The taxpayer has approached the Apex court contesting the order of the Delhi High Court that dismissed its writ petition and levied Rs 5 lakh after the HC discovered that the applicant had misled the court and tried to evade additional legal measures for the allegedly fake claim of the ITC under the Goods and Services Tax (GST) regime.

The case is concerned with a writ petition filed by M/s Shiva Enterprises, which had asked for the cancellation of its GST registration w.e.f June 30, 2025, specifying the closure of business.

What seemed like a simple cancellation request at first evolved into a significant case concerning alleged ITC fraud and misrepresentation in court.

The Delhi High Court, at the time of dismissing the writ petition, observed that on the conduct of the taxpayer. The court mentioned that the applicant had taken GST input tax credit (ITC) surpassing Rs 1 crore while depositing zero tax in cash, even after reporting an approximate turnover of nearly 6 crore within a lesser time.

Further, HC relied on a field inspection report furnished via the GST department, which mentioned that no business activity was discovered at the declared place of business and that local residents did not accept the existence of any such firm at the address. The registered mobile number of the taxpayer was discovered to be non-operational.

Throughout the proceedings, the proprietor tried to challenge the inspection report by presenting a video that featured a store with a sign displaying the company’s name. On questioning, it specified that the board had been installed merely a day earlier, only for the objective of recording the video.

Also Read: Fraudsters’ Mind vs Govt Intelligence for Fake GST Invoices

HC said that the taxpayer had misled the Court about the nature of his business. The whole attempt seems to have been escaping the legal action via the department for the ITC, which is mentioned to have been taken from fake entities. Also, the applicant tried to misrepresent the status of his shop by hanging a board merely for the objective of taking a video. The court could not condone the same conduct.

The HC, while keeping that the applicant had abused the writ jurisdiction, dismissed the petition and levied Rs 5 lakh, asking the amount to be deposited with the Delhi High Court Bar Association, the GST Department, and the Sales Tax Bar Association in defined proportions.

The Court acknowledged that it could have imposed strict measures on the petitioner but chose not to, as the GST Department had already begun new proceedings by issuing notices for additional investigation and action.

Read Also: How GST Software Handles Input Tax Credit (ITC) Tracking

The taxpayer dissatisfed from the dismissal of the writ petition, along with the levying of high costs, has now approached the Apex court. The challenge is seen as questioning not only the High Court’s unfavourable conclusions regarding conduct but also the proportionality of the costs that were levied.

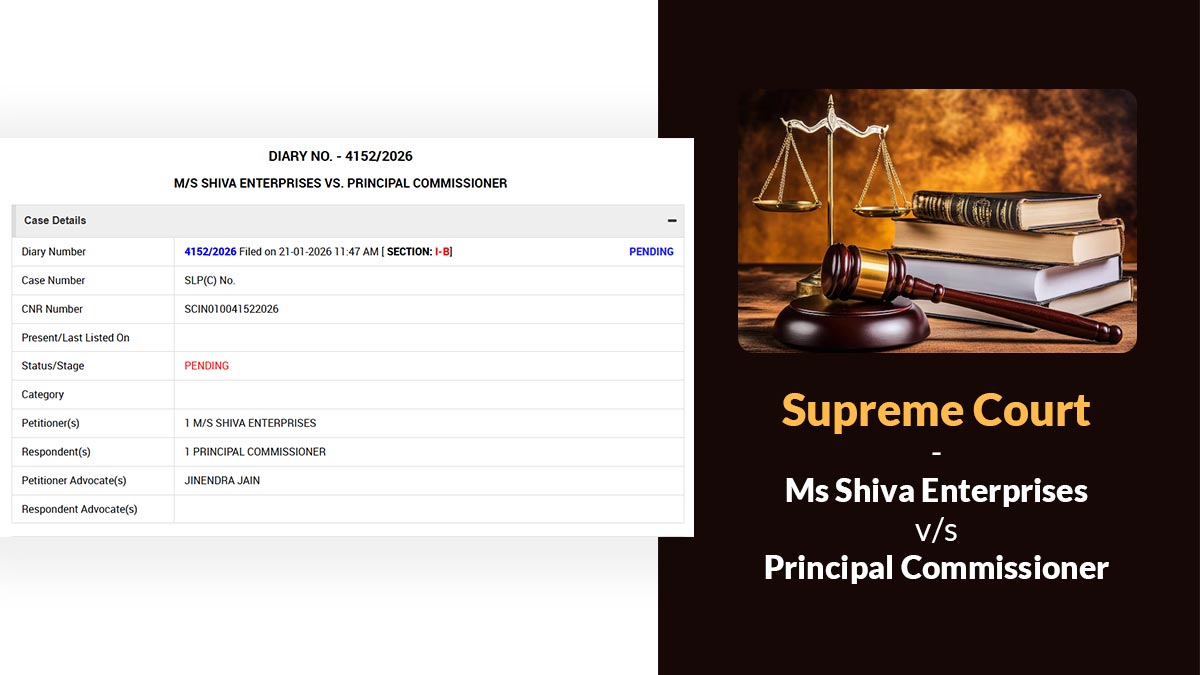

| Case Title | Ms Shiva Enterprises vs. Principal Commissioner |

| Diary No. | 4152/2026 |

| For the Petitioner | Jinendra Jain |