The Income Tax Department has rolled out new tools to enhance transparency and compliance in recent years. These include the Annual Information Statement (AIS) and the Taxpayer Information Summary (TIS).

While they are useful for reducing mismatches between taxpayer disclosures and third-party data, they have their own issues. Taxpayers often face confusion from the mismatched entries, duplication of transactions, and complex categorisation. Here, the newer income tax software arrives, bridging the gap between official statements and individual tax filings.

Overview of AIS and TIS

A detailed view of a taxpayer’s financial transactions is provided under the Annual Information Statement (AIS). It comprises data such as savings account interest, dividends, securities transactions, foreign remittances, and property purchases. The AIS is bigger than Form 26AS, which includes tax deducted at source (TDS) and advance tax.

The simplified version is the Taxpayer Information Summary (TIS). It takes the data from the AIS and presents it in a categorised, concise format for immediate reference in the return filing.

Such documents aim to facilitate tax compliance. Errors in reporting, incorrect tagging of transactions, or duplicated entries can lead to discrepancies during the filing of returns, resulting in notices or demands from the tax department.

Common Problems with AIS/TIS

Mismatched income details, duplicate reporting, and incorrect categorisation in AIS/TIS are the problems that taxpayers often encounter. The intricacy of longer statements makes the reconciliation difficult and increases the chances of filing errors.

Data Mismatch

A problem emerges when the AIS specifies a higher income compared to what the taxpayer actually obtained. For instance, dividends declared but not credited in a fiscal year may still appear as taxable income.

Overwhelming Complexness

AIS collects a vast amount of data, often spanning dozens of pages, for active investors. Reconciling this information manually can be overwhelming.

Repetition of Entries

Multiple entities may report specific transactions. For example, a mutual fund redemption report by both the fund house and the broker, showing up twice in the AIS.

Categorisation Blunders

Sometimes the transactions may be misclassified, for example, personal transfers showing as taxable income.

In What Way Does ITR Software Solve These Problems?

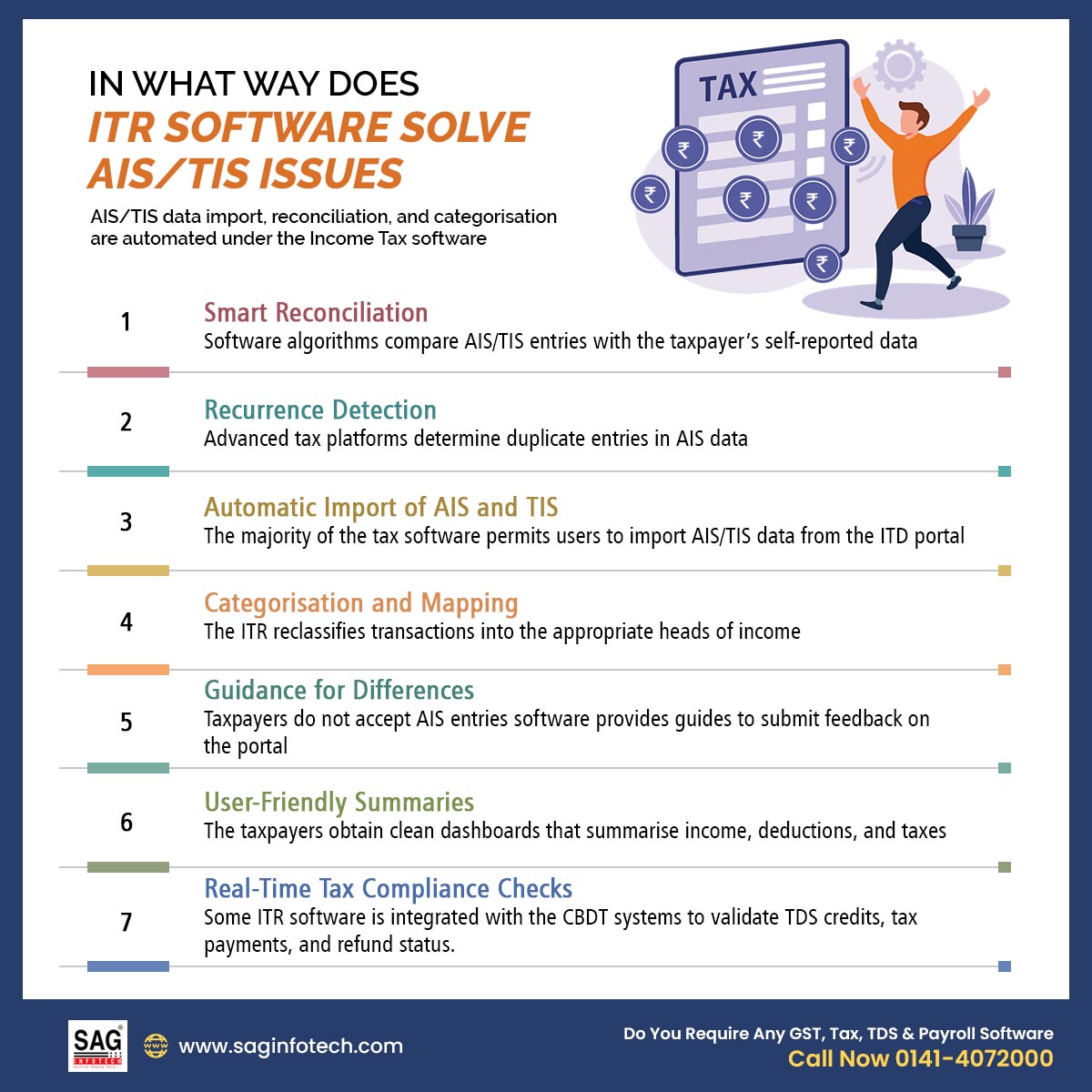

AIS/TIS data import, reconciliation, and categorisation are automated under the Income Tax software. It fetches mismatches, removes duplicate entries, and presents a simplified summary for correct tax filing.

Smart Reconciliation

Software algorithms compare AIS/TIS entries with the taxpayer’s self-reported data (like salary slips, bank statements, or trading reports). The mismatches are specified quickly with suggestions on whether the entry includes, excludes, or corrects.

Recurrence Detection

Advanced tax platforms determine duplicate entries in AIS data. For instance, if the same income report file is submitted via two distinct entities, then the software specifies it and confirms that the same is considered merely once in the return.

Automatic Import of AIS and TIS

The majority of the tax filing software permits users to import AIS/TIS data from the Income Tax Department portal using JSON or PDF formats. This eliminates manual entry, reducing the likelihood of human error and saving time.

Categorisation and Mapping

Income tax software reclassifies transactions into the appropriate heads of income—salary, house property, capital gains, or other sources. The same makes the return filing process easier and ensures consistency with tax laws.

Guidance for Differences

When taxpayers do not accept AIS entries, the software provides guides to submit online feedback on the Income Tax portal. This supports rectifying errors before filing the return.

User-Friendly Summaries

Rather than steering via longer AIS documents, the taxpayers obtain clean dashboards that summarise the income, deductions, and taxes paid. The same shows the objective of TIS, but with effective precision and personalisation.

Real-Time Tax Compliance Checks

Some income tax software solutions are integrated with the CBDT systems to validate TDS credits, tax payments, and refund status. This states that returns filed are less likely to be flagged for scrutiny.

Major Advantages for Taxpayers

The income tax software, by addressing AIS/TIS challenges, offers several benefits:

- Time Saving: Automates reconciliation that would otherwise take hours.

- Peace of Mind: Decreases the risk of receiving notices for mismatches.

- Transparency: Presents data in simple, easy-to-understand formats.

- Precision: Minimises errors and mismatches.

- Tax Compliance: Confirms taxpayers stay aligned with the latest Income Tax Department requirements.

Closure: The rollout of AIS and TIS shows a step towards data-driven tax compliance. But such intricacy of these documents can burden the taxpayers, specifically those with distinct income sources. Such issues are being effectively addressed via the income tax software by automating data import, detecting mismatches, eliminating duplication, and facilitating categorisation.

Consequently, the taxpayers are enabled to submit the returns with confidence. As they know that their income disclosures are aligned with the official records. In between the digital taxation, this software acts as a partner, turning a potential compliance challenge into a facilitated, stress-free experience.