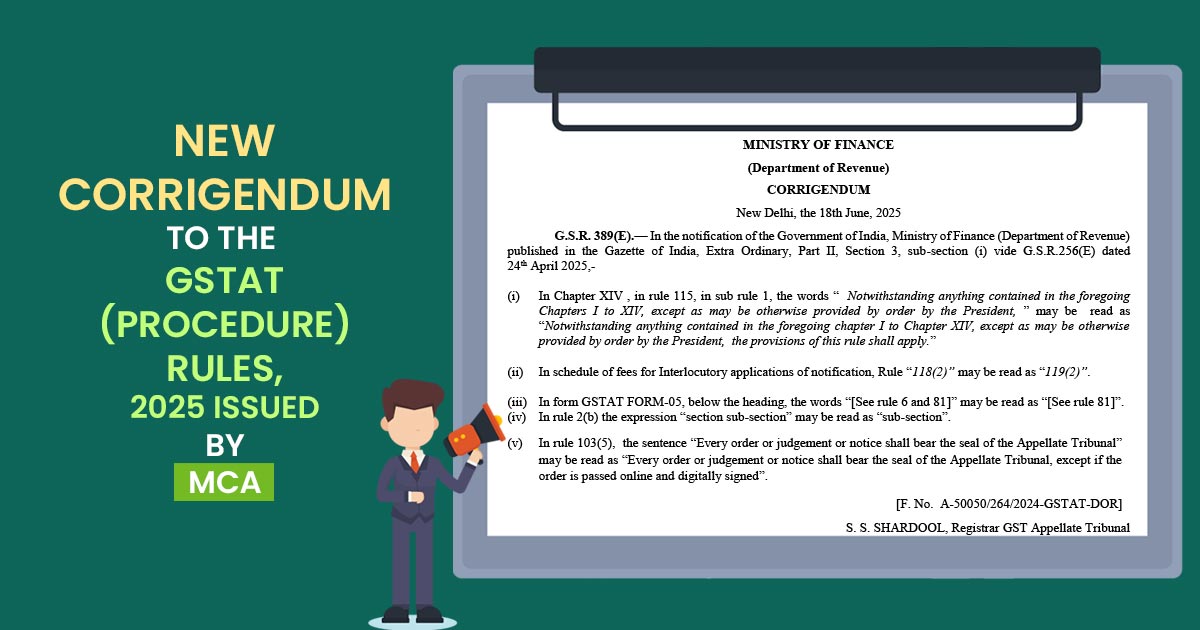

A corrigendum has been issued via the Ministry of Finance (Department of Revenue) to the notification G.S.R. 256(E), originally published on April 24, 2025, to improve and cite the norms under the Goods and Services Tax Appellate Tribunal (GSTAT) framework.

Technical errors are being addressed by the revised notification-published as G.S.R. 389(E) in the Gazette of India, and furnishes the legal clarity on distinct provisions.

Corrections Incurred

- Clarification Issued on Rule 115(1):

The introductory text of Rule 115(1) in Chapter XIV has been updated under the corrigendum to confirm coherence with preceding chapters. The modified rule cites that: “Notwithstanding anything contained in the foregoing chapter I to Chapter XIV, except as may be otherwise provided by order of the President, the provisions of this rule shall apply.”

Read Also: MoF Notifies GST Appellate Tribunal Procedure Rules, 2025 Via G.S.R. 256(E)

- Correction to Rule Reference for Application Fee:

From Rule 118(2) to Rule 119(2), the rule reference in the schedule of fees for interlocutory applications has been revamped, aligning the same with the regulatory framework.

- Amendment Issued for GSTAT Form-05:

The citation below the heading in FORM GSTAT-05 has been revamped. It must now read: “[See rule 81]” instead of “[See rule 6 and 81]”, eradicating unnecessary cross-referencing.

- Correction of Typographical Error in Rule 2(b):

With the accurate phrase “sub-section”, a grammatical correction replaces the phrase “section sub-section”.

- Exception for Digital Orders Under Rule 103(5):

A clarification has been added, citing that the orders, rulings, or notices passed online and digitally signed shall not need to hold the physical seal of the Appellate Tribunal. The revised sentence now reads: “Every order or judgement or notice shall bear the seal of the Appellate Tribunal, except if the order is passed online and digitally signed.”

The purpose of this revision is to ease the procedure of the newly operational GST Appellate Tribunal (GSTAT) and enhance legal accuracy in the GST litigation process.