The Delhi High Court granted a stay on the charge of Goods and Services Tax (GST), including interest and penalties, on the Competition Commission of India (CCI) for consideration received by the Commission from diverse parties in dispute before it.

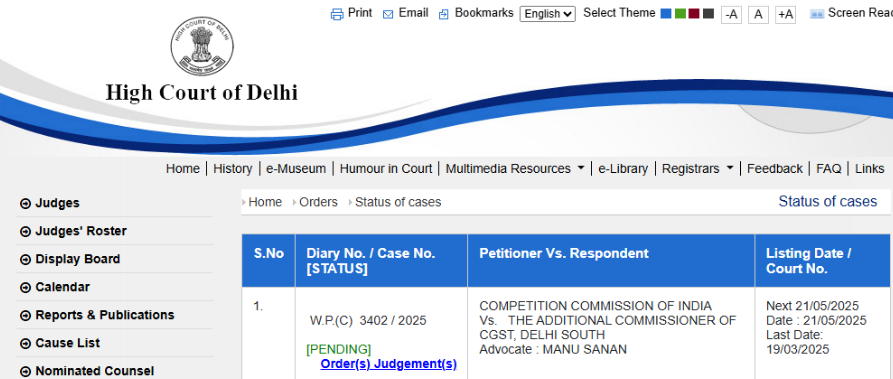

A bench of Justices Yashwant Verma and Harish Vaidyanathan Shankar issued the stay in a writ petition filed by the CCI contesting the order issued by the Additional Commissioner of CGST (Delhi South).

CCI claimed that the order of the CGST Commissioner was poor since it losses to consider a ruling of the Delhi High Court where it was ruled that the activities of the Central Electricity Regulatory Commission (CERC) were not charged to tax under the CGST Act, 2017, since statutory regulatory functions do not entitle as ‘business’ and are waived under Schedule III of the CGST Act.

CCI also outlined that it has challenged the identical issues in earlier service tax proceedings, where authorities ruled that its activities were not charged to tax. In those proceedings, the orders determined that all fees accumulated by the CCI are statutorily mandated, and no ‘service’ is inherent in its functions. The GST department has appealed that decision and the case stayed pending before the Customs, Excise and Service Tax Appellate Tribunal (CESTAT).

Read Also: Delhi CESTAT: No Service Tax on Business Exhibitions Held Abroad

CCI asked for equality with CERC and DERC, which the Court accepted.

Senior Advocate Sujit Ghosh and Advocate Manu Sanan of Sanan Law, have represented CCI.

Source: BarandBench