Here comes another addition to the Budget 2020 wishlist which seeks GST rate cut on BS-VI vehicles to 18% and behests for the announcement of an incentive-based scrappage policy, by the Society of Indian Automobile Manufacturers (SIAM), an industry body for automobiles.

Further, pleas have been made by the industry body from the Finance Minister Nirmala Sitharam for the increased budget allocation for internal combustion engine (ICE) bus procurement by state transport undertakings.

“As SIAM, we have urged the Finance Ministry to consider announcing an incentive-based scrappage policy and also increase Budget allocation for ICE bus procurement by State transport undertakings,” stated SIAM President Rajan Wadhera.

“Hence, we have also requested the government to reduce GST rates for BS-VI vehicles effective April 1 from 28 per cent to 18 per cent,” Wadhera added.

According to him, the high-prices of BS-VI vehicles may decline the demand. Reduction in the GST rates will certainly increase the purchasing power of consumers and so the demands for BS-VI vehicles.

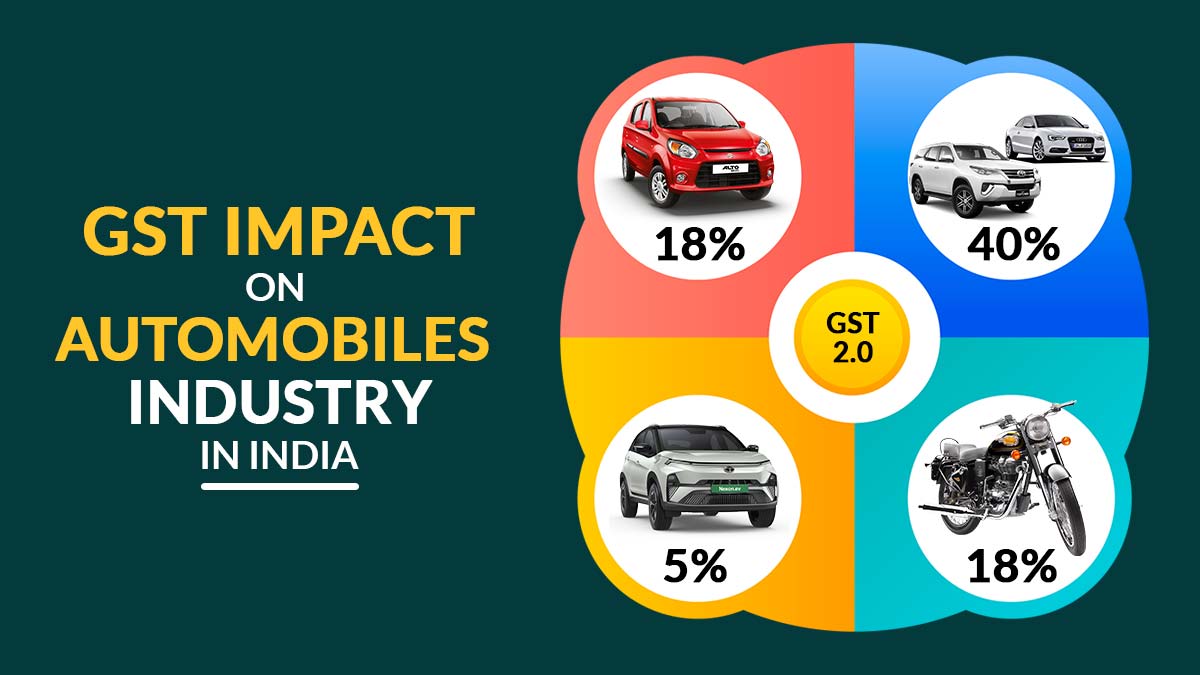

Read Also: GST Impact on Automobile and Spare Parts Industry in India

Stringent emission rules BS-VI will become effective in a full-fledged way from April 1, 2020, and this will mark the transition from present BS-IV norms. According to the estimates made by industry, BS-VI vehicles are anticipated to be costlier by at least 10% more than the current rates.

The auto sector in India has encountered the worst phase and decade-lowest sales in the year 2019. This long-drawn-out and an unprecedented downturn in the industry has been detrimental for the sales of all the vehicles across all the segments.

There was an overall decline of 13.77% in 2019 across the categories that includes passenger vehicles, two-wheelers and commercial vehicles. The wholesale of vehicles during the year stood at 2,30,73,438 units, whereas that in the year 2018 was 2,67,58,787 units.

Petitions have been made for GST rate cuts and reduction in burden due to transition to BS-V, by the auto industry with hopes to revive back the sector with government’s support.