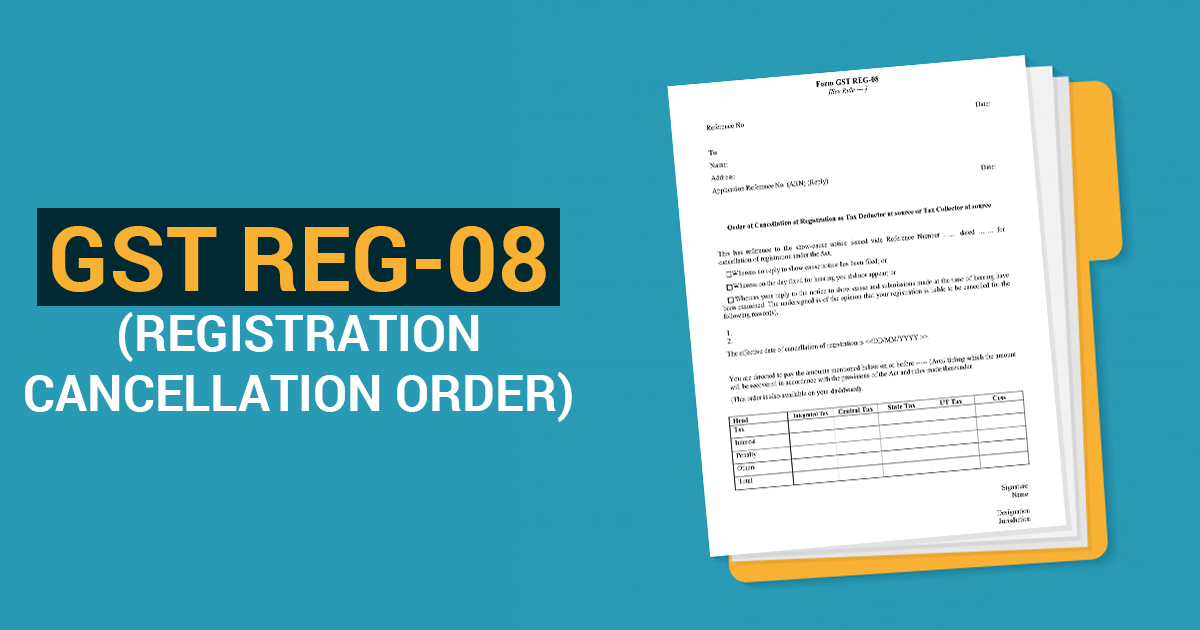

The enrollment of the TDS deductor or TCS collector form GST REG 08 is used to cancel the order. The proper officer may not accept the GST enrollment if prepared with TDS deductor/ TCS collector and is longer eligible to deduct TCS and TDS in form GST REG 08.

The procurement relevant to the form GST REG 08 is clarified in the current article.

Initiating Procurements Narrating to Form GST REG 08

In form GST REG 08 of Central Goods and Services Tax Rules, 2017 the Rule 12(3) which administers the plan of providing or communicating. Below are the details of Rule 12(3):

- The enrollment of form GST REG 08 to TDS deductor or TCS collector has been cancelled by the proper officer though giving an order.

- In the investigation, the proper officer must be provided before giving Form GST REG 08, that the TDS or TCS will not be deducted by TDS deductor or TCS collector.

- The proper officer issued the form GST REG-08 electronically to the TDS deductor or TCS collector.

- In rule 22 the method of revocation of registration which issues Form GST REG-08 after the Central Goods and Services Tax Rules, 2017 stated in the procurement of rule 12(3).

Steps to be Accompanied Earlier to Issuing the Form GST REG-08

In Form GST REG-08 from the above steps, the proper officer is needed to observe the process of GST cancellation stated in rule 22 before giving the certificate of cancellation. The stated process is notified under:

In Form GST REG-17 the proper officer gives the show cause notice needed by the individual to show cause reason for not cancelling the GST enrollment.

- Answering to it in form GST REG-18 from the issue of notice within the period of 7 days if affronted

- In form GST REG-18 the Proper officer will not accept the registration application if the response field is not satisfactory, and apprise the TDS deductor of the TDS collector

Content of Form GST REG-08

Form GST REG-08, fundamentally, covers the subsequent necessary features

- Date and reference number

- The information of the person to which enrollment gets cancelled.

- Address

- Name

- if any Application Reference Number of the reply filed

- Cause for revocation of the enrollment.

- Convenient date for cancelling the enrollment.

- The due date of payment and the path of payment of tax, interest, penalty or other amounts, if unspecified

We have inadvertently made an application

for issuance of Tax Deductor Number and the same has been approved by the

department on 07th August 2018 under the Business Constitution of Any Other body

notified by the committee.

Section 24(vi) of the CGST Act, 2017 provides for compulsory liability for registration for the deductors of TDS. As per section 51 of the CGST Act, 2017,

the following are the persons who are liable to deduct TDS under GST:

– Department of Central Government or State Government or

– Local Authority

– Governmental Agencies

Such category of persons as may be notified by the government on the

recommendation of the GST Council Hence in view of the above it is clear that private limited companies are not liable to

deduct TDS and in our case, the same has been applied and issued inadvertently.

We want to cancel that GST number as a TDS deductor. Can the Department make us fine or penalty on me .??? Because I am not liable.

Please guide us.