The government seems to collect more GST in this fiscal year compared to the expectations with the continuous surge in the monthly mop-up recommending the Budget estimate for 2023-24 can be amended upwards if the Finance Minister Nirmala Sitharaman shows the Interim budget for 2024-25 dated 1st Feb 2024.

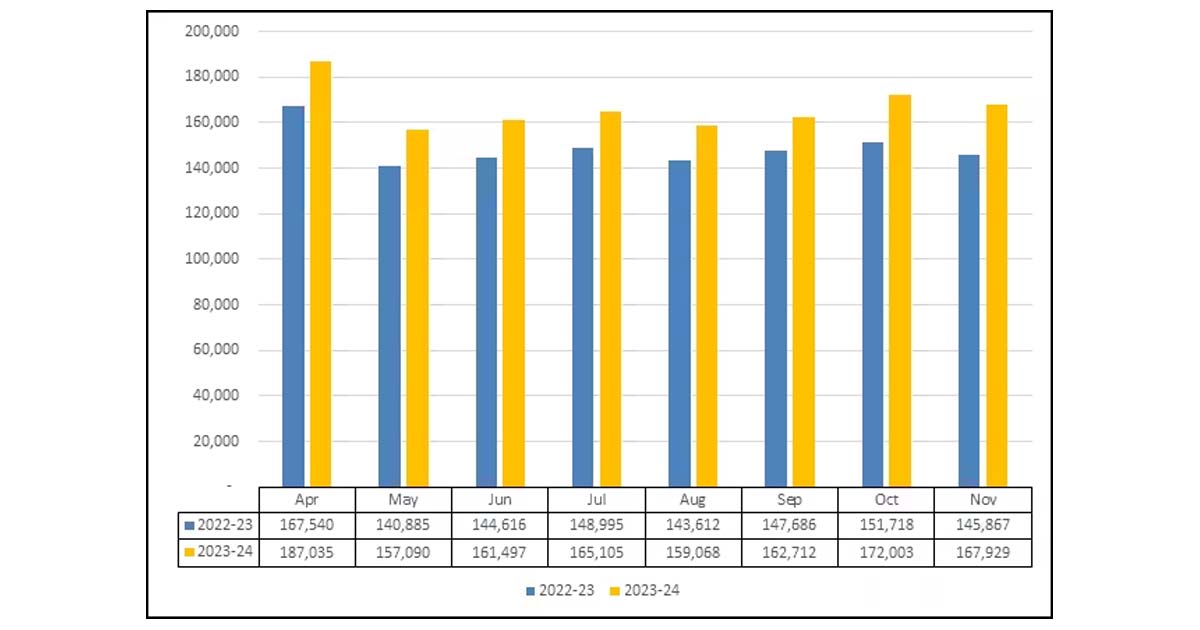

In the initial 8 months of 2023-24, the total GST collections shall be Rs 13.32 lakh cr a 12% exceeding the collected in April-November 2022. As the new indirect tax regime has started from 1st July 2017 the monthly collections have been surged slowly, the Finance Minister told to the Parliament.

The GST collection has surged to a record high of Rs 1.87 lakh cr in April 2023. Also, the monthly GST collection at the time of the present fiscal year has crossed Rs 1.50 lakh cr, FM answered a question in Lok Sabha.

According to the latest information for November, released on December 1, GST collections have stayed more than the Rs 1.5-lakh-crore mark for 9 consecutive months.

The data for November also took the average monthly collection in 2023-24 to Rs 1.67 lakh crore, up from Rs 1.51 lakh crore in 2022-23, Rs 1.24 lakh crore in 2021-22, Rs 94,734 crore in 2020-21, Rs 1.02 lakh crore in 2019-20, Rs 98,114 crore in 2018-19 and Rs 89,885 crore in 2017-18.

The finance ministry on January 1 shall release the indirect tax collection data for December.

Compared to the expectations the Indian economy rose faster, In July-September the Gross Domestic Product (GDP) rise stood at 7.6% crossing all the approximations, and the GST mop-up seems to be more than what the 2023-24 budget has forecasted. The finance ministry in this year’s budget has predicted that the centre’s GST collections will surge to 12% from 2022-23 to Rs 9.57 lakh cr.

Read Also: GST Collection – Why the Final Lap of Current F.Y. is Extremely Important

The total GST collection consists of State GST, Central GST, and Integrated GST. The Central GST or CGST is been credited to the Consolidated Fund of India and the state GST is been provided to the states. The integrated GST is settled between the Center as well as the States and union territories every month based on the place of consumption and the cross-usage of the ITC.