An addition cannot be made solely based on a mismatch between sales reported in the books and the figures in Form 26AS, particularly when the discrepancy arose due to double deduction of Tax Deducted at Source (TDS) by the client, Wockhardt Hospitals Ltd (WHL), the Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has ruled.

The applicant, Sudhir Dayalal, was in the business of interior and turnkey contracting under the name M/s. Modfun. For A.Y. 2012–13, he furnished the ITR declaring Rs. 45,20,414. At the time of assessment, the assessing officer discovered a mismatch of Rs 54,39,879 between the sales notified in the profit and loss account and the numbers in the Form 26AS.

The taxpayer mentioned that because of timing, the difference has emerged, and that the income was proposed in the forthcoming assessment year, with the TDS claimed in the existing year. But the explanation was rejected by AO, which held that it amounted to the postponement of tax obligation and added the amount as undisclosed income. U/s 271(1)(c), the penalty proceedings were initiated.

An ad hoc disallowance has been made by the AO of Rs 85,487, being 10% of expenses such as transportation, conveyance, and motor car charges, mentioning possible personal use.

Both the additions and disallowances have been validated by the Commissioner of Income Tax(Appeals)[CIT(A)] without acknowledging the detailed reconciliation of the taxpayer.

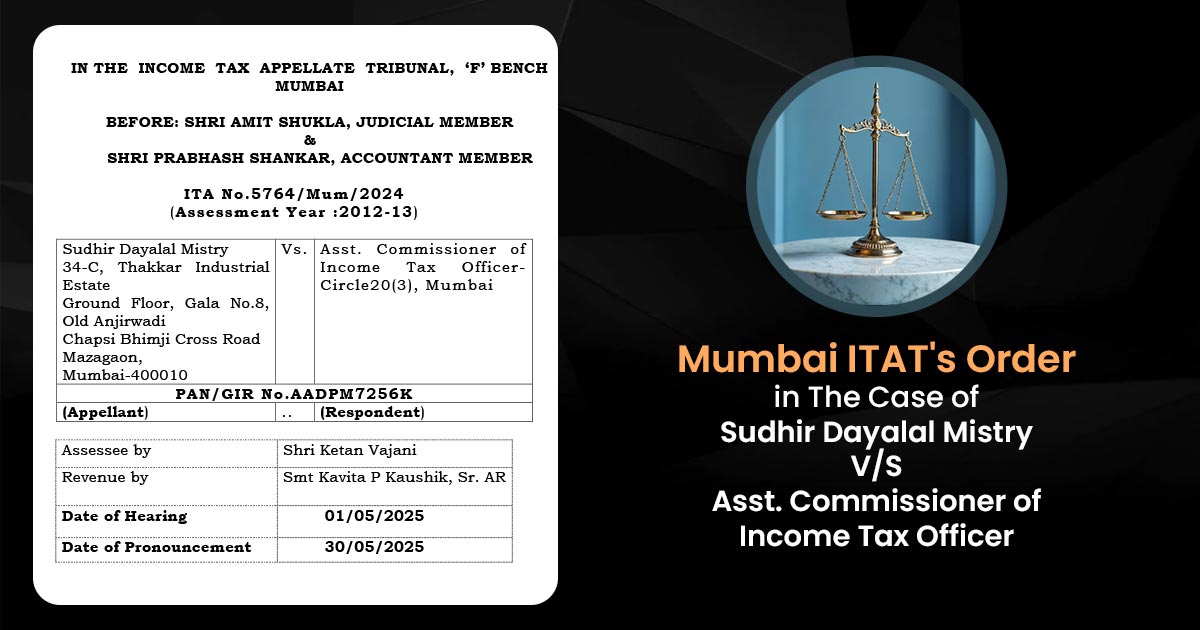

After hearing both parties and analysing the documents, the two-member bench, including Amit Shukla(Judicial Member) and Prabhash Shankar (Accountant Member), said that the addition of Rs 54,39,879 was based only on a mismatch between Form 26AS and the sales reported in the books.

The assessee clarified that the contract with Wockhardt Hospitals Ltd. extended over two years, during which the total receipts were in agreement with the figures reported in Form 26AS.

It was noted that TDS was deducted from both the interim and final bills, which resulted in duplicate entries appearing in Form 26AS.

In the proceedings of the CIT(A), a detailed reconciliation and confirmations from WHL were furnished by the taxpayer specifying how the mismatch emerges due to the timing distinction and the system-pertinent TDS deductions. CIT(A) effectively acknowledged this information.

As there is a difference in Form 26AS, no addition can be made when the proper books were kept and the income was notified earlier. The bench discovered that there is no necessity to send the case back for additional verification and removed the addition.

No particular proof was specified to reinforce the disallowance of Rs 85,487 on the estimated personal use of expenses, Mumbai ITAT stated. As it was made on an ad hoc basis, the disallowance was removed.

Subsequently, the taxpayer’s appeal was permitted.

| Case Title | Sudhir Dayalal Mistry vs. Asst. Commissioner of Income Tax Officer |

| Case No. | ITA No.5764/Mum/2024 |

| Assessee by | Shri Ketan Vajani |

| Revenue by | Smt Kavita P Kaushik |

| Mumbai High Court | Read Order |