GSTR 5A is a mandatory form required to be filed by all internet service providers or Online Information and Database Access or Retrieval (OIDAR) Service Providers. Here, SAG Infotech provides all the GSTR 5A Form-related details along with rules and regulations, and compliance requirements, through a step-by-step online return filing procedure.

- What is GSTR 5A

- Who is Required to File GSTR 5A

- Difference Between GSTR 5 and GSTR 5A

- GSTR 5A Due Date and Penalty Charges

- GSTR 5A Filing Requirements

- Simple Procedure to File GSTR 5A Online

- General Queries on GSTR 5A Form

OIDAR: The Internet is the source of medium connecting services from abroad to India and vice-versa. There are many ways which offer services to users across different countries. For instance, Amazon is delivering cloud-based services (AWS) to India from the United States.

Latest Update

- The new advisory for GSTR-5A is related to changes in Table 5B report supplies made to Registered GSTINs (B2B supplies). View more

- The GST department has added an advisory for supplies in tables 5D and 5E of form GSTR-5A. View more

The common mode of transferring such services is the Online Information and Database Access or Retrieval (OIDAR) Service Provider. Thus, OIDAR services are basically a sort of service rendered by utilizing the internet medium. These services are transferred to service users without using any physical medium attached to the service provider. OIDAR services come under the ambit of GST with consideration to ensure that the domestic service providers provide an equal option regarding the cost as well.

Applicable GST: The OIDAR service providers are liable to pay GST under the indirect tax bracket. A return form, GSTR-5A has been mentioned to be filed by the OIDAR service providers delivering services to unregistered service recipients in the country.

The Service recipients are categorized into two types:

- An unregistered Person, Local Authority, Government

- When the users receive such services from the service provider, it is the responsibility of the service provider to pay GST under the government of India. The services rendered here should be for an objective other than commerce or business. For such users, the GSTR 5A is to be furnished.

- Registered Person/Entity

- The taxes on such services which are received by a person/ entity are applied in a reverse charge mechanism. It is the responsibility of the recipient to pay GST to the government of India. As mentioned, the GST will be payable through the reverse charge mechanism. The returns as well are required to be furnished accordingly. The service’s users are to furnish returns or add these services when filing the returns.

What is a GSTR 5A Form?

GSTR 5A is a compulsory form filed by the NRI service providers and Online Information and Database Access or Retrieval (OIDAR) Service Providers. The form is required to be filed every month irrespective of transactions and business deals.

Who is Required to File GSTR 5A Form?

GSTR 5A is filed by all the NRI service providers or Online Information and Database Access or Retrieval (OIDAR) Service Providers.

What is the Difference Between GSTR 5 and GSTR 5A?

Although there is very less difference between GSTR 5 and GSTR 5A while the commonality is that GSTR 5 is a filing form which is filed by Non-resident Indians. They are required to file on every 20th of the succeeding month. The form includes all the details of sales and purchases in the form

while GSTR 5A is a return form which is required to be filed by NRI online service providers or Online Information and Database Access or Retrieval (OIDAR) Service Providers who offer their online services in India and earns revenue in return.

What is the Due Date for Filing GSTR 5A Online?

NRI service providers are required to file GSTR 5A by 20th March 2026. It is compulsory to file GSTR 5A even if no transactions or business is dealt with in a particular month.

| Month | Due Date |

|---|---|

| February 2026 | 20th March 2026 |

| January 2026 | 20th February 2026 |

| December 2025 | 20th January 2026 |

| November 2025 | 20th December 2025 |

| October 2025 | 20th November 2025 |

| September 2025 | 20th October 2025 |

| August 2025 | 20th September 2025 |

| July 2025 | 20th August 2025 |

| June 2025 | 20th July 2025 |

| May 2025 | 20th June 2025 |

| April 2025 | 20th May 2025 |

| March 2025 | 20th April 2025 |

| February 2025 | 20th March 2025 |

| January 2025 | 20th February 2025 |

| December 2024 | 20th January 2025 |

What is the Penalty for Late GSTR 5A Filing?

When a taxpayer misses a due date in a relevant period, a late fee is chargeable in the following respect:

| Type of return | Late Fee Per Day |

|---|---|

| Normal Return | Rs. 50 |

| NIL Return | Rs. 20 |

GSTR 5A Filing Prior Requirements

According to the Act, a GSTR 5A is required to be furnished on a monthly basis. The last date for filing the GSTR 5A return form is the 20th of the next month. Here are certain things, you need to consider before filing a GSTR 5A return.

- Non-resident OIDAR is required to file GSTR 5A on a mandatory basis

- The return is required to file every time in a tax period whether there is no business activity or no return

- The return will be filed after paying the due or tax amount

- It is not required to maintain the electronic cash ledger as there is no input tax credit facility while filing the form

- It is not possible to file a return for this period if you didn’t file the return for a previous tax period

Let’s Learn the GSTR 5A Online Filing Procedure

Table 1: GSTIN of the service provider

Table 2: Name of the registered taxpayer and trade name

Table 3: Name of the legal representative in India furnishing the return in India on behalf

Table 4: Time period (month & year) for filing the return

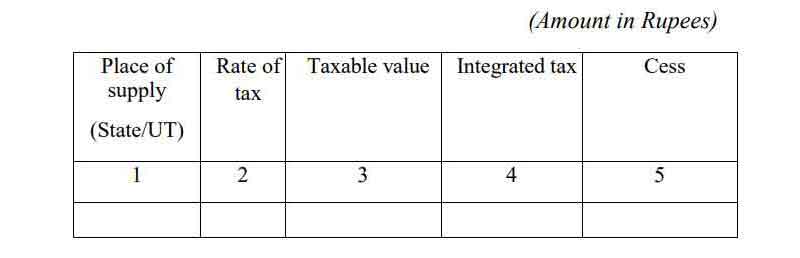

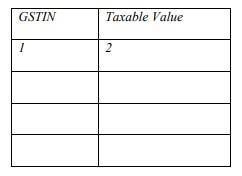

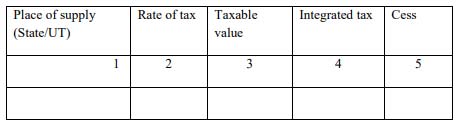

Table 5: Taxable outward supplies assigned to service users in India comprising the tax rate, taxable value, details of place of supply, cess, and integrated tax.

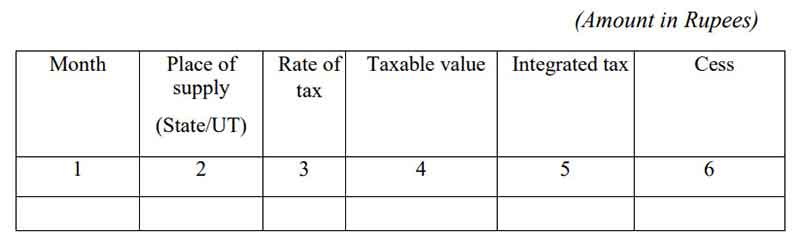

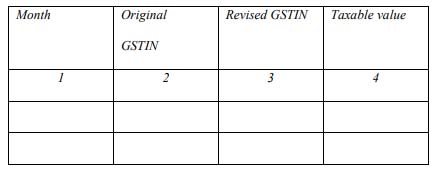

Table 5A: Modifications to taxable outward supplies assigned to non-taxable persons in the country for the tax period

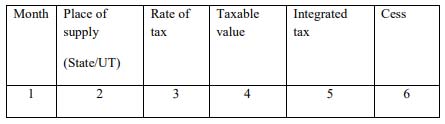

Table 5B: Before the registered individual in India, the taxable outward supplies of online data and database access or retrieval services incurred apart from the non-taxable online recipient where the tax is to get levied via the stated registered individual or reverse charge basis.

Table 5C: Before the registered individual in India the revisions to the taxable outward supplies of the online data and database access or retrieval services incurred apart from the non-taxable online receiver where the tax is obligated to get paid via the said registered persons on a reverse charge basis.

Table 5D: Online money gaming Supplies made to a person in India.

Table 5E: Revision to supplies of online money gaming incurred to an individual in India.

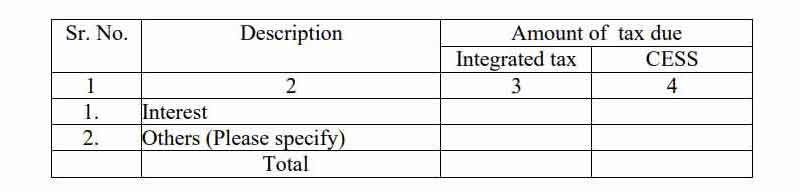

Table 6: Evaluation of penalty, interest and any other amount

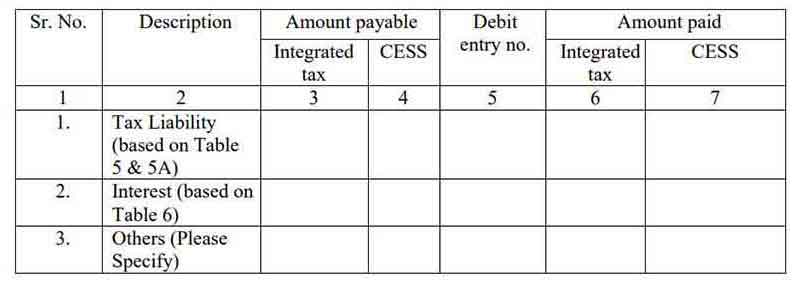

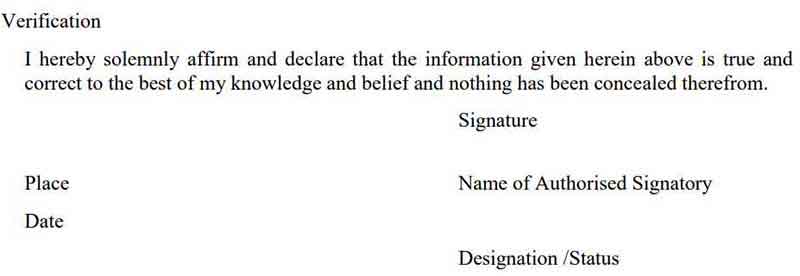

Table 7: Late fee, tax interest, and any other chargeable or paid amount

After completing the GSTR 5A, an acknowledgement is sent and is as well informed automatically through an email to the taxpayer.

General Queries on GSTR 5A Form

Q.1 – What is GSTR-5A?

GSTR-5A is the return which is supposed to be filed by all the Online Information and Database Access or Retrieval (OIDAR) services providers who provide services to the un-registered person or customers from a Foreign Country to a person is sitting in India Conditioned, the person should not be registered.

Q.2 – When should one file GSTR-5A?

This is a monthly return which needs to be filed by 20th of the month following the Tax period for which the return is effective or it could be filed on the extended date which in some special case has been extended by the Commissioner.

Q.3 – Who all are required to file GSTR-5A and Is it mandatory to be filed?

It is mandatory for all the Non-Resident Online Information and Database Access or Retrieval (OIDAR) services providers to file their return through Form GSTR-5A. GSTR-5A is required to be filed even if no Business activity has taken place (Nil Return) in the tax period/regime

Q.4 – Is registration under non-resident OIDAR service providers category is necessary?

Yes, without registration filing under GSTR 5A is not possible.

Q.5 – Are all the OIDAR needed to furnish GSTR 5A?

Only the OIDAR service sources are required to file GSTR 5A those are non-resident and delivering services to government or non-registered persons.

Q.6 – How to file GSTR 5A with the help of Authorised representatives in India on behalf of the service providers?

The legal representatives of the non-resident OIDAR sources can work on behalf of their agent and furnish GSTR 5A. They can also help in paying the taxes due.

Q.7 – Can ITC be availed in GSTR 5A form?

No, there is no norm to get the input tax credit in GSTR 5A. As it is realized from the format that no field or table requires entering the details of the ITC available.

Q.8 – State the available modes for preparing GSTR-5A?

GSTR-5A could be prepared through the below-discussed modes:

- After logging in to the system, data is entered online on the GST portal.

- Using the third party application of the Application Software Provider (ASPs) through GST Suvidha Providers (GSPs) we get all the information about GSTR 5A with FAQs. Information regarding the filing date and the complete procedure is discussed there.

Q.9 – What are the pre-requisites for filing GSTR-5A?

The Pre-requisites for filing GSTR-5A are:

- The Taxpayer should be a registered OIDAR services provider and should be obtaining a valid GSTIN.

- He/she should be carrying a valid User ID and Password. The taxpayer should have a valid & non-expired/non-revoked PAN-based Digital Signature (DSC) to get filed with DSC. The Taxpayers have the facility to file the return through EVC also. In case the authorized signatory is not an Indian citizen, an OTP would be shared through an e-mail message.

Q.10 – From where can I file GSTR-5A?

The steps involved in Filing GSTR-5A is as below:

- Log in to the GST Portal

- Click on Services > Returns > Returns Dashboard command

- This is how GSTR-5A would get filed successfully

Q.11 – What are the details that are required to be furnished in GSTR-5A?

The various details which could be furnished by the taxpayer in the GSTR-5A form are:

- Complete details of taxable outward supplies made to non-taxable persons/ consumers in India

- Amendment to the details which have furnished in preceding tax period(s) could be done.

- Details of interest, or any other amount and offset of the liabilities etc could be viewed here.

Q.12 – Can one file GSTR-5A for the current period in case the return for the previous period has not been filed?

No, there is no such provision. The GSTR-5A return cannot be filed for the current tax period unless the return for the previous tax period is filed.

Q.13 – Can one file GSTR-5A return after making part payment of taxes?

No, there is no such provision and facility made available to the customers to file GSTR-5A after making part payment of taxes. The GSTR-5A form could be filed only after making the full payment of taxes and other liabilities for the return period.

Q.14 – Can OIDAR services provider claim ITC in GSTR-5A?

No, OIDAR services provider cannot claim any ITC in GSTR-5A.

Q.15 – Is there any late fee charged to the taxpayer if he is delayed filing GSTR-5A?

Currently, there is no provision for a late fee in case of a delayed filing of GSTR-5A.

Q.16 – What happens after Form GSTR-5A is filed?

After the GSTR-5A form is successfully filed, acknowledgment is generated and a message through email is sent to the taxpayer on the Indian mobile number of the authorized signatory which has been furnished in the registration application. It is to be noted that if the registered mobile number belongs to the authorised Indian person then the related SMS would also be sent to the same authorized signatory.

Q.17 – Is there an Electronic Credit Ledger available for GSTR-5A?

No Electronic Credit Ledger is maintained for GSTR-5A.

Q.18 – If a person has already made payment on CBEC Portal for GSTR-5A liabilities, does he require to make payment on the GST Portal again?

No, if a taxpayer has already made payment on the CBEC Portal for GSTR-5A liabilities, he is not required to make any payment on the GST Portal again. It is just required to mention the Payment Reference number and Date of the payment as generated in the CBEC Portal on the GST Portal, prior filing GSTR-5A. The Payment Reference number should be either numeric or Alphanumeric and should be up to 25 digits.

How to fill interest liability in GSTR-5A? How to access table 6 in GSTR-5A?

Please goto this link, It will resolve your query https://tutorial.gst.gov.in/userguide/returns/index.htm#t=GSTR-5A.htm