For All India Special Drive, Rajasthan Commercial Taxes issues clarification against the fake GST registration. However, the genuine assessee would not be needed to worry.

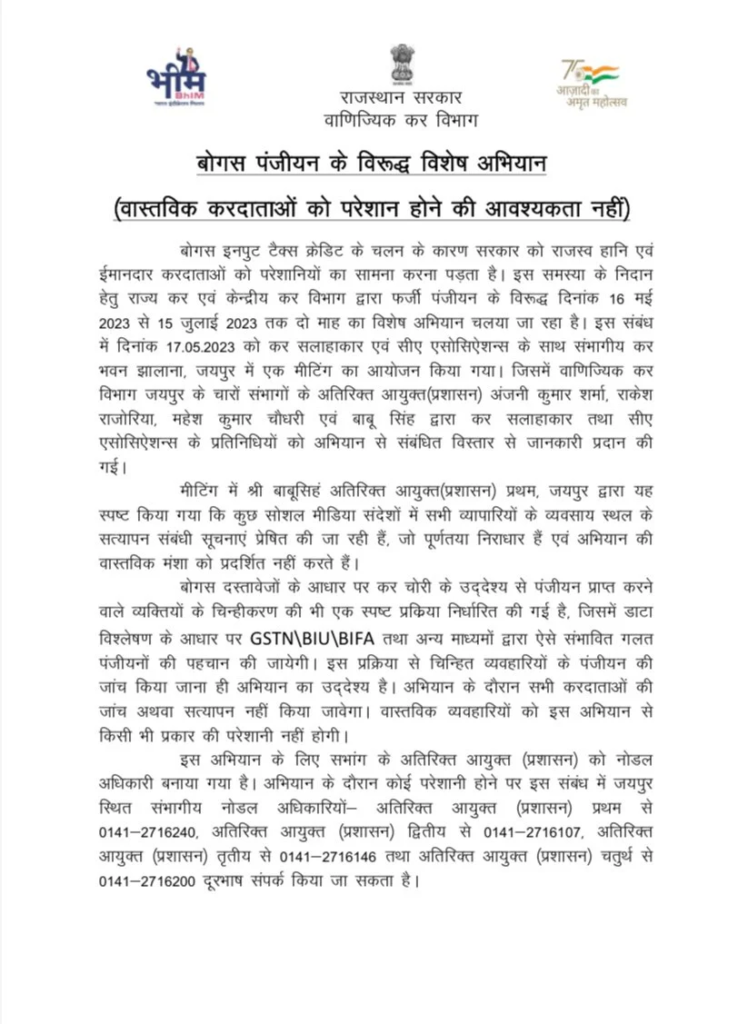

The government would be needed to suffer a loss in revenue and the honest assessees would be required to suffer from the issues because of the fake practice of ITC. State tax and central tax department run a special campaign of two months from 16th May 2023 to 15th July 2023 in order to resolve the issue of fake registration. At Divisional Kar Bhawan Jhalana, Jaipur a meeting was conducted with the tax consultants and CA associations on 17.05.2023.

There the Additional Commissioners (Administration) Anjani Kumar Sharma, Rakesh Rajoria, Mahesh Kumar Chaudhary, and Babu Singh of the four divisions of the Commercial Taxes Department Jaipur furnished the information of the campaign to tax consultants and representatives of CA Associations.

At the meeting, the data for the verification of all the trader’s business locations would be sent in certain social media messages which would be wrong and does not show the correct intention of the campaign said, Mr Babusingh, Additional Commissioner (Administration)-I, Jaipur.

A defined approach has also been mandated to recognize those who have gained registration for the purpose of tax evasion on the grounds of fake papers, in which such incorporated erroneous registrations would be identified using GSTN\BIU\BIFA and other ways based on data analysis.

With such a method, the objective of the campaign is to double-check the registration of the merchants. There would be no assessee known or verified at the time of this campaign. For honest company owners, the initiative shall cause no issues.

For such a campaign, the Additional Commissioner (Administration) of the society has been made the nodal officer.

The case when there is any issue arises at the time of the campaign, in this respect, Jaipur-based regional nodal officers Additional Commissioner (Administration) I to 0141-2716240, Additional Commissioner (Administration) II to 0141-2716107, Additional Commissioner (Administration) III to 0141-2716145 and Additional Commissioner (Admn) IV can be contacted over the phone 0141-2716200.