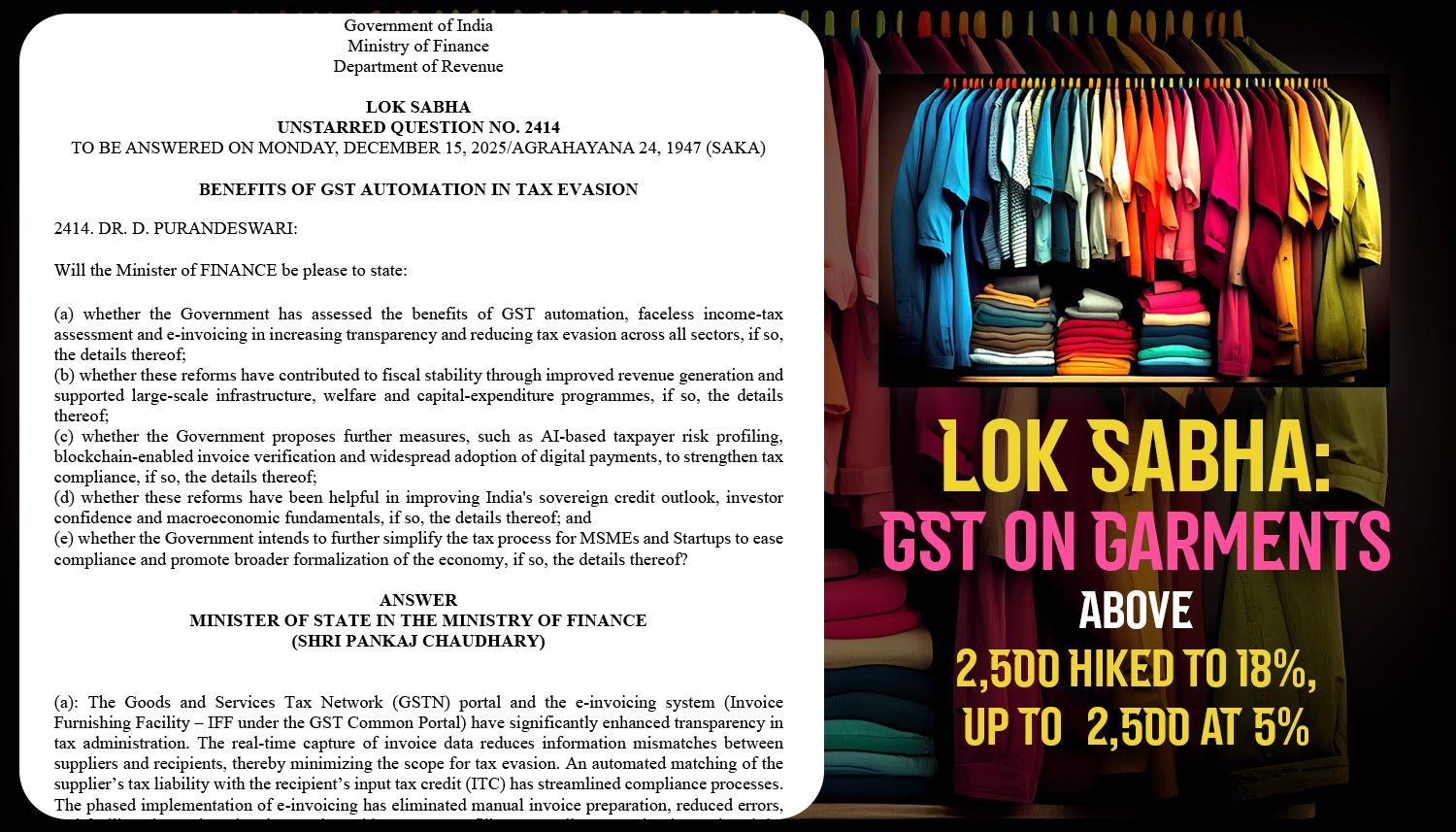

On readymade garments and clothing accessories priced exceeding Rs 2,500 per piece, the Central Government, following recommendations of the 56th GST Council meeting, has increased the Goods and Services Tax (GST) rate to 18% from 12%. W.e.f September 22, 2025, the revised rates shall come into force, the Ministry of Finance informed the Lok Sabha.

Meanwhile, the 56th GST council meeting has raised the limit for the concessional 5% GST rate on apparel from ₹1,000 per piece to ₹2,500 per piece. Consequently, the garments that have costs up to Rs 2500 will now draw merely 5% GST, a move objected to enhance affordability and boost consumption demand in the labour-intensive garment sector.

The government said that the GST rate for handmade and hand-embroidered shawls has been retained at 5%, with the earlier price limit removed. GST is 5% on the other hand-embroidered textile articles like embroidery motifs, strips, and handmade lace.

The Ministry’s GST rate rationalisation can rationalise and expand employment in the garment industry. From the revision in September 2025, the gross GST collections for October 2025 stood at ₹1,95,936 crore, showing a 4.6% year-on-year rise.

The government, to support the textile sector, has decreased the GST to 5% from the previous 12% and 18% rates on man-made fibres and yarns. This reduction is for improving the competitiveness of MSME textile manufacturers and exporters.

The textile industry will successively receive support via schemes such as PM MITRA Parks, the Production Linked Incentive (PLI) Scheme for MMF and technical textiles, SAMARTH for skill development, the National Handloom Development Programme, and export incentive schemes like RoSCTL and RoDTEP.

Get More Details