The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has ruled that a co-operative society earned a rental income from letting out its administrative building is assessable under the head “Income from House Property” and not as “Income from Other Sources.”

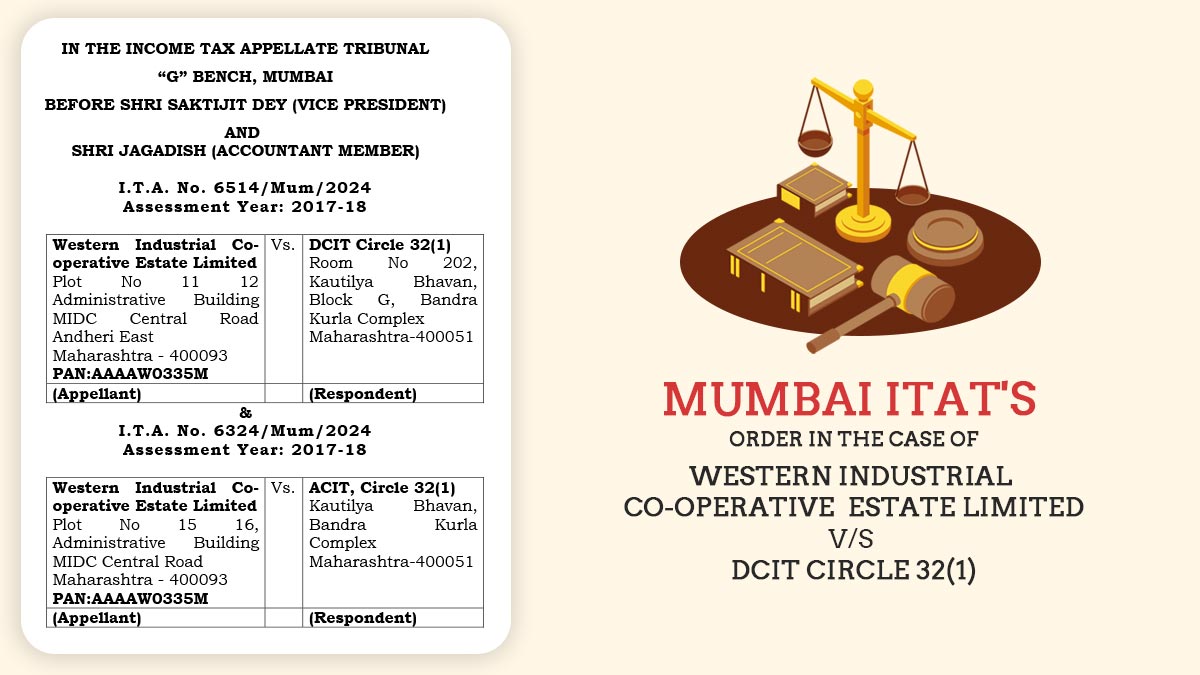

The matter was heard by a Bench comprising Vice President Saktijit Dey and Accountant Member Jagadish, which was considering cross appeals filed by Western Industrial Co-operative Estate Limited for the Assessment Year 2017–18.

The assessee, a registered co-operative society based in MIDC, Andheri, had consistently reported rental income from its administrative building under the head “Income from House Property.” However, for the relevant assessment year, the Assessing Officer deviated from the established position and treated the rental receipts as “Income from Other Sources,” while also denying the standard deduction, sub-letting charges paid to MIDC, interest on borrowed capital, and certain other expenses.

The Tribunal, keeping the claim of the taxpayer, said that no revision was there in facts or in the nature of activity compared to earlier years, when similar rental income had been accepted as income from house property. The Bench outlined that the assessing officer cannot arbitrarily revise the head of income without any material revision in the circumstances.

The Tribunal noted that if the department has consistently accepted a certain treatment in previous years, it cannot adopt a different stance in a later year without proper justification. Consequently, the Tribunal instructed the Assessing Officer to classify the rental income as “Income from House Property.”

Read Also: Delhi ITAT Permits Tax Deduction U/S 24(a) for Taxable Nature of Rental Income from Property Leases

The Tribunal granted consequential relief by allowing a 30% standard deduction u/s 24(a) and permitting interest on borrowed capital under Section 24(b). Additionally, the disallowance of sub-letting charges paid to MIDC was nullified, in accordance with a prior Tribunal decision related to the same taxpayer.

Regarding other matters, the Tribunal remanded the issue of the allowability of specific expenses related to testing and miscellaneous income, along with the deduction claimed u/s 80P for storage charges, back to the Assessing Officer for a fresh review in line with legal requirements.

Consequently, the appeal filed by the taxpayer concerning the main issues was approved, while the associated rectification appeal was dismissed as unnecessary.

| Case Title | Western Industrial Co-operative Estate Limited Vs. DCIT Circle 32(1) |

| Case No. | ITA No. 6514/Mum/2024 A.Y. 2017-2018 |

| For Appellant | Shri Satyaprakash Singh |

| For Respondent | Shri Arun Kanti Datta |

| Mumbai ITAT | Read Order |