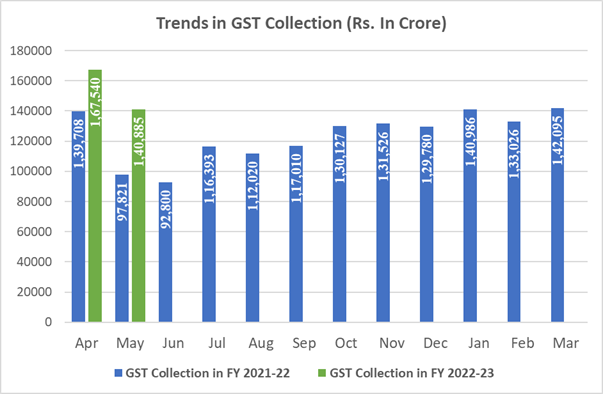

GST collection crosses Rs 1.40 lakh crore mark 4th time since the start of GST; 3rd month at a stretch since March 2022.

Rs 1,40,885 cr is the total GST revenue collection in the month of May 2022 of which CGST is Rs 25,036 cr, SGST is ₹32,001 crore, IGST is ₹73,345 crore (along with Rs 37,469 cr collected on the import of goods) and Rs 10,502 cr is cess (along with Rs 931 cr collected on the import of the goods).

The government has settled Rs 27,924 cr to CGST and Rs 23,123 cr to SGST via IGST. Rs 52,960 cr for CGST and Rs 55,124 cr for the SGST is the total revenue of the center and states in the month of May 2022. Moreover, the center has shown the GST compensation of Rs 86912 cr to the states and union territories on the date 31.05.2022.

Read Also: New Technology & Tight Compliances Behind High GST Collections

For the month of May 2022, the revenues are 44% more elevated as compared to the GST revenues in the same month’s former year of Rs 97,821 crores. In the month the revenues from the import of the goods were 43% more elevated and the revenue made via domestic transaction (including import of services) are 44% higher as compare to the revenues from these sources in the same month former year.

It is the fourth time the monthly GST collection has crossed the Rs 1.40 lakh cr mark since GST has been implemented and the third month at a stretch since March 2022. The May month collection is related to the GST returns for April, 1st month of the fiscal year would be lower than that in April which relates to the returns for March which is the end of the fiscal year. But the same is good to note that the gross GST revenues have crossed the ₹1.40 lakh crore mark, in the month of May 2022. The total number of e-way bills generated in April 2022 was marked at 7.4 cr, a 4% lower as compared to 7.7 cr e-way bills generated in the month of March 2022.

The below-mentioned chart specified the trends in the monthly gross GST revenues in the present year. The table specified the state-wise figures of GST collected in every state in May 2022 with respect to May 2021.