A relief has been granted by the Delhi High Court before Satwant Singh Sanghera, a pilot formerly employed with the now-collapsed Kingfisher Airlines, against a tax demand of over Rs 11 lakh.

It was claimed by Singh that he had duly furnished his ITR for the said assessment years and the company had deducted TDS from his salary. It was shown in Form 16A issued via the company.

He claimed that the amount was not deposited with the government as of the default of the company and he is not obligated to file the tax which was already deducted from his remuneration.

Singh laid on Section 205 of the Income Tax Act, of 1961 which restricts the direct demand on taxpayers to the extent to which the tax has been deducted from his income.

The Assistant Commissioner of Income Tax had issued an intimation to the Petitioner u/s 245 of the Income Tax Act.

The income tax department has been empowered by the provision to adjust any due demand from an earlier assessment year against the refund of the existing year. The same adjustment emerges when the assessee has not filed the tax obligation from an earlier year and a refund is available in the present year.

It was marked by the High Court bench of Justices Vibhu Bakru and Swarna Kanta Sharma that the problem before it is covered via an earlier decision of the coordinate bench in Sanjay Sudan v. The Assistant Commissioner of Income Tax & Another (2023).

It was carried that neither can the demand qua the tax deducted via the deductor/employer get recovered from him nor can the identical amount get adjusted against the future refund, if any, liable to get paid to him.

On 01.06.2015 the High Court mentioned that issued via CBDT, specifying that the deductee/assessee could not be called to file the tax, which has been deducted at source from his income.

As per that the HC set aside the demand notices and asked the revenue to refund the amount obligated to Singh.

Appearance: Advocate Archit Arora for the applicant; Senior Standing Counsel Shlok Chandra with Junior Standing Counsel Naincy Jain and Madhavi Shukla, and Advocate Sushant Pandey for Revenue

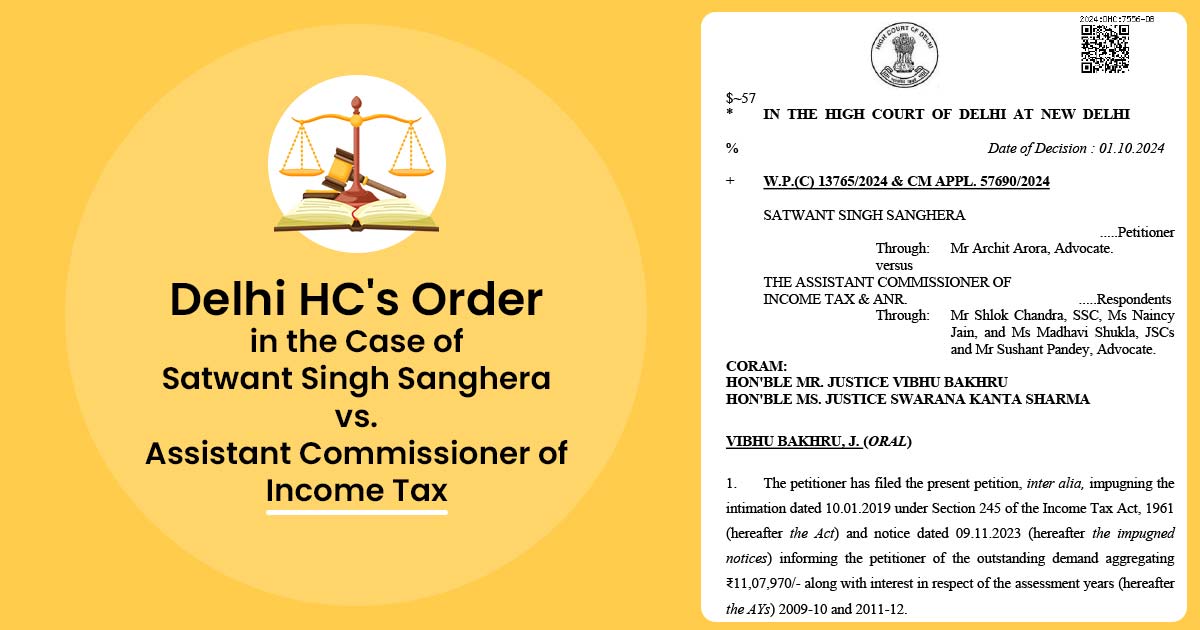

| Case Title | Satwant Singh Sanghera Vs. Assistant Commissioner of Income Tax |

| Citation | W.P.(C) 13765/2024 & CM APPL. 57690/2024 |

| Date | 10.10.2024 |

| Counsel For Petitioner | Mr Archit Arora |

| Counsel For Respondent | Mr Shlok Chandra, Ms Naincy Jain, Ms Madhavi Shukla, and Mr Sushant Pandey |

| Delhi High Court | Read Order |