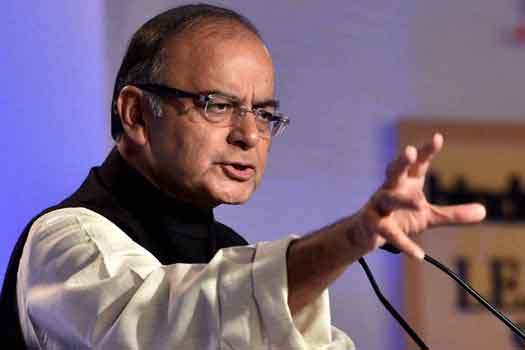

New Delhi: Due to the extreme criticism faced by the proposed EPF tax regime, Finance Minister Arun Jaitley has made an announcement to withdraw the controversial EPF taxation proposal on Tuesday morning. He said that there will be a thorough evaluation of the same, which the government would take.

The major parties involved in criticizing the proposal were the opposition as well as the affiliates of the ruling BJP’s intellectual advisor, the RSS.

The EPF tax regime proposed by Jaitley in Budget 2016-17 was to withdraw tax of 60 percent of the accumulations in the employee provident fund from April 1, 2016 onwards, except for the amount was utilized to get the annuities.

Recommended: Budget 2016 Unveils Tax Relief for Small Taxpayers

“In view of representations received, the government would like to do a comprehensive review of this proposal and therefore I withdraw the proposal,” announced by Jaitley in Lok Sabha. On the other side, Congress went for an objection and said the Centre’s proposal should be fully reviewed.

Jaitley when explained the logic behind the taxation proposal, conveyed, “Employees should have the choice of where to invest. Theoretically such freedom is desirable, but it is important the government to achieve policy objective by instrumentality of taxation. In the present form, the policy objective is not to get more revenue but to encourage people to join the pension scheme.”

According to the new rule that is going to be there in the Budget is that it will affect only the private sector lofty employees. From 3.7 crore people who make a contribution in the EPF, more or less 60 lakh have used the scheme to avoid taxes.