While discovering that the taxpayer has a valid reason to acknowledge the payments for ‘transactional charges’ to be not covered u/s 194J(1)(ba) of the Income Tax Act, the New Delhi ITAT ordered to deletion of the penalty order passed by the CIT(A) u/s 271C.

Under Section 194J(1)(ba) of the Income Tax Act, any payment made to the director like sitting fees, remuneration, or any other sum other than those on which tax deductible under section 192 is to be considered for deduction of tax at source at 10% rate under section 194J.

Section 271C of the Income Tax Act stresses the law connecting to the penalty that the Income Tax Department must levy for failure to deduct TDS or remit TDS before the applicable due date.

The Bench of the ITAT, Anubhav Sharma (Judicial Member) and Dr. B.R.R. Kumar (Accountant Member) witnessed that “After considering the explanation given by the assessee in regard to the ‘Transaction charges which the tax authorities have considered as ‘Professional charges’ paid to directors falling in limb (ba) of sub-section (1) of section 194J of the Act, it comes up that the PCIT has accepted the plea of the assessee that payments made to directors on account of sitting fee is allowable. The assessee seems to have had valid reasons to consider the payments on account of ‘transactional charges’ to be not covered by Section 194J(1)(ba) of the Act as there is no such head in this section. Thereby not deducting the TDS seems to be out of bonafide belief. Imposition of penalty is thus not justified.” (Para 4)

Case Facts of Ambience Private Limited vs ITO

As per the information from ACIT, a verification was finished under section 201(1)/201(1A) and it was marked that at the time of survey procedures performed at the premises of the taxpayer’s company, it was discovered that the taxpayer was making payments for the directors sitting fees amounting to Rs.6,80,000 without deduction of TDS subsequently.

Also, the taxpayer had paid an amount of Rs.10,89,200 for the transaction charges being professional payment without deduction of TDS in breach of section 194J. Therefore, after issuing a SCN under section 271C, the penalty order was passed.

As per the petition, the CIT(A) had bifurcated the payments to directors as a sitting fee penalty to the extent of Rs.68,000. However, he maintained the penalty of Rs.1,08,920 for professional charges paid to directors.

Tribunal Observations

The bench learned that the taxpayer was beneath the bonafide belief that no TDS is needed to get deducted from the sitting fees of the Directors.

The Bench noted that the taxpayer is covered under the provisions of section 273B which cites that when there is a reasonable cause no penalty under section 271C must be levied.

The Bench noted that concerning the Transaction charges, the taxpayer was beneath the bonafide belief that no class of TDS under which the same transaction would counted, and therefore the taxpayer does not deduct the TDS. The same shall not be out of place to cite that the payee does not pay the whole taxes on all the obtained transaction charges from the taxpayer in their respective tax return.

Hence, the ITAT permitted the petition of the taxpayer on finding that the penalty levying was not justified.

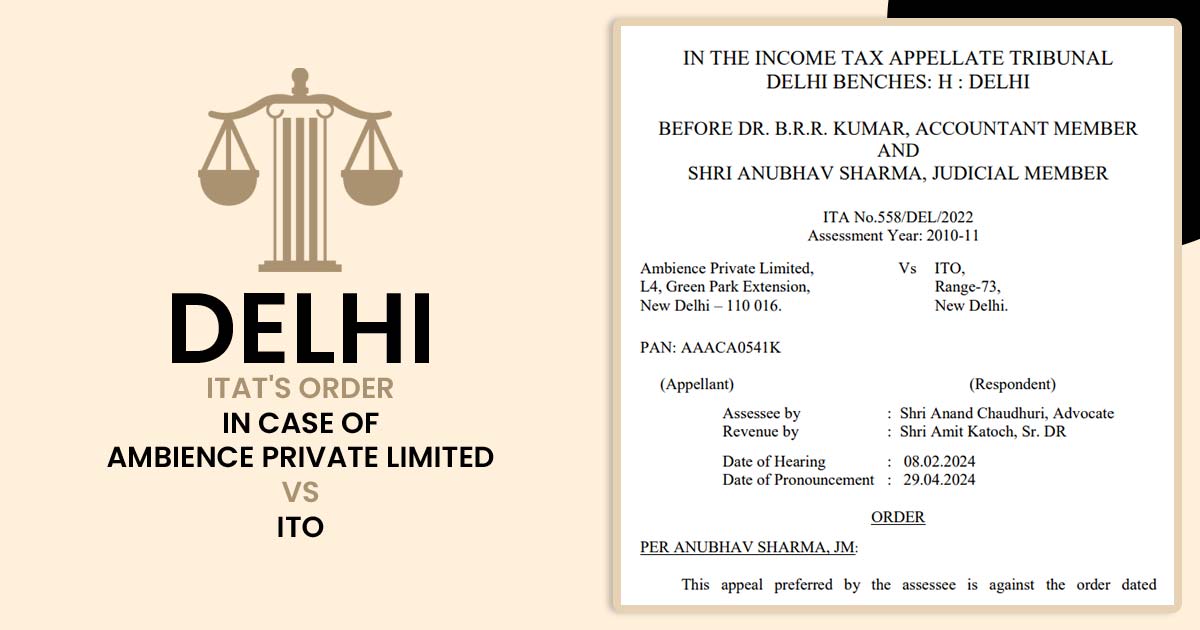

| Case Title | Ambience Private Limited vs ITO |

| Citation | ITA No.558/DEL/2022 |

| Date | 29.04.2024 |

| Assessee by | Shri Anand Chaudhuri, Advocate |

| Revenue by | Shri Amit Katoch, Sr. DR |

| Delhi High Court | Read Order |