Form GSTR-4A is said to be the auto-drafted and read-only form towards the composition assessee, auto-generated as per the information which is saved or furnished Form GSTR-1 and 5 and furnished Form GSTR-7 of the deductors in which the composition assessee is the recipient. The composition assessee had not taken any action for Form GSTR-4A. This form is for the view.

You must know that:

Form GSTR-4A might be practised as a reference to insert the information in Form GSTR-4.

Differentiate Term Debit/Credit Notes Prior & Post to Delinking of Form GSTR-4A

| S.no. | “Before Delinking of Debit/ Credit Note” | “After Delinking of Debit/ Credit Note” |

|---|---|---|

| 1 | “Original invoice number and original invoice date were auto-drafted” | “Original invoice number and original invoice date fields are not visible” |

| 2 | “POS field was not available” | “POS field is auto-populated as a mandatory field” |

View the Return Form GSTR-4A with Easy Steps

Step 1: Open www.gst.gov.in URL.

Step 2: From the GST Home page login to the Portal with valid details.

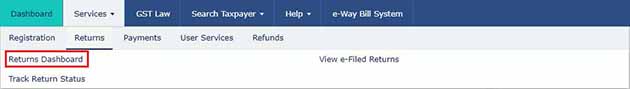

Step 3: Navigate to Services > Returns > Returns Dashboard command.

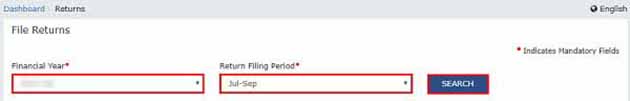

Step 4: The file returns page will appear. Here, select the relevant Financial Year & Return Filing Period from the drop-down list.

Step 5: Now, click the SEARCH tile.

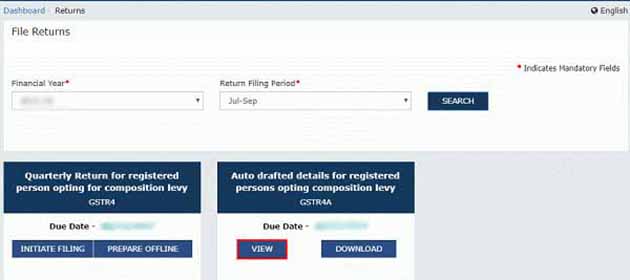

Step 6: From the File Returns page check the GSTR4A tile, find and click on the view tile.

Note: If the number of invoices is over 500, you will have to download the invoice to view it in your Form GSTR-4A. To generate the file, click on the Download button and on the Generate File tile in the GSTR-4A tile.

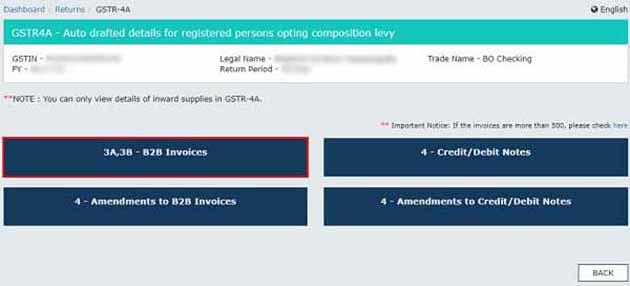

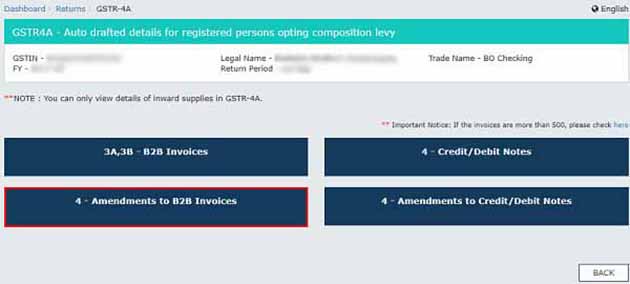

GSTR4A – The auto-draft details will be displayed for the registered persons opting for the Composition Levy page.

Click on the following tile names to get more details:

- 3A,3B – B2B Invoices

- 4 – Credit/Debit Notes

- 4 – Amendments to B2B Invoices

- 4 – Amendments to Credit/Debit Notes

3A and 3B – Business to Business Invoice

It will show all inward supplies got from registered suppliers. The B2B section of Part A of GSTR-4A will be auto-populated when suppliers in their respective returns of GSTR-1 and GSTR-5 upload or save their invoices.

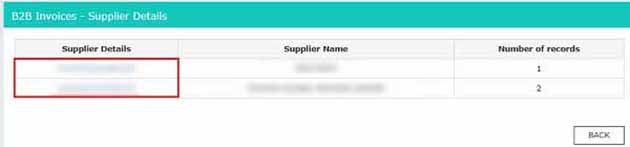

Step 1: Now, click on the tile having text ‘3A,3B – B2B Invoices’. The B2B Invoices – Supplier Details page will appear

Step 2: Click on the GSTIN hyperlink under Supplier details to check all the invoices uploaded by the supplier.

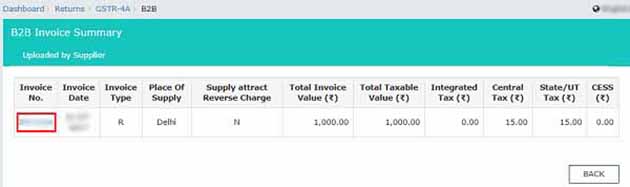

Step 3: Now, click on the hyperlink present under Invoice No. to check the details of the invoice.

Step 4: Details of a particular item will be displayed on the screen.

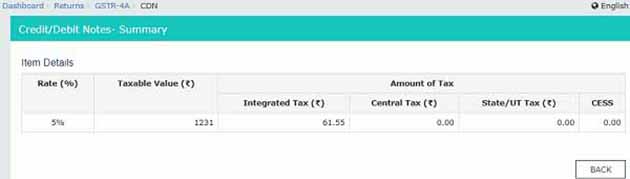

4 – Credit and Debit Notes

Here, users can see credit/debit notes attached by the supplier in their respective returns (GSTR-1/5).

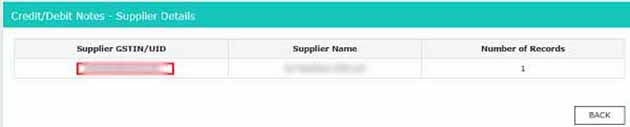

Step 1: Click on the tile having text ‘4 – Credit/Debit Notes’. The Credit/Debit Notes – Supplier Details page will be displayed.

Step 2: Users have to click on the GSTIN hyperlink under supplier details to view all the invoices uploaded by any particular supplier.

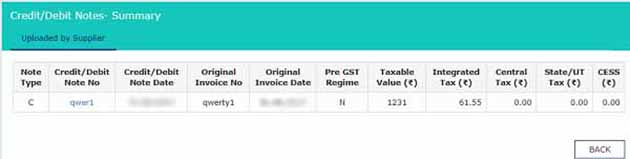

Step 3: Under the Credit/ Debit Note No click on the hyperlink to check the details of the attached credit/debit note.

Step 4: Complete details of that particular Credit/ Debit Note will be displayed.

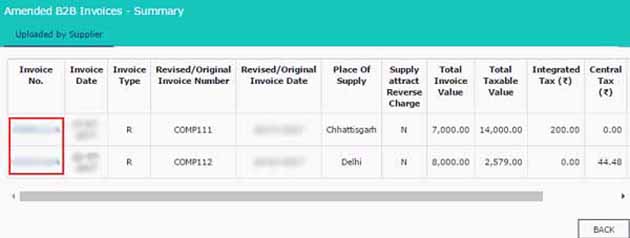

4 – Amendments to Business to Business Invoice

This particular section pertains to all those invoices which have been amended by the supplier in the return of GSTR-1 and GSTR-5, respectively.

Step 1: Click on the tile “4 – Amendments to B2B Invoices“. The Amend B2B Invoices – Supplier Details page will appear.

Step 2: Click the hyperlink present under GSTIN to check the supplier of the amended invoice that has been uploaded on the portal.

Step 3: Click on the hyperlink presented under Invoice No. to check the details of the invoice.

Step 4: Details of the particular item will appear on the screen.

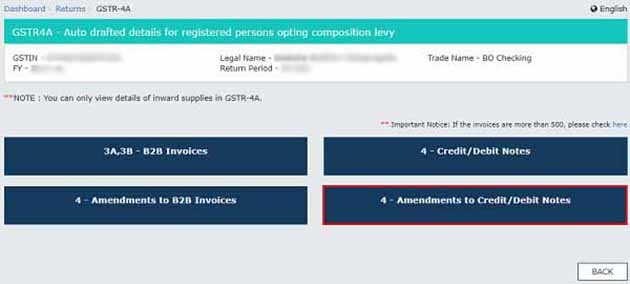

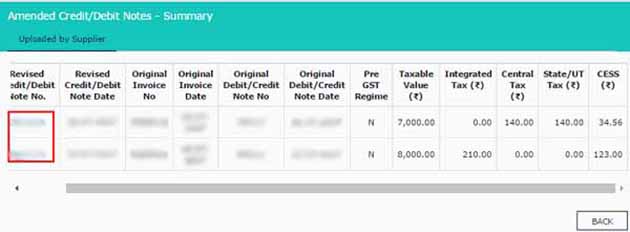

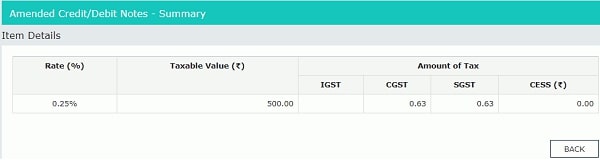

4 – Revisions to Credit and Debit Notes

This section features all the revisions of debit/credit notes made by the supplier in their respective returns GSTR1 and GSTR-5.

Step 1: Click on the “4 – Amendments to Credit/Debit Notes” tile. The Amend Credit/Debit Notes – Supplier Details page will appear.

Step 2: Click the hyperlink under the GSTIN column to check the amended credit/debit notes uploaded by the supplier.

Step 3: Now, click the hyperlink under Credit/ Debit Note No to check the details of the invoice.

Step 4: Details of that particular amendment credit/debit note will be displayed.

Major FAQs on Return Form GSTR 4A

Q.1 – What are several sections for Form GSTR-4A and what do they reveal?

Form GSTR-4A mentioned the sections below as:

- 3A,3B – B2B Invoices: The sections mentioned the inward supplies obtained from the enrolled suppliers.

- 4 – Credit/Debit Notes: The sections show the credit or debit noted added through the supplier for the corresponding returns.

- 4 – Amendments to B2B Invoices: The section shows that the invoices are changed through the supplier in their returns.

- 4 – Amendments to Credit/Debit Notes: This shows that the revisions of credit or debit notes performed through the supplier for their corresponding returns.

Q.2 – Can I furnish Form GSTR-4A?

No, you will not need to furnish Form GSTR-4A. It is a read-only document given to you so that you have a record of all the invoices obtained from several suppliers inside the mentioned tax period.

Q.3 – Do I make amendments to or add invoices in my Form GSTR-4A for the case in which there occur any errors or items missing for the information uploaded through the supplier assessee?

No, one shall not makes any revisions towards Form GSTR-4A, as it is a read-only document.

Q.4 – I add some new invoices in Form GSTR-4. Do I am able to view the invoices in Form GSTR-4A?

The new or missing invoices totaled by the composition assessee in Form GSTR-4 are not added to GSTR-4A of either the present or consequent tax period.

Q.5 – What will be executed if the composition assessee furnished his Form GSTR-4 and the supplier is furnishing his Form GSTR-1/5 post that for a respective tax period?

If the composition assessee has furnished his Form GSTR-4 and the supplier is furnishing his Form GSTR-1/5 post that for the respective tax period for the case Form GSTR-1/5 data shall get auto-populated to the subsequent open period Form GSTR-4A.

For instance:

The receiver has furnished Form GSTR-4 for Q1. the supplier filed the Form GSTR-1 for July month. In this case, Form GSTR-1 the invoices will be populated in the subsequent open period that is Q2 of Form GSTR-4A.

Q.6 – When do I require to download the invoices to see them inside my Form GSTR-4A?

If the number of invoices exceeds 500 then you are urged to download the invoices to see them in your Form GSTR-4A.

View & Download GSTR-4A Form in PDF

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."