It was carried by the Ahmedabad Bench of Income Tax Appellate Tribunal ( ITAT ) that interest income made through the deposits with co-operative banks entitled to a deduction under Section 80P(2)(d) of the Income Tax Act,1961.

With earlier rulings the decision aligns that permit such deductions, stressing that only interest from co-operative banks, not scheduled banks, is qualified under this section.

The appellant-assessee the Salestax Employees Co-Operative Credit Society Ltd., filed its return on 05.10.2017, declaring NIL income. The case was assigned for limited scrutiny, and statutory notices were issued. The AO discovered that the taxpayer has made Rs. 86,730 from FDR and Rs. 32,755 from savings bank interest, claiming deductions u/s 80P of the act.

The decision of the Apex court has been mentioned by the assessing officer in Totgar Co-operative Sales Society Ltd carried that the same income does not entities for the deduction and disallowed the claims mentioning the amount to the income of the taxpayer.

The dissatisfied taxpayer filed an appeal to the Commissioner of Income Tax(Appeals), which was dismissed. The CIT(A) ruled that the interest of Rs. 86,730 from an FDR in Axis Bank was not permissible u/s 80P(2)(d), while the taxpayer asserted the interest was from Ahmedabad District Co-operative Bank.

Indeed the taxpayer claimed that Rs 88,956 interest was filed on a loan CC amount with the co-operative bank. CIT(A) even after that rejected the deduction and dismissed the rectification application u/s 154 citing that the original order was not retrievable.

The taxpayer furnished a second appeal as being dissatisfied with the tribunal asserting that CIT(A) erred in carrying that the interest was obtained from Axis Bank. it was mentioned by the taxpayer that the interest of Rs 86,730 was from Ahmedabad District Co-operative Bank. it was claimed by the taxpayer that as a credit co-operative society it was qualified for a deduction u/s 80P(2)(d).

The taxpayer’s deduction was permitted by the tribunal for the interest made from the deposits with co-operative banks u/s 80P(2)(d), seeking the AO to validate if the Ahmedabad District Co-operative Bank is registered under the Co-operative Societies Act.

The deduction for the interest via the savings account with the Axis Bank was rejected as Axis Bank is a scheduled bank and not a cooperative bank.

On the ruling of the Apex court, the rejection took place in Totgar’s Co-operative Sale Society and the tribunal’s decision in the Sardar Patel Co-operative Credit Society Ltd. case, which clarified that deduction u/s 80P(2)(d) is only applicable to interest made from co-operative banks.

The plea was partly authorized by a single-member bench Ramit Kochar (Accountant Member).

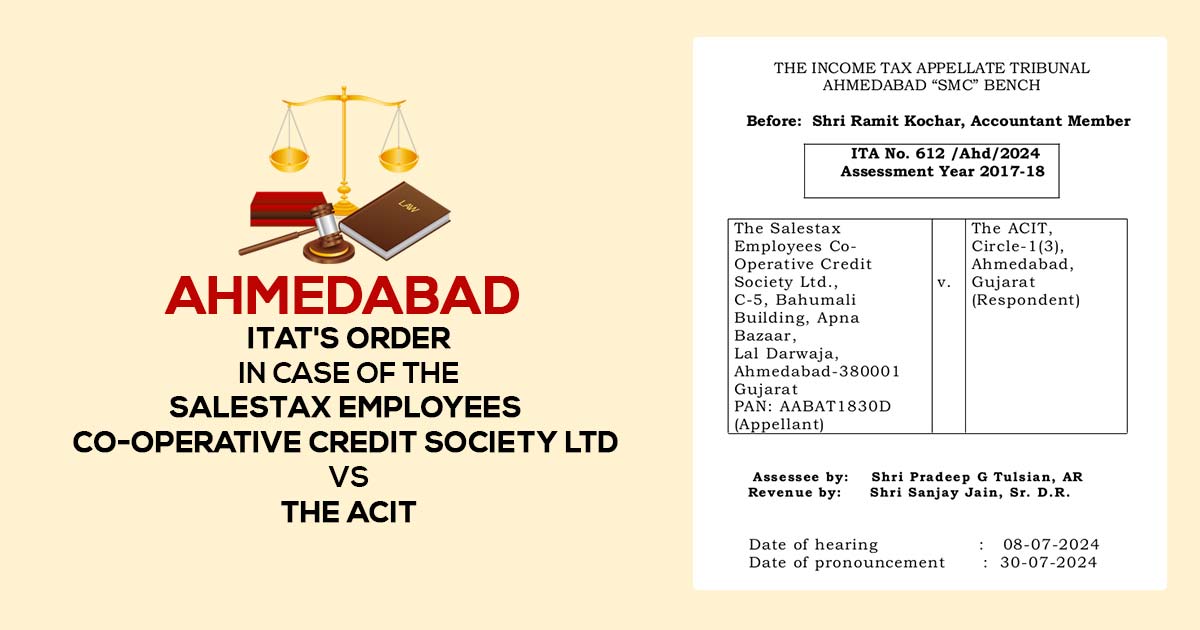

| Case Title | The Salestax Employees Co-Operative Credit Society Ltd Vs. The ACIT |

| Citation | ITA No. 612 /Ahd/2024 |

| Date | 30-07-2024 |

| Assessee by | Shri Pradeep G Tulsian, AR |

| Revenue by | Shri Sanjay Jain, Sr. D.R. |

| Ahmedabad ITAT | Read Order |