Differently-abled People or Divangjans were facing various problems in vehicle registration, after observing all the problems the Search Results Ministry of Road Transport & Highways (MORTH) has made some changes in the vehicle registration form that will help Divangjans to utilize various financial benefits including but not limited to benefits under GST.

Government also updated categories in the registration form to add ownership details of vehicles, these categories are driving training school, charitable trust, Divangjans, state transport department, central government, individual, educational institute, local authority, among others.

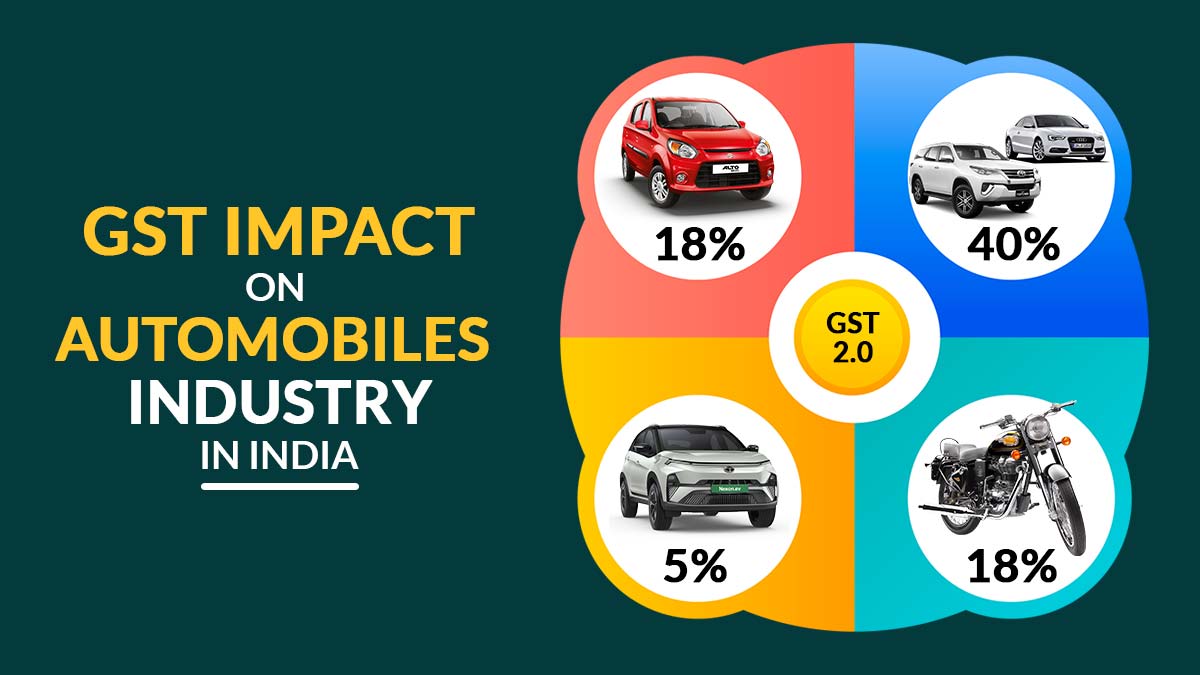

Read Also: GST Impact on Automobile and Spare Parts Industry in India

An Official statement also has been released and it states that “It has come to the notice of the ministry that the ownership details are not properly reflected under the ownership under the various forms under CMVR (central motor vehicle rules) required for registration of the motor vehicles… As per the current details under CMVR 1989, the ownership captured does not reflect the details of the Divyangjan citizens”.

Differently-abled or Physically disabled people will now be able to avail Goods and Services Tax (GST) and other financial incentives including exemption from paying Toll on highways under various Government schemes. Earlier, vehicle ownership details were not captured in the registration form thus availing all these benefits was not easy for such citizens.

The statement also added that “With the proposed amendments, such ownership details would be properly reflected and divyangjan would be able to avail the benefits under various schemes”. The MORTH also invited Stakeholders to comment or register their response within 30 days