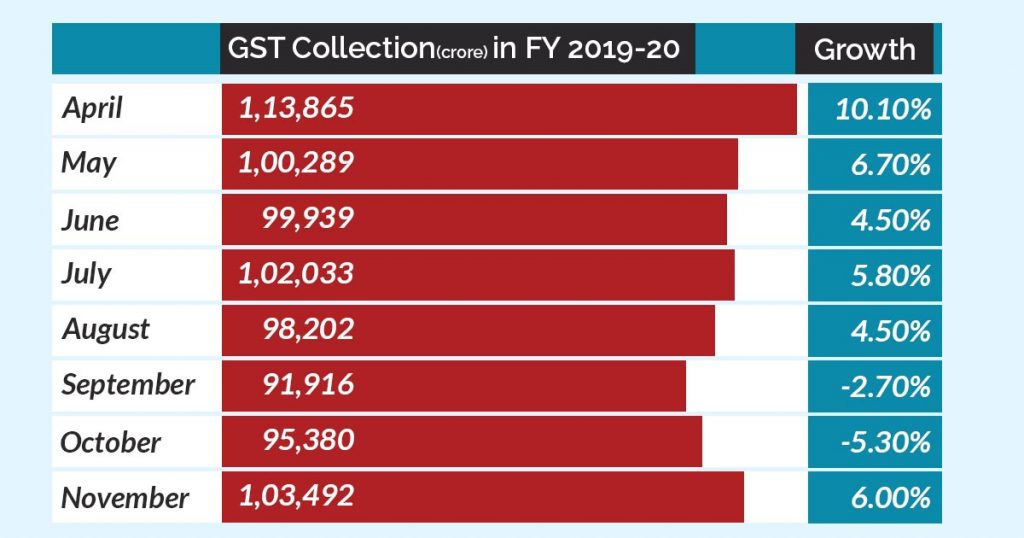

Finally, a rise in Goods & Service Tax (GST) collection in the month of November to INR 1.03 lakh crore has brought good news for GST officials who have been constantly working for measures to improve GST collection. This rise by 6% seems to reverse the last two month’s fall in GST collection. Experts are associating this increment to festive & wedding season and increased adherence to the tax rules.

Last year, in the month of November, the total GST collection was INR 97,637 crore which is 6% less in comparison to the GST collection in the same month of this year. This hike along with the hike in GST collection of November when compared to GST collection of INR 95,380 crore in October this year, indicates impressive economic recuperation, demand comes back and higher adherence to taxation laws.

“After two months of negative growth, GST revenues witnessed an impressive recovery. During the month, the GST collection on domestic transactions witnessed a growth of 12%, highest during the year,” a government official stated.

The total GST collection of INR 1,03,492 crore in the month of November includes CGST of INR 19,592 crore, SGST of INR 27,144 crore, IGST of INR 49,028 crore (INR 20,948 crore collection on imports) and Cess of INR 7,727 crore (INR 869 crore collection on imports). In November, a growth by 12%, encountered on domestic transactions, is the highest surge of the year.

In the current fiscal year, the slowdown in economic growth has brought down the revenue collection for the government. Higher revenue collections from tax indicate higher financial relief to the government. There was an upsurge in net tax revenue by 3.4% in the period between April to October from a year ago. This year, the Indian economy slowed down and reached the lowest of six-year in July-September. 4.5% economic growth in India indicates decelerated Indian economy during this quarter, while nominal GDP growth in the same quarter crashed to 6.1% – the lowest of the decade, which affects the tax collections.

GST collections had gone down by 2.7% and 5.3% in the month of September and October, respectively, of the year 2018.

“While the increase in collections is encouraging, it’s difficult to read too much into the collection for one month, particularly because October was also a month of festivals. We need to see what’s the trend,” said Pratik Jain, a partner at PwC. “The GDP (Growth Domestic Product)

Abhishek Jain, a tax partner at EY also shared his views on the topic and said, “This (increase in collections) might be a festive occurrence – whether the intensity with this will go up, only time will say,” Collections may have got a lift from better compliance measures. “With the implementation of anti-evasion measures like investigation on identified discrepancies through analytics and the recently implemented restrictions on availing of unmatched credits, there was a general expectation of collections witnessing an increase.”

The total number of GSTR 3B Returns filed

It is for the eighth time that revenue collection from GST has surpassed INR 1 lakh crore since the beginning of the GST regime. July 2019 is the last time when the GST collection had crossed INR 1 lakh crore.