Nischal Maheshwari, Head Edelweiss Securities in his interview with a prominent news provider discussed some basic facts and issues regarding GST and its impact on various items as stated by him that consumer goods and white goods are no luxury goods anymore.

Read Also: GST Impact on Automobile Industry in India

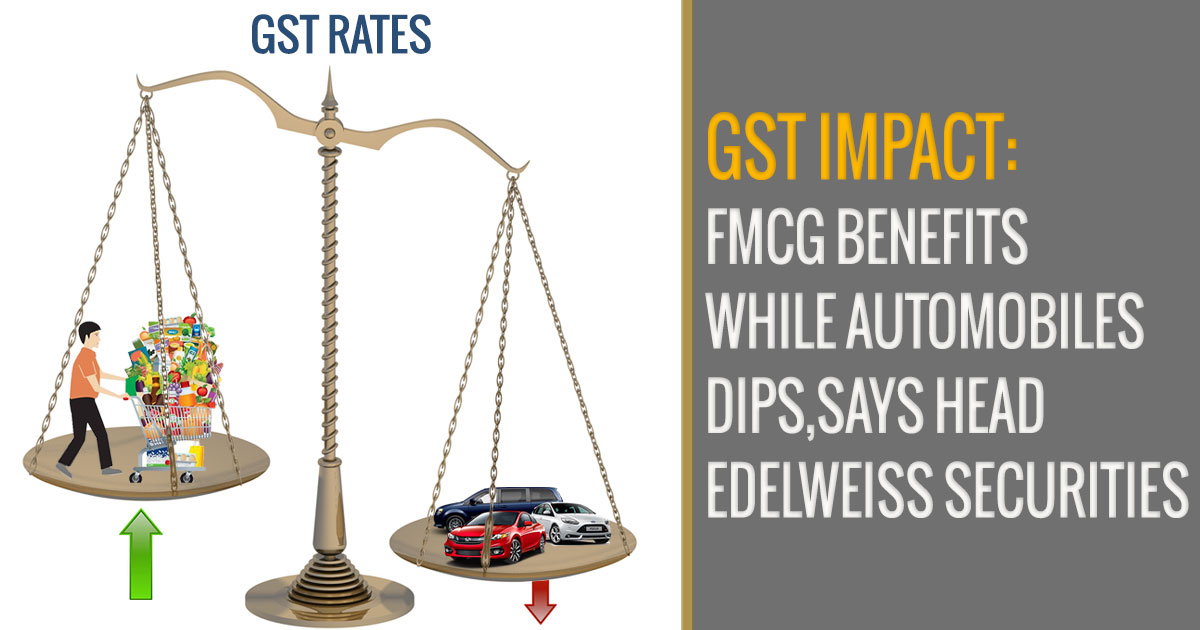

While asking about the GST slab rate structure and its positive/negative impacts he said that “The good list is obviously FMCG where I think most of the people were expecting that they will continue to do a 28% kind of a number. But they have been put in 18% slab. I think that would be a clear beneficiary.

On the other hand, the clear loser would be auto industry, auto sector was expected to move down from around 24-25% on average taxes to around 18%, but now it will actually be going up to around 28%.”

Recommended: GST Impact on Common Man

And for the White goods and its tax rate fixation he said that “in all sectors basically in the consumption side should be the beneficiary. Initially, there is going to be a bit of a kneejerk reaction but the bigger beneficiary over the next two years will be the inclusion of most of the consumption sector.”