The Income Tax Appellate Tribunal (ITAT) in Surat made an important ruling regarding tax reassessment cases. They decided that if a company is undergoing a tax review, the process remains valid even if the company is later removed from the official register by the Registrar of Companies (ROC). The key point is that the tax notice must have been issued before the company was removed.

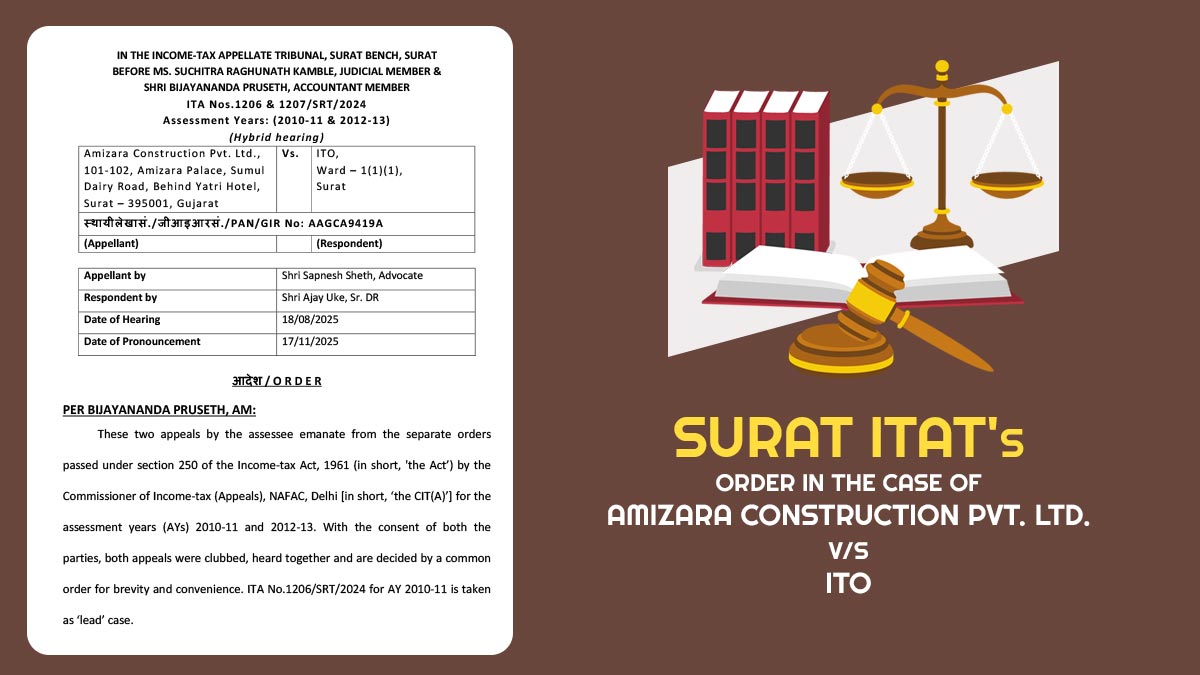

The appellant from Surat, Amizara Construction Private Limited, contested separate appellate orders passed for the AY 2010-11 and 2012-13. The matter has emerged post AO reopened the assessments grounded on data concerning cash deposits made in the company’s bank account and issued notice u/s 148 of the Income Tax Act, 1961, dated 31.03.2017.

As no income return was submitted and no adequate submission for the cash deposits source was provided, the AO finished the assessment u/s 144 read with Section 147 of the Income Tax Act, 1961, treating the deposits as unexplained income.

The appellant before the first appellate authority claimed that, as the company did not exist as its name had been struck off from the records of the Registrar of Companies (ROC) on 21.06.2017, the assessment itself was not valid. The assessment order has been set aside by the CIT(A) and asked the AO to perform a fresh assessment post allotting due chance to the taxpayer.

Advocate Sapnesh Sheth for the appellant stated that once the company’s name is struck off, no valid assessment could be articulated in its name. And the alleged unexplained income was linked to cheque discounting transactions undertaken in the course of business.

The Bench of Suchitra Raghunath Kamble, Judicial Member, and Bijayananda Pruseth, Accountant Member, kept the order of the CIT(A). The Tribunal stated that the Finance Act, 2024, had inserted a proviso to Section 251(1) of the Income Tax Act, 1961, w.e.f 1.10.2024, expressly widening the powers of the appellate authority to set aside assessments framed u/s 144 and remand the case for fresh adjudication.

Read Also: Chennai ITAT: Non-Faceless Reassessment Notices Under IT Section 148 Not Valid

The Tribunal denied the claim of the taxpayer, holding that the appeal of non-existence was wrong, as the company was very much in existence on the issuance date of the notice u/s 148. The Bench mentioned that the ROC strike-off came into force merely on 21.06.2017, and the reassessment proceedings had already been validly initiated.

The ITAT, under the statutory revision and the factual matrix, ruled that the CIT(A) had acted under jurisdiction in restoring the case to the AO for a fresh assessment, giving the taxpayer. Thereafter, the appeals were dismissed.

| Case Title | Amizara Construction Pvt. Ltd. vs. ITO |

| Case No. | ITA Nos.1206 & 1207/SRT/2024 |

| Appellant by | Shri Sapnesh Sheth, Advocate |

| Respondent by | Shri Ajay Uke |

| Surat ITAT | Read Order |