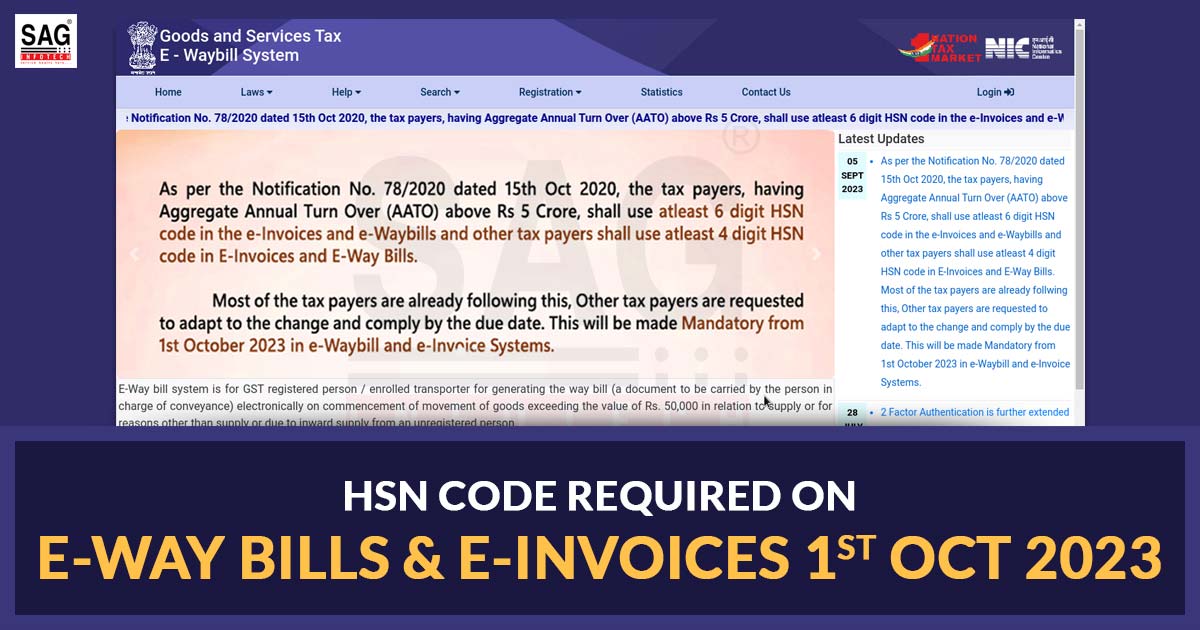

The GST E-way bill system released an update on September 05, 2023, which mentions that, in accordance with Notification No. 78/2020 dated October 15, 2020, taxpayers with an Aggregate Annual Turnover (“AATO”) exceeding Rs 5 Crore must utilize a minimum 6-digit HSN code in their e-Invoices and e-Waybills. Other taxpayers should use a minimum 4-digit HSN code in their E-Invoices and GST E-Way Bills.

While many taxpayers are already adhering to this requirement, we kindly request all other taxpayers to adapt to this change and ensure compliance by the specified deadline. This change will become mandatory starting from October 01, 2023, for the e-Waybill and e-Invoice Systems.

| Aggregate Turnover in the Preceding Financial Year | Number of Digits of Harmonised System of Nomenclature Code (HSN Code) |

|---|---|

| Up to INR 5 Crores | 4 |

| More Than INR 5 Crores | 6 |