The Andhra Pradesh High Court instructed the Respondent Authority to allow the submission of GST TRAN-1 Form either through Electronic medium or through a manual medium, within 30 days.

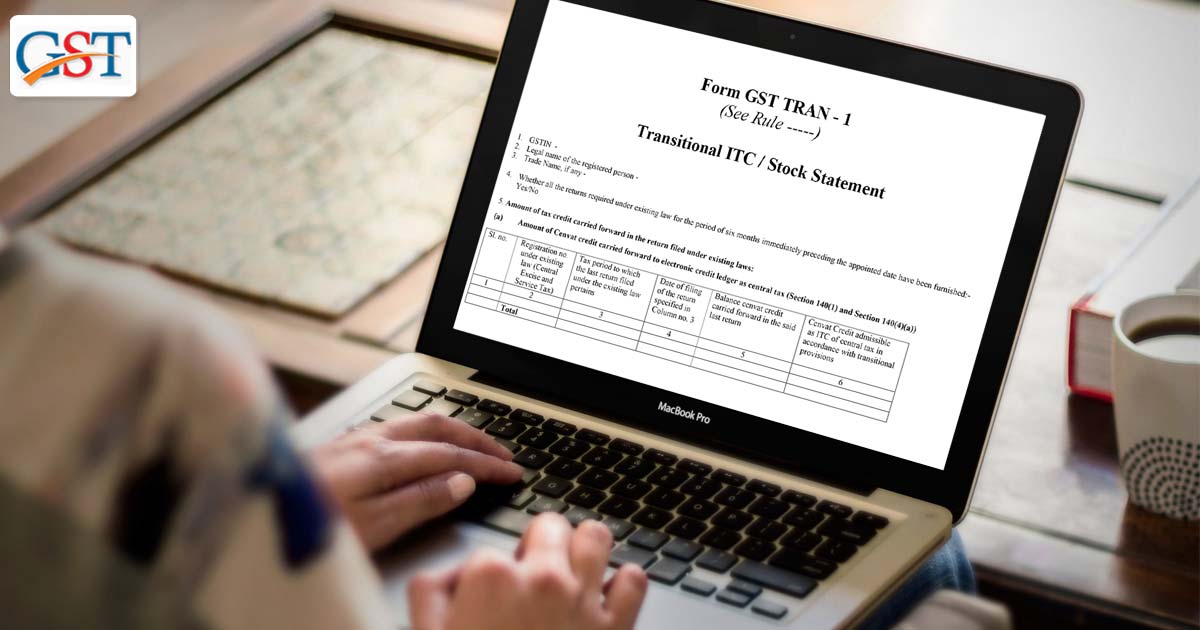

It comes in a matter where the petitioner is in partnership and doing business of pulses and turmeric registered. The petitioner reached the court and requested to direct the Respondent Authority to accept his GST TRAN 1 form

As per provided details, the petitioner submitted that he failed to upload the GST TRAN-1 due to the technical glitches on the portal, internet connectivity and technical issues could be the culprit there.

He also pleaded that the Petitioner also met the Nodal Officer several time in between and also submitted letters requesting them to allow him to furnish Form GST TRAN-1 on the basis of the decision and circular of the GST Tax council

The Counsel for the Writ Petitioner represented print-out of screenshots of the GSTN Portal which indicates the various attempts made by the Petitioner to furnish TRAN-1 Form.

The division bench which directed the Respondent Authority consist of Justice C. Praveen Kumar and Justice Lalitha Kanneganti. And they directed the respondent authority to allow the Petitioner to submit GST TRAN-1 Form either through electronic mode or through the alternative mode means manually, by settling a cut off date, within 30 days from the date of receipt of judgment, In which event, according to the law the same can be dealt with.