In the petition of SKH Sheet Metals Components Pvt LTD, the Delhi High Court instructed the GST Authority to initiate an online portal to enable Petitioner to furnish a revised declaration TRAN-1 through electronic mode or through manual mode.

In this case, SKH Sheet Metals Components Private Limited is the petitioner who has a unit for the manufacture of final products and sale to OEMs at Pune Maharashtra. The petitioner has all the registrations, along with CENVAT credit of specified duties, capital goods, taxes paid on inputs, and input services in terms of Cenvat Credit Rules, 2004. The petitioner also availed input tax credit

The petitioner filed returns from time to time through the suitable forms and also declared all the details of the credit period, the credit received during the return period, and also the closing balance of the credit accessible which can be carried forward for the next period.

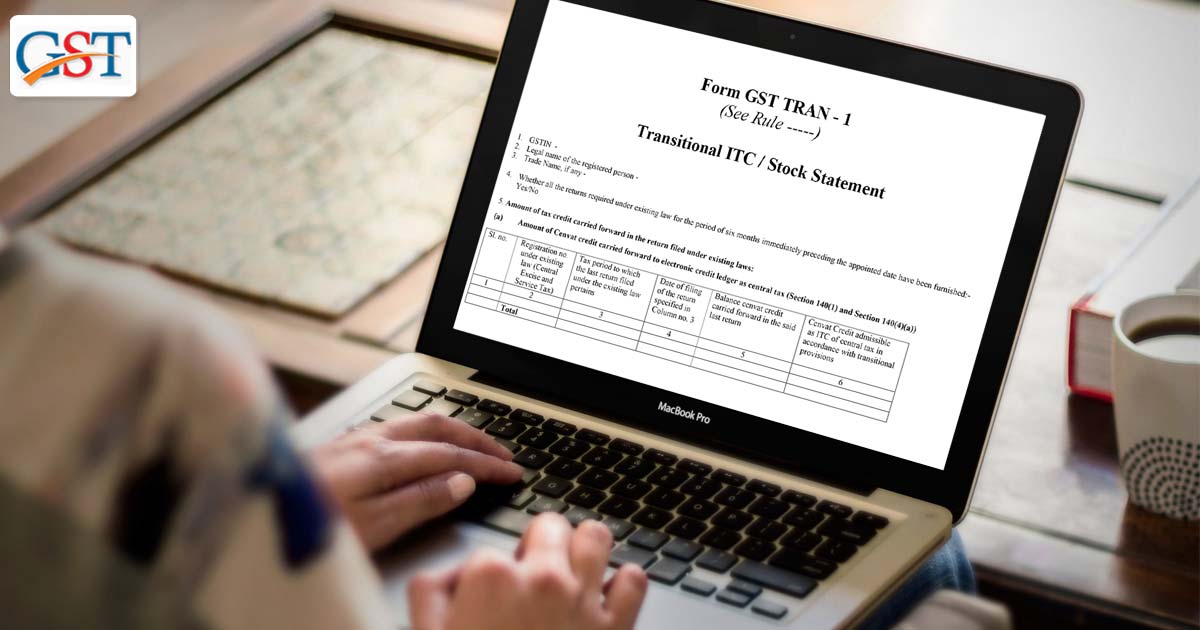

The petitioner claims that the petitioner is entitled to a transitional credit consisting of Central Excise Cenvat Credit, Service Tax Cenvat Credit, and Input MVAT Credit. To avail the credit in electronic credit ledger under GST laws, on August 27, 2017, he filed a form GST TRAN-l

While submitting the form they noticed that only Rs. 1,01,24,382/- is being displayed on the GST portal it is far less than the total credit of Rs. 6,52,58,081/-.They also noticed that Rs. 5,51,33,6991/- as CENVAT credit is not displayed in the electronic credit ledger. Here the total CENVAT credit consists of Rs.3,86,54,605/- as Central Excise and Rs.1,64,79,0811/- as Service Tax.

They contacted Respondent authority and brought the mismatch to their notice and also reported the issue they are facing. But the respondents only suggested that since the portal enables the taxpayers to make necessary corrections, so the taxpayer can use the available option to rectify the error. The petitioner reported this issue from time to time but they don’t get any positive support and outcome.

The respondent authority contended that the mismatch occurs due to the human error so there is no provision or the rules available that can be utilized to recover the shortfall.

In this case, the petitioner finally gets the outcome from the division bench of Justice Sanjeev Narula, and Justice Manmohan and they instructed the Tax Authority

The bench of Delhi High Court expressed their anguish and stated that “The case before us is one where there is a complete lack of understanding and fairness on the part of the Tax Department. The fact that Respondents have done nothing to solve the problem faced by the Petitioner, fueled with the adamant stand before us, contributes to the skepticism of GST technical infrastructure, which we feel should and can be easily avoided. Only if Respondents were to engage with the taxpayers with a genuine intention to solve the problems, confidence in the system can be built up and such matters would not reach courts,”.