Taking cues from the debacle faced by the Central Government and the GST Council during the first launch of GST E Way Bill for transporters, the government has decided on a phased rollout of the e-way bill services for transporters. The move is mostly meant to reduce the GSTN network which had earlier crumbled under the unexpected traffic load.

Mr Hasmukh Adhia, the Central Revenue Secretary, confirmed that e-way bill would be implemented in a phased manner. E Way Bill is touted as the Centre’s big move towards curbing tax evasion by transporters. Under the GST Law, each transporter must carry an e-way bill for the Transport of goods worth more than Rs. 50,000 (Single Invoice/bill/delivery challan) in value in a vehicle. The E-way Bill has to be generated on E Way Bill Portal.

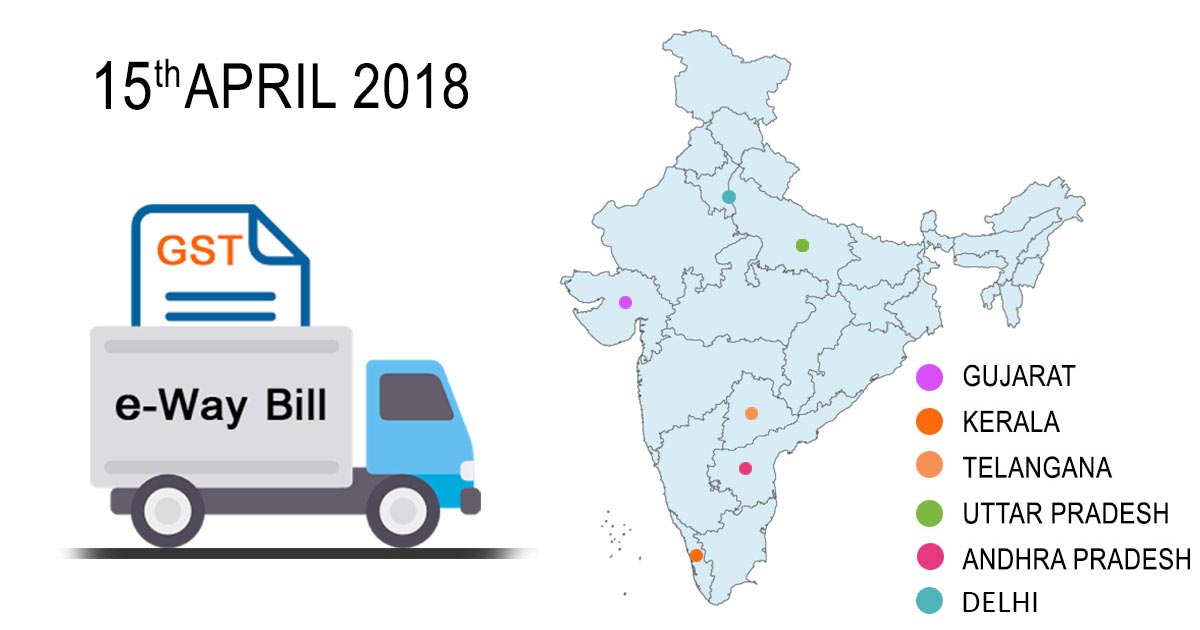

Intra-state implementation of E Way Bill was slated to kick-off from 15th April 2018 in a phased manner. Accordingly, transporters must generate the mandatory e-way bill for intrastate transfer of goods within the premises of five states and capital of India namely Uttar Pradesh, Andhra Pradesh, Gujarat, Kerala, Telangana, and Delhi. The same has been confirmed by the Authorities at the Centre.

Reportedly, the Government had already started the e-way bill system for inter-state transfer of goods on the 1st this month. Karnataka was the first state to introduce the intrastate e-way bill for the transport of goods within the state’s boundaries.

Read Also: Suggestions for the Government Before GST E Way Bill Re-launch

at what distance, e waybill is required for sale of goods value of more than 50000 Rs.