GST collection in November 2021 has been topping the charts since the implementation of GST as there is 25% growth from the same month last year and 27% higher than 2019-20. The GST revenue (gross) collected in the month of Nov 2021 is INR 1,31,526 crore and dividing it has CGST at INR 23,978 crore, SGST at INR 31,127 crore, IGST at INR 66,815 crore with INR 32,165 crore collected on import of goods) and Cess at INR 9,606 crore (including INR 653 crore collected on import of goods).

In which the settled amount is INR 27273 crore to the CGST part and the INR 22655 crore towards the SGST from the IGST as part of the regular settlement. The total revenue is INR 51251 crore for the state and centre. in which are INR 53782 crore for centres and INR 53782 for states.

Read Also: Govt Expects INR 1.5L cr GST Collection in Upcoming Months

The centre also released INR 17000 crore to the UT and states for GST compensation.

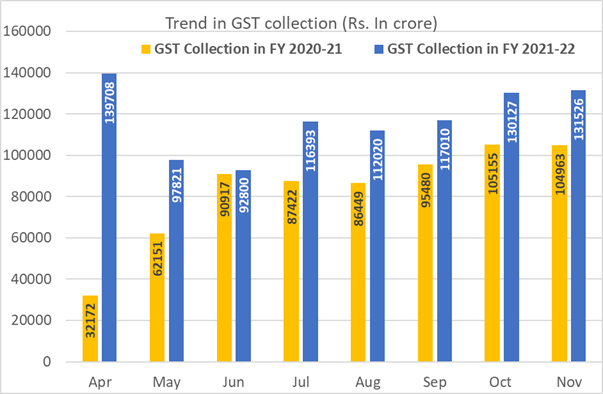

The below chart mentions the trends for the monthly gross GST revenues considering the current year. Also, the table mentions the state-wise figures of GST collected in each State within the month of November 2021 as compared to November 2020.