The Goods and Services Tax Appellate Tribunal (GSTAT), Principal Bench at New Delhi, has ruled that when a contractor voluntarily remits the residual input tax credit (ITC) advantage determined via the Directorate General of Anti‑Profiteering (DGAP) to its principal, no separate anti-profiteering action is needed under section 171 of the Central Goods and Services Tax Act, 2017 (CGST Act).

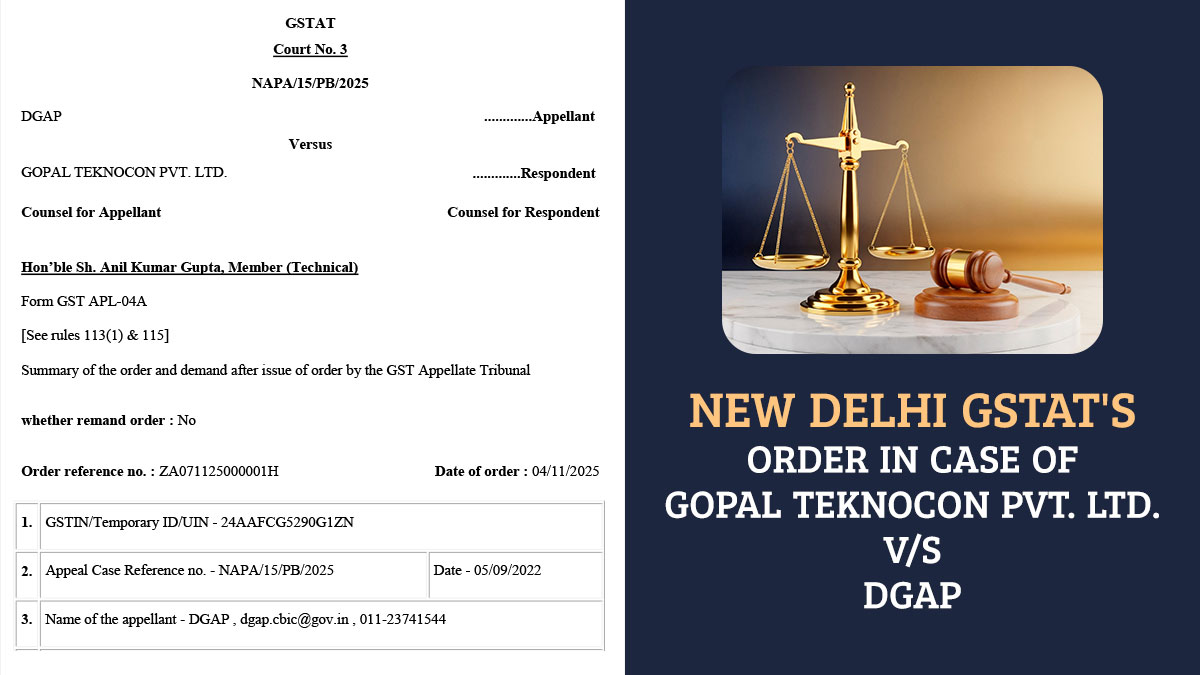

A Bench of GSTAT, Principal Bench, Justice Sh. Anil Kumar Gupta (Technical Member) was hearing an appeal filed by the Directorate General of Anti‑Profiteering (DGAP) on the concerns: whether the respondent failed to pass on the benefit of GST input tax credit (ITC) or tax‐rate reduction to its recipient in violation of Section 171(1) CGST Act and the Anti-Profiteering Rules; whether DGAP’s computation is acceptable.

Indian Oil Corporation Ltd. (Pipeline Division, Rajkot) filed a complaint alleging that Gopal Teknocon, which was engaged as its contractor for maintenance and inspection of crude oil storage tanks, unable to pass on the benefit of incremental input tax credit (ITC) after the roll out of GST, as mandated u/s 171(1) (anti-profiteering measures) of the Central Goods and Services Tax Act, 2017 (“CGST Act”).

On Anti-Profiteering, the Standing Committee directed the case to DGAP for investigation. DGAP stated that the respondent is not able to pass the benefit of incremental ITC after GST.

The computation of DGAP has been acknowledged by the respondent in the written response to the GSTAT and complied with its obligation.

The Bench noted that the respondent has fulfilled its obligations under Section 171(1) of the CGST Act. It affirmed the computations made by the DGAP and concluded the investigation, stating that no further action is necessary under the anti-profiteering rules.

Read Also: BDCDA Urges Traders to Migrate to Regular GST to Avail ITC Benefits

The Bench also emphasised that the anti-profiteering provisions are intended to be remedial and aimed at protecting consumer welfare, rather than serving a punitive purpose. Once the quantified benefit has been properly passed on to the beneficiary and compliance has been verified, continuing the proceedings does not serve any regulatory purpose.

| Case Title | Gopal Teknocon Pvt. Ltd. vs. DGAP |

| Case No. | NAPA/15/PB/2025 |

| GSTAT New Delhi | Read Order |