplicated/missing in AIS, the software shows alerts.

- Recommends whether to go with Form 16 / books of accounts or AIS values.

- Lowers the chance of incorrect entries.

Bulk Management for Professionals

- CAs managing hundreds of clients save time: one dashboard exhibits whose AIS/TIS is mismatched, whose refund is delayed, and whose return has not been filed.

- Averts last-minute hussle in peak due dates.

Prefilled Data Validation

- The portal of the government prefill often pulls incorrect/missing values.

- Software validates prefilled data against your records and allows you to edit safely before submission.

More Rapid Corrections & Audit Trail

- You can file ITR with corrected figures and keep software-generated working papers if AIS/TIS has errors (like wrong cost of shares).

- This serves as evidence in case of future notice, software maintains logs of mismatches and user corrections.

Closure: With the correct technological tools, the ITR filing process can be efficient. Taxpayers, by using reliable income tax software, can mitigate common pitfalls, enhance operational efficiency, and ensure compliance with current statutes.

An individual taxpayer, a business proprietor, or a tax professional, when choosing the correct software solutions, can make ITR filing faster and efficient, which improves their overall experience.