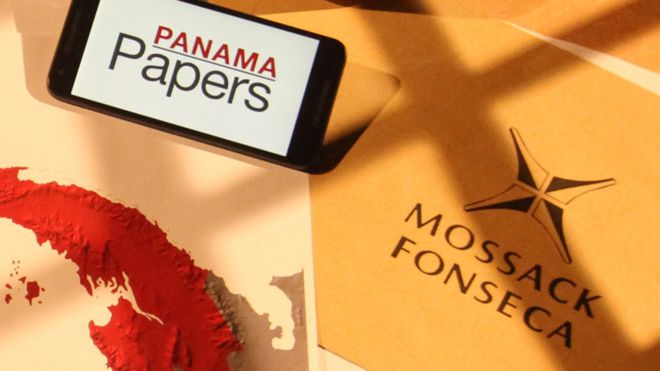

The Indian income tax department may send a notice to call all Indians whose named leaked in Panama Papers. The notices could be sent within 2 months. Recently, the panama papers news was picked up a big issue in India as the more than 500 Indian names including top industrialists and Bollywood actors that mentioned in millions of documents leaked from Panama law company, Mossack Fonseca. This firm has surrounded by a massive controversy at global level for hiding secret investments of reach and powerful people.

After sending notices to about 50 of them by the income tax department, the Indians are coming from two weeks and asking, how their names mentioned in the documents. Now, the department is also checking whether they elided their earned money in India to tax havens, or broke any low to invest their money abroad. A person said, “Summons would be sent to everyone (named in the papers). Then their statement on oath would be recorded.”

A finance ministry wing that solves money-laundering issues and the enforcement directorate may also help the tax department in solving controversy, investigations and collecting evidence.

According to the legal and tax advisers, many clients that have linked to the Panama Papers, they have worried about the statement on vow as they will be not able to change it again.

The tax consultant said, “The tax officers can demand explanations of income generated and tax paid in the last 16 years.”

“Government would require bank statements if it were to prove a wrongdoing in the court of law”, the tax lawyer said. He further added, “The onus then, to provide evidence of otherwise, would be on the tax authorities.”

Recommended:

Passport and Driving Licence are Service Tax Free

Income Tax Relaxation Rs. 3000 for Less or Equal to Rs. 5 lakh Salaried Persons