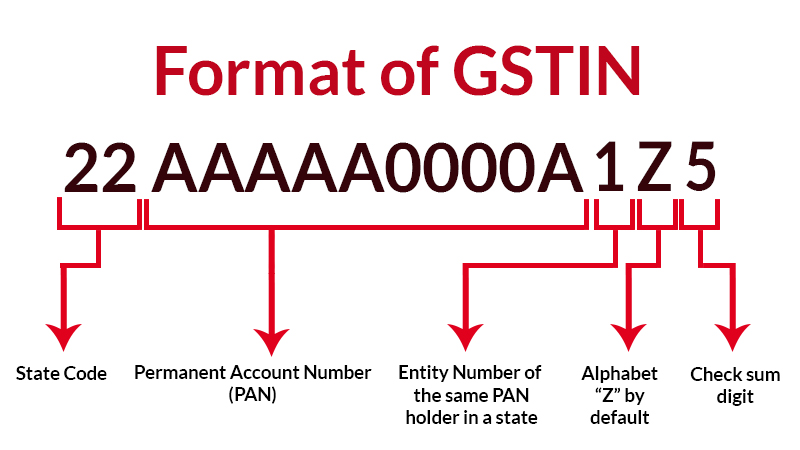

The Goods and Services Tax Network has finally brought the feature of ‘registering complaints regarding misuse of PAN in GST Registration’. Consequently, it shall check the misuse of PAN, grab the fraudsters and assist the officials in conducting an enquiry and further provide input for the making a decision related to the cancellation of the registration of the culprits.

Taking a view of the procedure, once a complaint is being registered, it shall be forwarded to the concerned jurisdictional authority where the fraud has been committed and then further proceedings shall be undertaken.

Steps to Register the Complaint Misuse of PAN

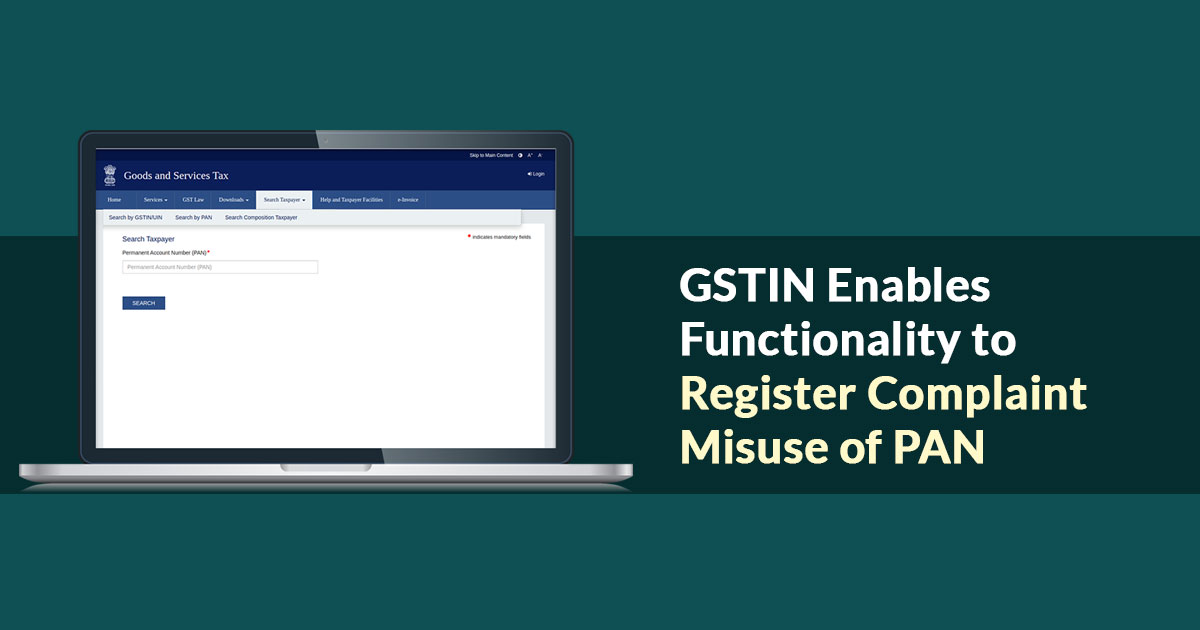

Step 1: At the web portal of GST, an option of ‘search functionality is given. It is used to identify whether any GSTIN has been issued on a particular PAN or not. Go to ‘Search Taxpayer’ > ‘Search by PAN’. Thereafter, the system shall display details of the GST registration that is available on the aforesaid PAN. However, in case, no registration is found on that PAN, the message ‘No Records found’ shall pop up on the screen.

Step 2: Any individual who has become the victim of PAN being misused might directly or through an authorised representative register a complaint at the GST Portal. He might search the GSTIN based on Permanent Account Number (PAN)

Step 3: On clicking of ‘Report’ option, the following image shall pop up. In the case of Individual PAN (Wherein the 4th letter in PAN is P), Legal Name as per PAN shall be auto-populated. Meanwhile, during registering a complaint, the complainant shall have to provide the e-mail and the mobile number for validation. Other information required is DOB, address and so on.

For an entity other than the proprietor, complainants have to enter the personal details that shall be followed by authentication of Aadhar.

Step 4: After the request has been submitted, ARN shall be generated. In case multiple GSTNs are selected for such complaints, ARN for each GSTIN

Step 5: In this step, the complaint so registered shall be made available to the competent authority at his dashboard under the heading “Application for Reporting Fake GSTINs for further necessary action.”

Step 6: After that, the issue can be taken ahead in order to track the status of the application via tract ARN at the GST portal pre-login.