Simple Meaning of ITR-U Form

Has your ITR ever been misinterpreted, or have you forgotten to report an income? Within two years, you can update your Income Tax Return (ITR U) under section 139(8A) of the Income Tax Act. It is calculated two years from the date of filing the original return. Taxpayers were instructed to file ITR-U to optimise their tax compliance without provoking legal action from the department.

Who Can File the Updated Income Tax Return Form?

Individuals who have made an error or overlooked certain income details can file an updated income tax return for any of the following:

- Belated Return

- Income Return

- Revised Return

An Updated Income Tax Return can be filed in the following cases:

- Taxpayers Missed the Due and Last Date

- Income Details Not Correct

- Select the Wrong Head of Income

- Taxes Paid at the Wrong Income Tax Slab Rate

- Carried Forward Losses Reduction

- Unabsorbed Depreciation Reduction

- Tax Credit Reduction Under Section 115JB/115JC

Deadline for Filing ITR-U Form

From the end of the relevant assessment year, an updated Income Tax Return (ITR-U) can be furnished within 48 months. For example, for A.Y. 2023-24, an updated return can be filed up to 31st March 2028.

Why You Should Choose Genius Tax Software for ITR-U Filing?

Genius software offers several advanced facilities that help to file the ITR-U form properly. The software has the ability to make backups, restore data, set a password, etc. XML/ JSON files can also be imported by the client, which is another good feature. CA professionals can easily e-file the ITR-U return form by selecting client data and uploading other forms without any errors.

Here in this post, we write complete steps to file an ITR-U form via Genius Software for two cases.

Case 1: The Original Income Tax Return is Not Filed

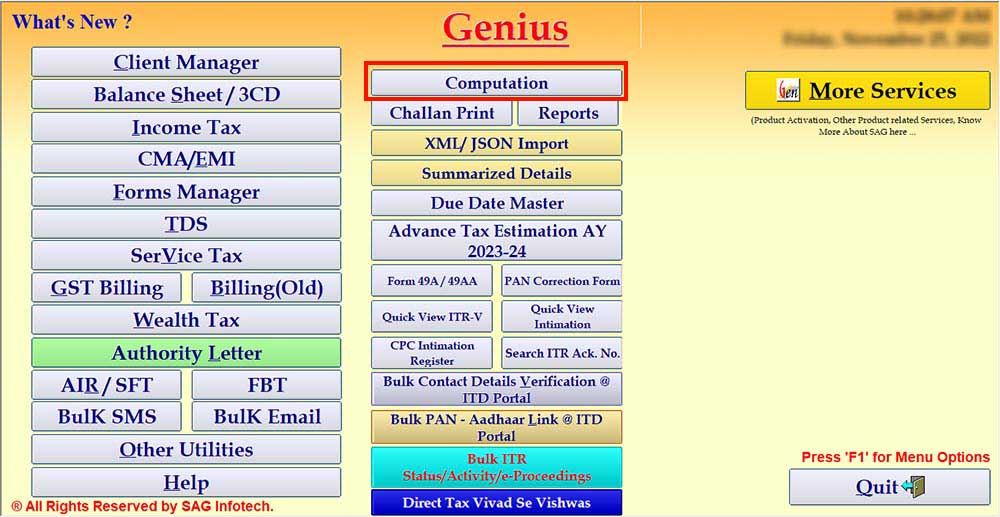

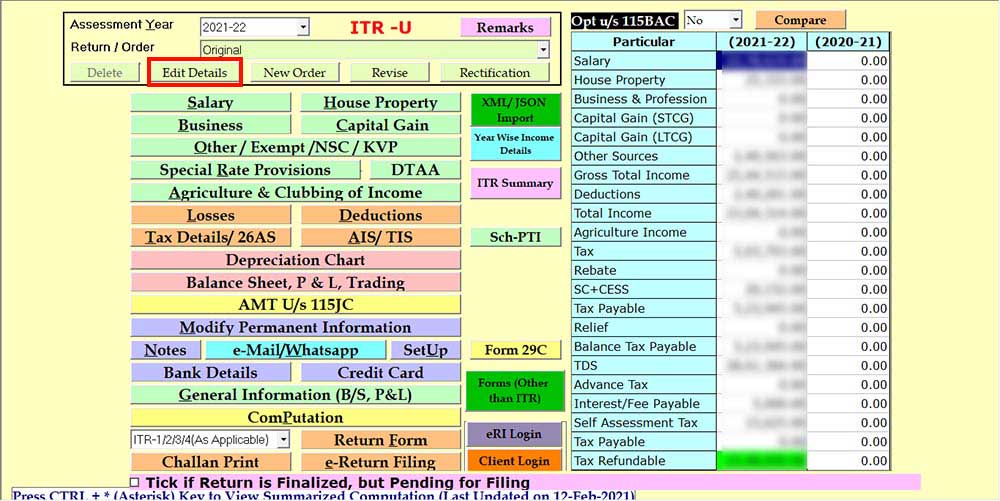

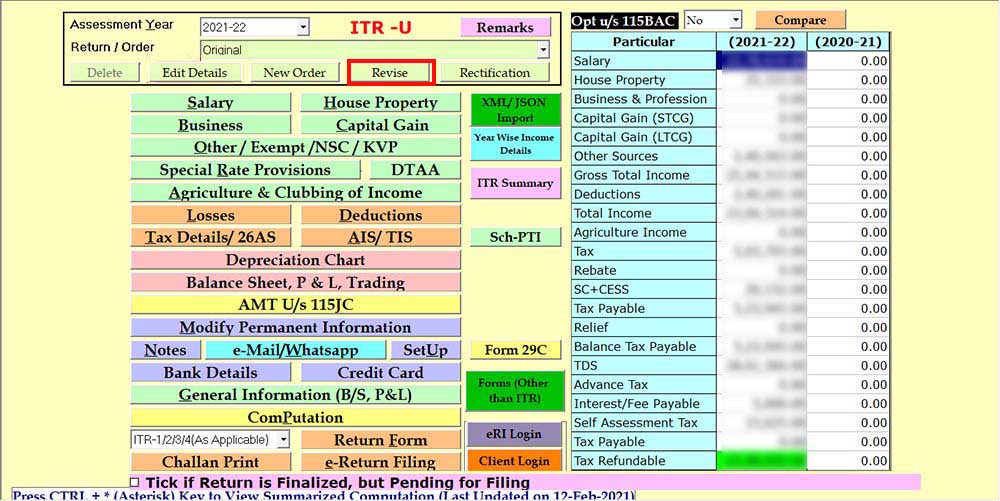

Step 1: Install the Genius software on your desktop and select the ‘Computation’ option for filing ITR-U.

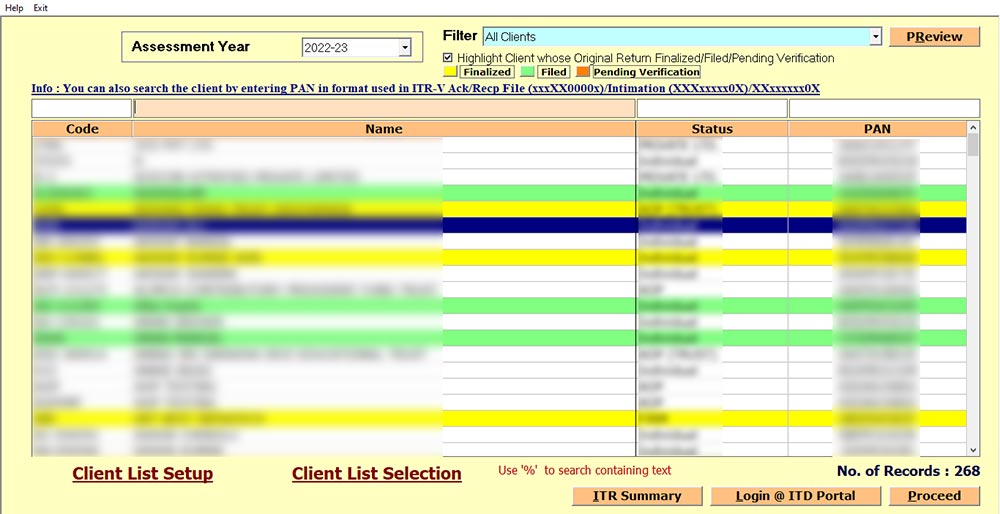

Step 2: After clicking the ‘Computation’ option, select the ‘client’.

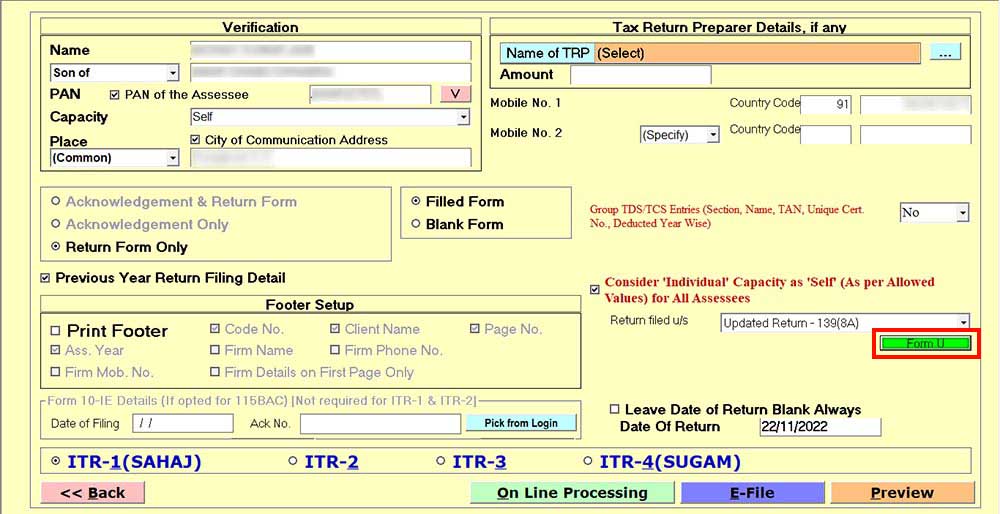

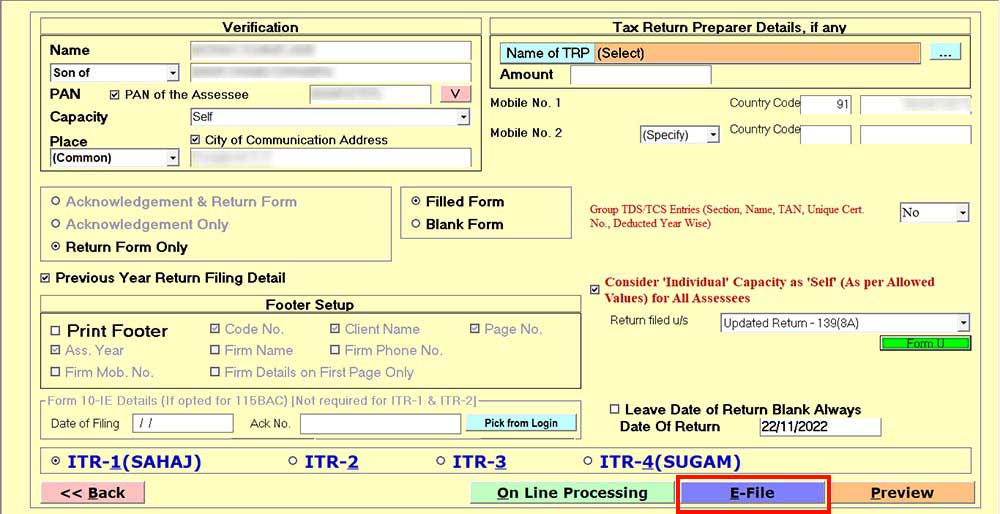

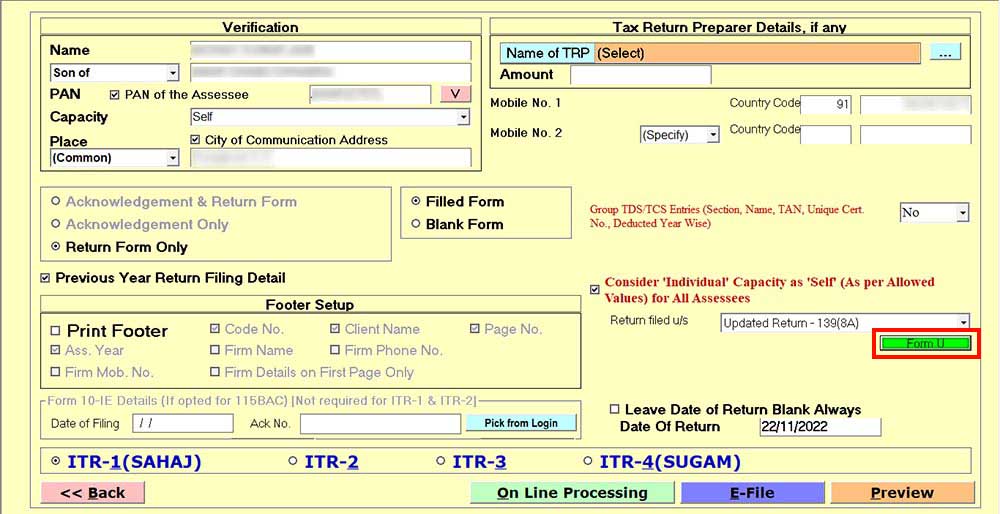

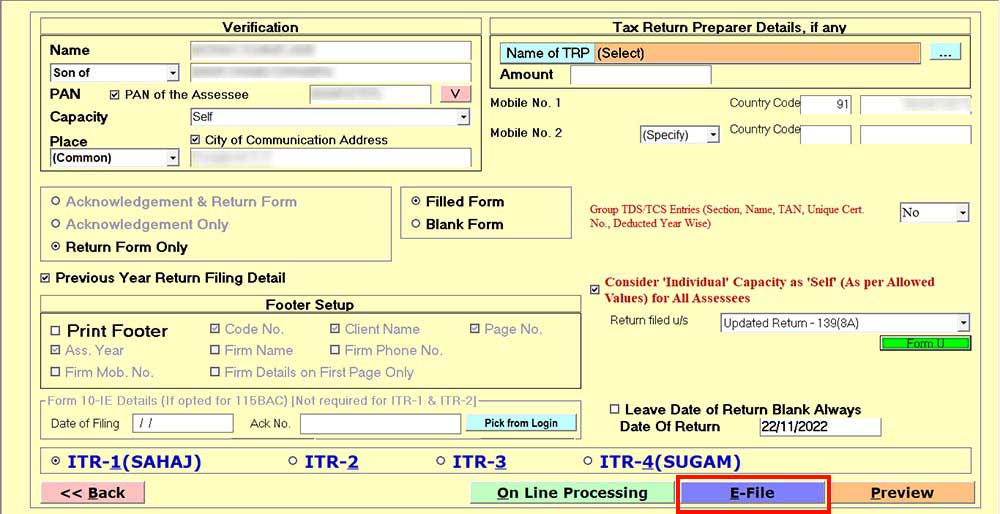

Step 3: After selecting the client, move the cursor to ‘Tax Return Prepare Details, If any’ and fill in the verification client details.

Step 4: Now move the cursor on return files u/s ⏩ then select the ‘Update Return -139(8A)’ form dropdown. Then click on ‘Form U’

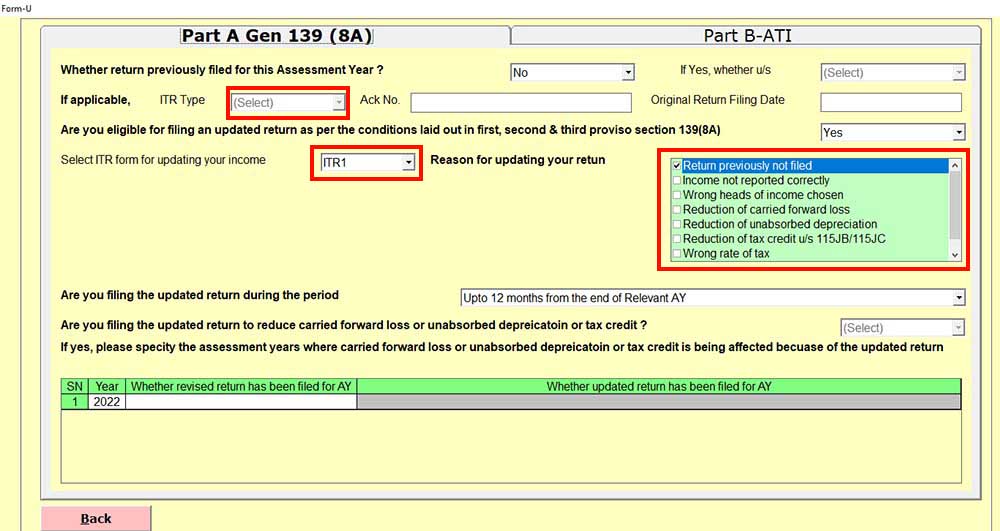

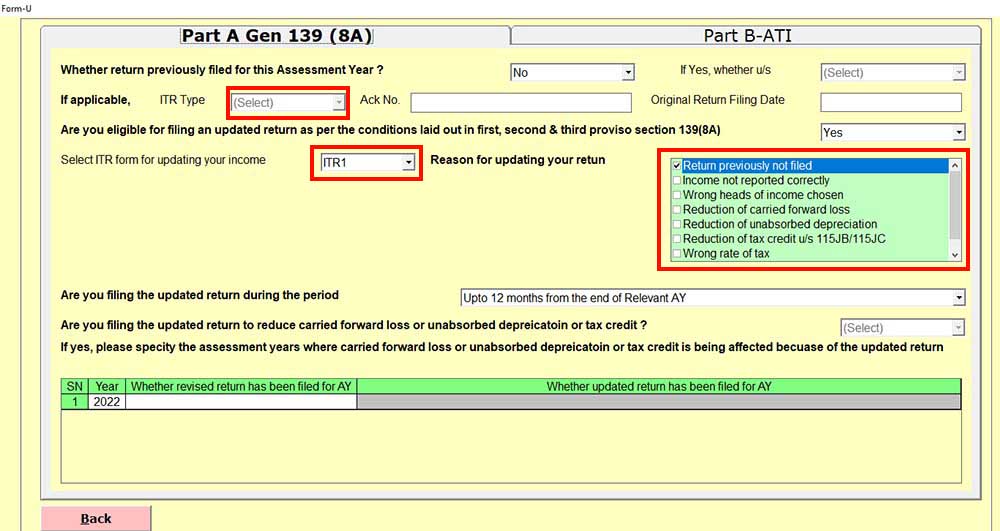

Step 5: Select ‘ITR Type’ to update your Income

Step 6: After selecting the type, select the ‘Income Tax Return’ form according to applicability.

Step 7: Now move on to the next step to select the ‘Reasons for Non-Filing Return’ for the dropdown menu.

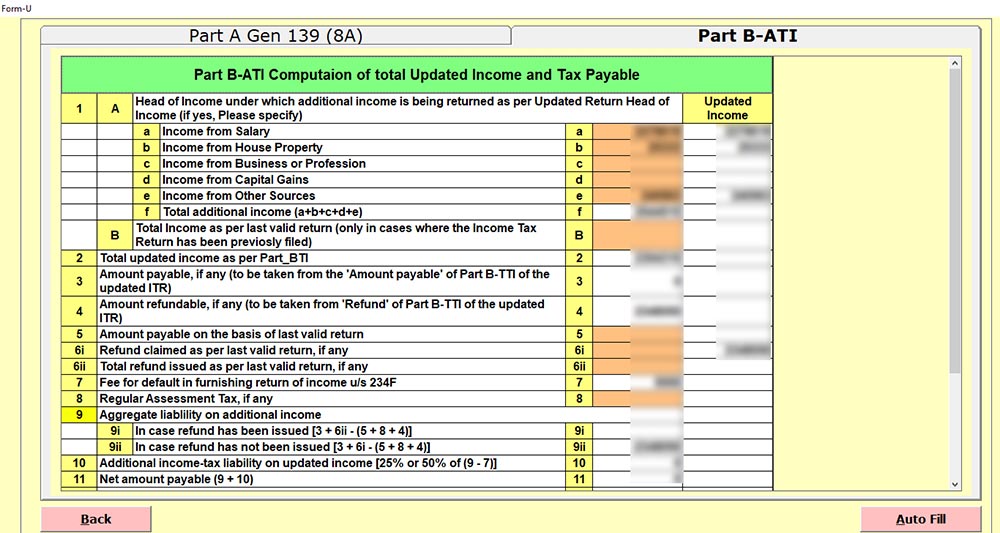

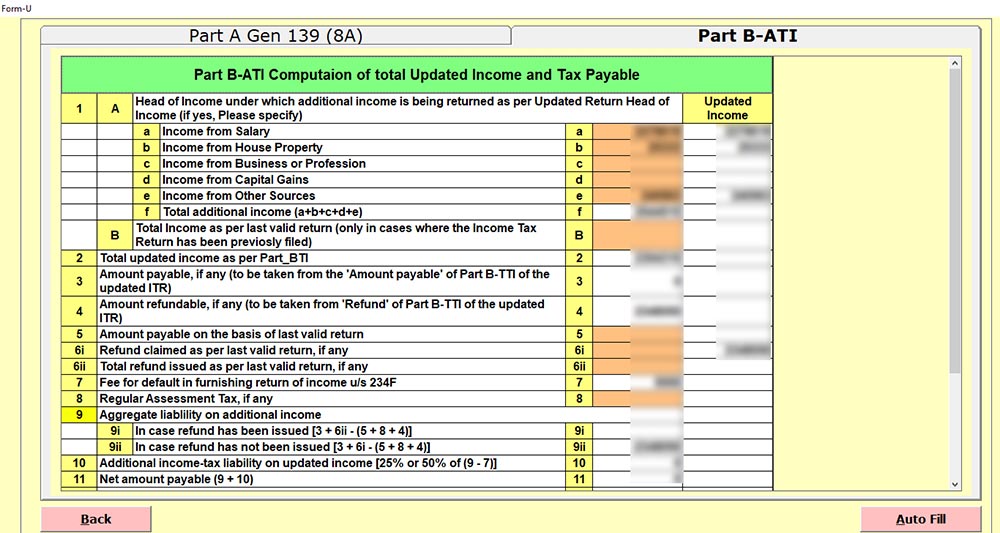

Step 8: After selecting the reason, move the cursor to ‘Part B-ATI’ and click on the Auto Fill button to fetch the data.

Step 9: Now, enter the Challan Details in column number 14

Step 10: After entering the challan details, click on the ‘E-File’ button and file the ITR-U return

Case 2: Original Income Tax Return Has Been Filed

Step 1: In the case of the original return filing, the client has to ‘Edit the Details’ and file the previous IT return details.

Step 2: Now move the cursor to the ‘Revise’ button and create a ‘Revised File’

Step 3: After creating a revised file, the client can update income details and select the return filed u/s 139(8A) form dropdown. Then click on ‘Form U’.

Step 4: After selecting the 139(8A) option, click on the ‘E-File’ button.

Step 5: After clicking ‘Form-U’, select ITR type, IT form and reason from Part A Gen 139 (8A).

Step 6: Now, click on Part B-ATI and click on the ‘Auto Fill’ button to fetch data and fill in the challan details in row 14.

Step 7: Last, enter the challan details. The client clicks on the ‘E-File’ button and files the return

Gone through Updated Return filing , good, but want to understand more.