The Gujarat government has announced a new measure similar to a passport system: Individuals applying for GST registration will undergo police verification to combat fake billing.

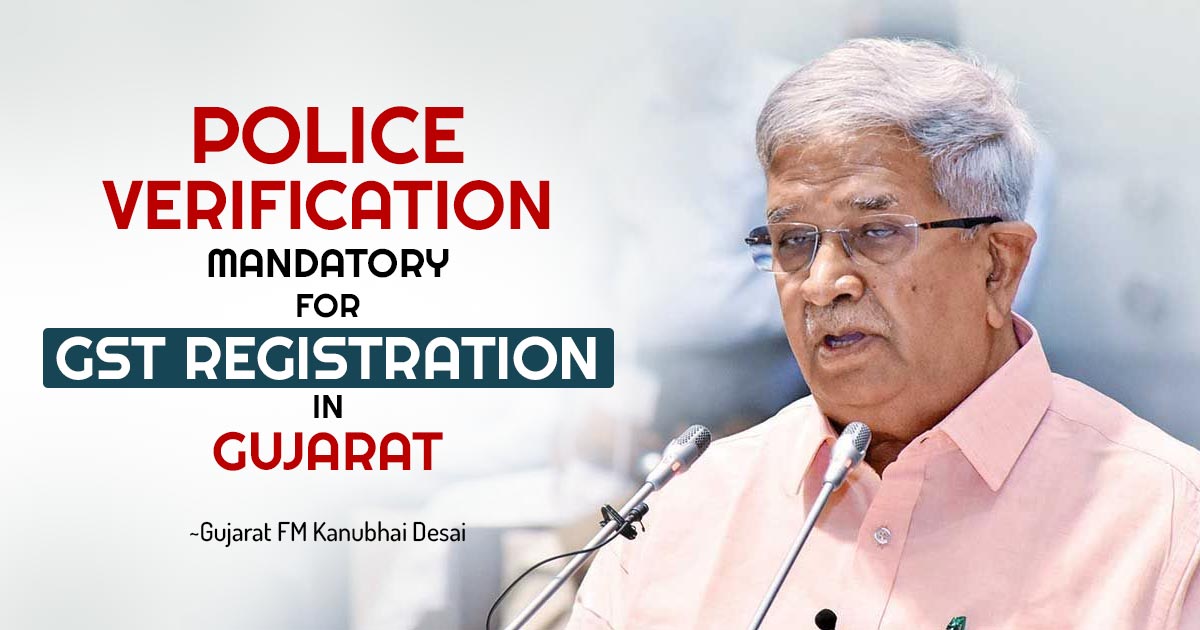

State Finance Minister Kanubhai Desai revealed this initiative during the monsoon session of the legislative assembly.

To address the problem of fraudulent billing, the GST registration process will be made more stringent by incorporating a police verification step, similar to the process for obtaining a passport. This step aims to reduce the potential for fraud through fake billing.

Minister Desai disclosed this plan while responding to concerns from opposition members about dishonest individuals claiming tax credits by presenting bogus GST invoices.

He made this announcement while presenting a Bill that aims to standardize the interest rates on overdue tax and duty payments.

The Gujarat Taxation Laws (Amendment) Bill, 2023, will establish a maximum interest rate and grant the government the authority to specify a lower interest rate through notification.

Two more Bills have been passed by the assembly one is The Gujarat Goods and Service Tax (Amendment) Bill and the other one is The Champaner-Pavagadh Archaeological Park World Heritage Area Management Authority (Repeal) Bill.

After a contentious debate, the Gujarat GST (Amendment) Bill, which suggests imposing a 28 percent tax on online gaming, was approved by a majority voice vote.

Senior MLA CJ Chavda called on the government to withdraw the Bill, arguing that it would essentially legalize gambling in Gujarat. This is because, instead of penalizing those involved in such activities, the government will now collect taxes from individuals who place bets through online applications.

Related: Arunachal Pradesh Govt Amends GST Bill 2023 for Adding New Provisions

Additionally, a third Bill proposed the elimination of an authority established in 2006 to protect heritage structures near Champaner and Pavagadh in the Panchmahal district.

The assembly was informed that the authority established in 2006 has become obsolete because the state government established the ‘Pavagadh Area Development Authority’ in June of the current year, serving the same purpose.