It has been held by the Income Tax Appellate Tribunal, Bangalore Bench that

If computer software is affixed onto hardware and the single product i.e. integrated unit is sold then Tax Deducted at source shall not be applicable.

Here, in this case, the assessee and the subject of consideration is M/s Autodesk Asia Private Limited that is a Singapore-based company. And it is involved in the trade and commerce of distribution of computer software along with providing ancillary services to its Indian distributors or customers. However, in certain specific cases, the assessee has also sold hardware to Indian clients.

It is further submitted that In the specific case, the sale of software or hardware has been made outside India and so the sale revenue from the Indian clients, in this case, has been received by the assessee outside the boundary of India.

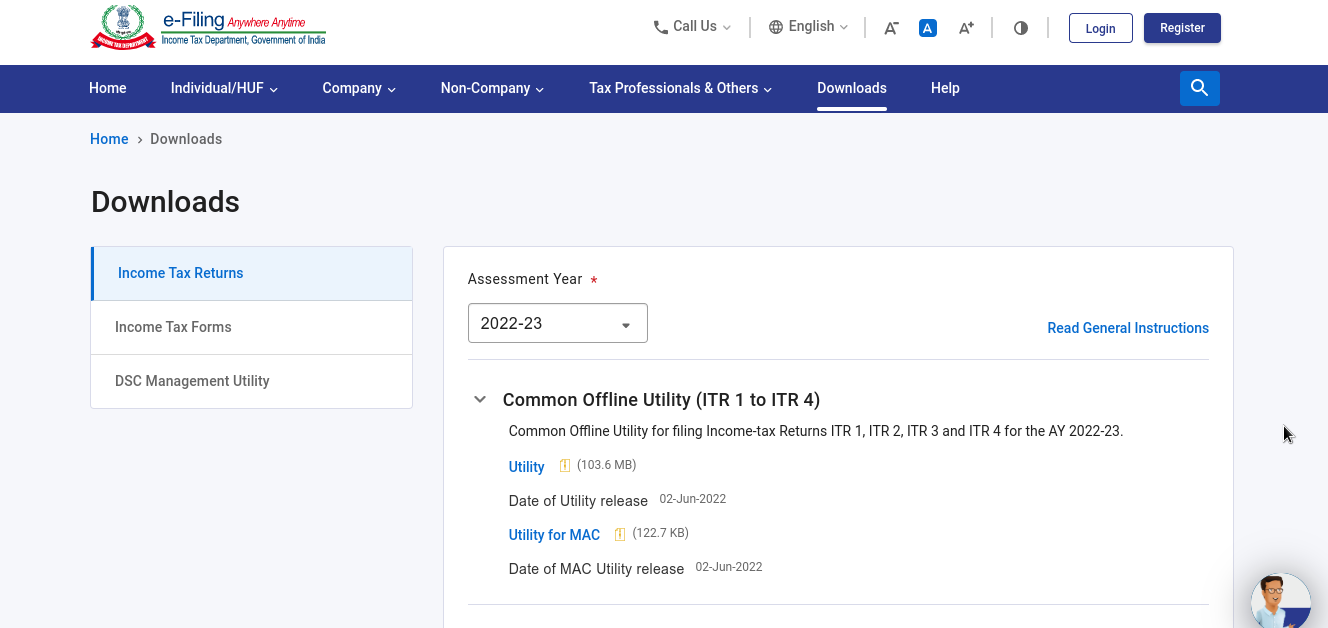

For the aforesaid transaction, the assessee has filed an Income Tax return

The Assessee has received Rs 232,34,01,380/- in the form of consideration for the distribution of computer software /hardware and the ancillary services in addition to Indian distributors /customers. While passing the Draft assessment, the assessing officer held that the aforesaid consideration that has been received leads to the Royalty under section 9(1)(vi) of the Act and Art 12 of India- Singapore DTAA.

The Assessing Officer further proposed to tax the above-mentioned amount received from Indian customers or distributors for the sale of hardware in the form of royalty on the rationale that the two components hardware and software are inseparable and so the software cannot function in obscene of hardware.

The Coram of Judicial Member Beena Pillai and Accountant member Chandra Poojari observed that the cases of the assessee fall within the domain of the second category of cases which is concerned with Indian resident companies that act as resellers or distributors by buying computer software from non-resident foreign suppliers /manufacturers and then reselling them to resident Indian end-users. Whereas the fourth category includes those cases wherein computer software is affixed onto hardware and then is sold as an integrated unit.

It was held by the tribunal that the buying of software in the present facts and circumstances doesn’t lead to the generation of any taxable income in India. Consequently, section 195 of the Act is not operative here. And the assessee does not bear any obligation to deduct tax at the source. Consequently, provisions of section 9(1)(vi) along with Explanation 2 are not applicable to the assessee considered.