A taxpayer that had earlier registered for the Goods and Services Tax (GST) and now wishes to cancel his registration can do so by filing the GST registration cancellation application in Form GST REG-16.

In this article, you can read about the procedure to file an application for the cancellation of GST registration

Latest Update

23rd November 2021

- “CBIC has notified the update related to the registration of cancellation form REG-16 on the gst.gov.in website. “Taxpayers can now withdraw their application for cancellation of registration (filed in Form REG-16) unless the tax officer has initiated action on it.”

Conditions for Filing Form GST REG-16

The process for the cancellation of GST registration of a taxpayer individual or entity can be initiated in the following two cases:

- By a GST officer when found the party guilty of GST violation

- By the taxpayer himself

Form GST REG-16 is used when the taxpayer himself wants to apply for the cancellation of his/her GST registration

- The business has been closed or discounted

- PAN for the business has been changed because of a change in constitution

- The taxable person no longer has to pay GST

- The taxable person no longer has to be registered in GST

- It is a voluntary registration with no GST liability

- The business has been transferred, de-merged, merged or sold

If your business fulfils any of these conditions, you can continue to file for the cancellation of your GST registration by following the steps below:

Steps by Step to File Form GST REG-16 on Official Portal

The application in Form GST REG-16 must be filed online in the following manner:

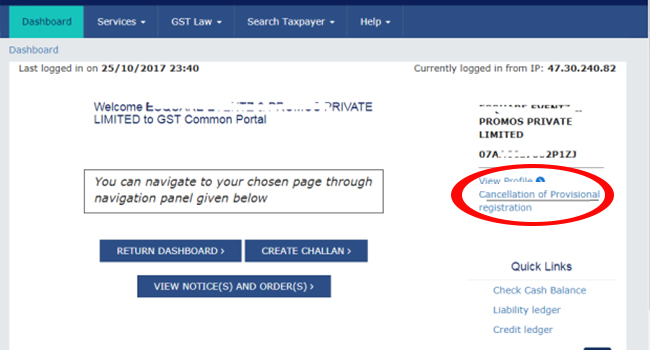

Step 1: Visit the GST Portal website gst.gov.in

Step 2: Log into your account by providing valid details

Step 3: Go to Services > Registration > Application for Cancellation of Registration

Step 4: The application form will be displayed on the page

Step 5: Enter your address and click ‘Save & Continue’

Step 6: Select the ‘Reason for Cancellation’ from the list

Step 7: Enter the date for cancellation of GST registration

Step 8: Enter the following, if applicable:

- Particulars of tax payable in respect of inputs available on semi-finished and finished goods

- Particulars of tax payable in respect of stocks of inputs

- Particulars of tax payable in respect of stock of capital goods

Step 9: Enter details of the tax paid by you, if any

Step 10: Check the verification box. Select the authorized signatory from the list and enter the place (your location)

Step 11: Re-check and verify the application via EVC or DSC. Click ‘Submit’

Upon successful application submission, you’ll receive ARN on your registered email address and mobile number.

Important Notes:

- If the registered taxpayer (sole proprietor) is deceased, the application for GST registration cancellation must be filed by their legal heir or business successor manually to the concerned authority.

- Once the GST registration cancellation application is submitted successfully, it may take up to 30 days for the concerned officer to review it and issue the cancellation order.

- The status of the cancellation application in Form GST REG-16 can be tracked on GST Portal by visiting Services > Registration > Track Application Status.

On filling GST REG-16 I am getting the message

Error

Submission failed

Verification has been failed. Please try again.

Can you please suggest the possible reasons.

Sir I fill the application for gst cancellation in how many days I received for cancellation email from gst department.

It totally depends on GST Dept

Sir I want to learn How to file GST return

Dear sir, you can check our GST tutorial videos for reference at this link https://saginfotech.com/gen-gst-video-tutorial.aspx

I have filed GSt reg 16 application for closure of business but could not reply to SCN issued in due time. Currently my GST registration status is suspended but i want to restart the business in the same company. How can i revoke my GST cancellation application online. Please guide

If it is suspended due to any delay in GST return filing then kindly file the same on due time it will restart your GST registration

I have registered GST as Tax Collector (Electronic Commerce Operator) by mistake. Today I visited VSO of our region for cancellation as I can’t apply for cancellation being a Tax Collector. He said it is assigned to Center GST office and the office is closed. Its been more than 3 years I am trying to cancel it. Please help me on this.

Thank you

“Please consult GST practitioner”

I have registered GST as Tax Collector (Electronic Commerce Operator)

Please help me how to cancel this registration, Cancellation option not showing in GST portal

Please login first to GST portal–>Services–>Registration–>Application for cancellation of registration, please follow the following path to cancel the same

Sir, I have taken the GST no in the month of nov20 but now in Carona time it is very difficult to start the business and I want my gst no should be returned

does its possible to surrender my GST no when my GST no is only 3 months old

Yes