The deduction under Section 80P cannot be denied for belated ITR filing, the Nagpur bench of Income Tax Appellate Tribunal (ITAT) ruled and directed the AO to examine the claim and determine the tax liability.

The taxpayer Somalwar Academy Education Societies Employees Co-op. Credit Society Mar submitted its income return for the assessment year under consideration on 26/03/2019 and claimed a deduction of Rs. 7,46,340/- under Section 80P of the Act. The CPC disallowed the same. The taxpayer contested the cited disallowance by filing a plea to the commissioner.

The commissioner, by dismissing the taxpayer’s appeal, confirmed the disallowance for the reason that the income return was not submitted within the specified deadline.

The order has been contested by the dissatisfied taxpayer via submitting a plea and said that before 01/04/2021, there was no enabling provision to make the adjustment, and the authorities shall not have disallowed the deduction claimed by the taxpayer.

The Revenue declined the assessee’s claim based on the judgment from the Hon’ble Jurisdictional High Court in the case of EBR Enterprises vs. Union of India & Another. This particular case focused on the interpretation of Section 80A(5) of the Income Tax Act, specifically regarding the eligibility for deductions under Section 80-IB(10). The court examined situations where the return of income was filed after the deadline and not in conjunction with the original return.

The taxpayer’s writ petition was not entertained by the Hon’ble High Court, citing that our duty is to legislate the provision contained in sub-section (5) of section 80A of the Act, as it stands in the statute book.

The Tribunal observed that the original due date for submitting the income tax return was set for 30 May 2018. However, the taxpayer submitted their return on 26 March 2019, which resulted in the return being classified as a belated return in accordance with Section 139(4) of the Income Tax Act.

The Tribunal made a reference to a significant judgment issued by the Hon’ble Kerala High Court in the case of Chirakkal Service Co-op. Bank Ltd. vs. CIT [2016]. This ruling is noteworthy for its implications and interpretations within the context of tax law.

“That the return filed by the Assessee beyond the period stipulated u/sec. 139(1) or 139(4) or 142(1) or 148 can also be accepted and acted upon provided further proceedings in relation to such assessments are pending in the statutory hierarchy of adjudication in terms of the provisions of Income Tax Act. In all such situations, it cannot be treated that a return filed at any stage of such proceedings could not be treated as non-est in law and invalid for the purpose of deciding exemption u/sec. 80P of the Act.”

Concerning the ruling of the Hon’ble Kerala High Court, the single bench of Narender Kumar Choudhry (Judicial Member) asked the AO to analyse the taxpayer’s claim and to determine the tax liability.

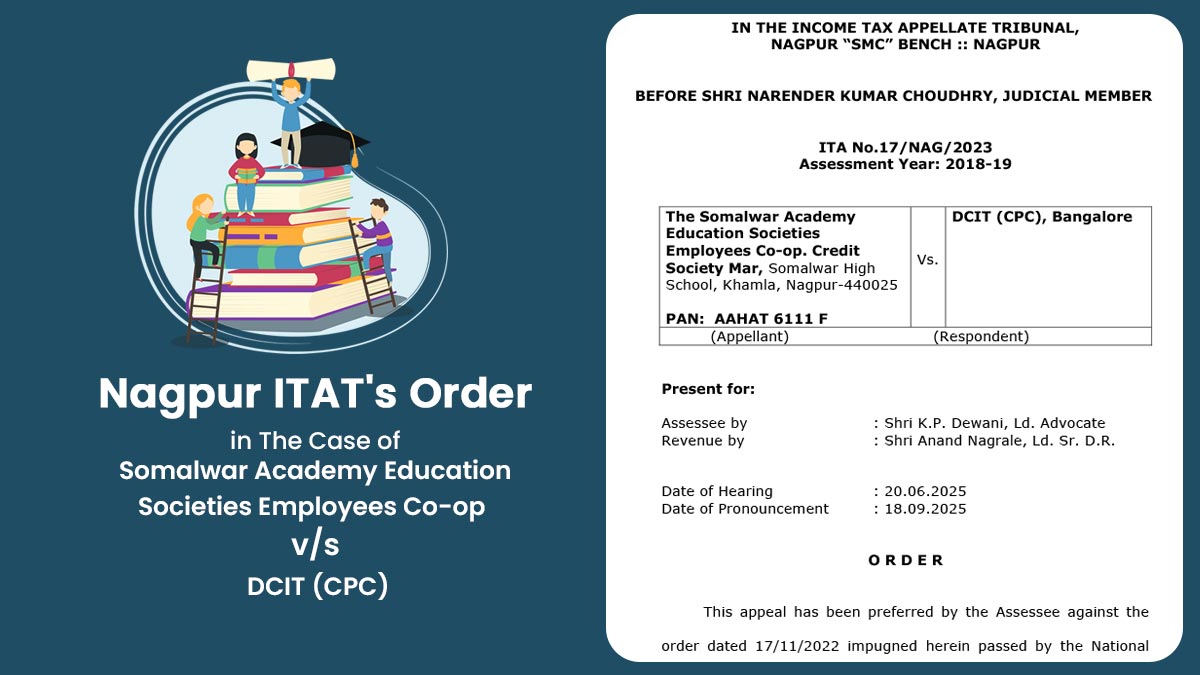

| Case Title | Somalwar Academy Education Societies Employees Co-op vs. DCIT (CPC) |

| Case No. | ITA No.17/NAG/2023 |

| Assessee by | Shri K.P. Dewani |

| Revenue by | Shri Anand Nagrale |

| Nagpur ITAT | Read Order |