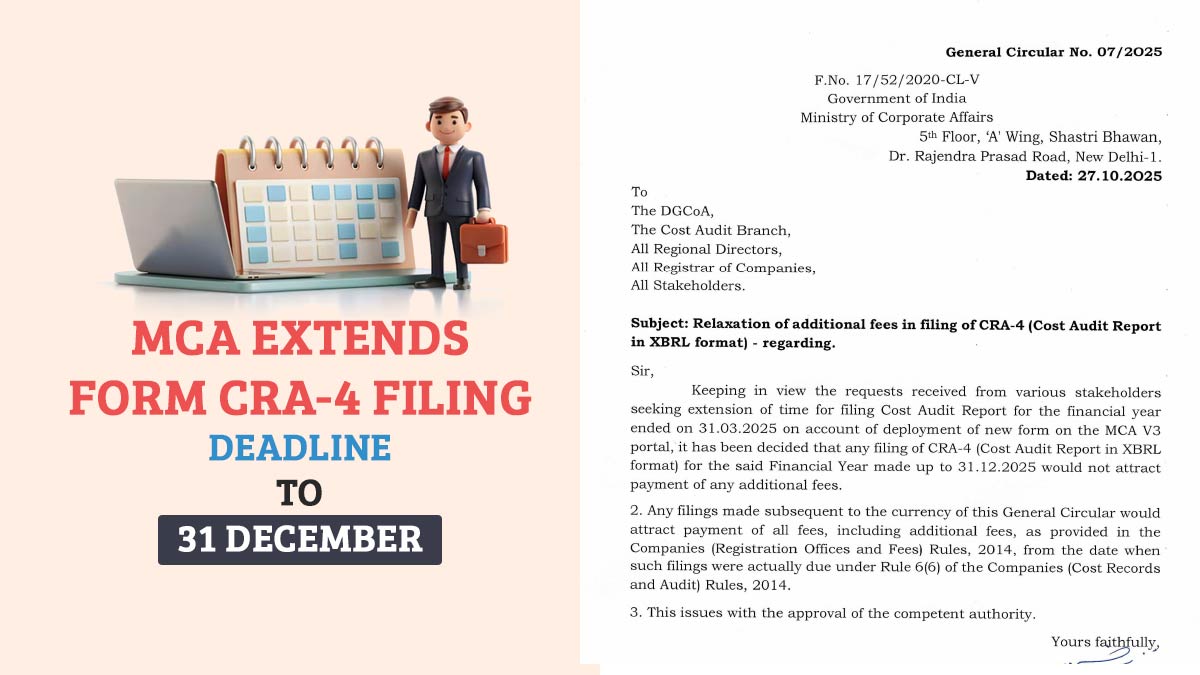

For filing Form CRA-4 (Cost Audit Report in XBRL format) for the financial year ending March 31, 2025, the Ministry of Corporate Affairs (MCA) has extended the deadline, providing relief to companies and cost auditors.

As per General Circular No. 07/2025, issued on October 27, 2025, the extension comes in reply to distinct representations from stakeholders citing challenges stemming from the deployment of the new CRA-4 form on the MCA Version 3 (V3) portal.

No Additional Fees for Filings Till December 31, 2025

MCA specified that no additional fees shall be imposed for the submissions made up to December 31, 2025. The same decision has the motive to facilitate the transition for professionals adapting to the upgraded filing system.

However, all applicable and additional fees will be charged on the filings made after December 31, 2025, as defined under the Companies (Registration Offices and Fees) Rules, 2014, calculated from the original due date specified in Rule 6(6) of the Companies (Cost Records and Audit) Rules, 2014.

Recommended: Easy to File CRA-4 & Annual Forms with Gen Complaw with XBRL Software

Consequently, the cost audit report for the financial year, which ended 31 March this year, will be furnished in the e-Form CRA-4 within 30 days from the date of receipt of the copy of the cost audit report by the company.

However, if a company has extended the time for holding the Annual General Meeting, e-Form CRA-4 can be filed within the predefined timeline provided under the proviso to Rule of 6 (6) of the Companies Rules (Cost Records and Audit) Rules 2014.