A Non-Resident Indian (NRI) residing in the US is facing an unexpected ordeal after selling his Pune property for ₹2 crore, despite complying with all regulations.

The issue emerges when the buyer deposits 20% TDS on the sale via the wrong form. NRIs’ records of tax have come into discrepancy from this mistake, as well as imposing a tax demand of Rs 46 lakh from the income tax department.

The buyer deducted Rs 18.68 lakh (20% TDS) from the sale proceeds and deposited it with the tax department, as per the order of the Delhi High Court on May 27, 2025.

The buyer, rather than using Form 27Q, designated for NRI sellers, used Form 26QB, intended for resident sellers. Therefore, the deducted tax is not shown in the Annual Information Statement (AIS) of the seller, deterring him from claiming the TDS credit at the time of filing his ITR.

INR 46 Lakh IT Notice

The NRI, while unaware of the error of the buyer, computed his actual capital gains tax obligation at Rs 1.91 lakh and filed the same as advance tax. The income tax department, due to the missing TDS credit in his AIS and non-filing of the ITR, considered him non-compliant. Therefore, u/s 148 (b), a notice was issued by them in March 2023, recommending that the income had not undergone the assessment.

The department does not consider the NRI’s furnished proof of advance tax payment and transaction information. An order of more than Rs 46 lakh in taxes has been issued by the tax officer in March 2025, and the penalty proceedings u/s 270A.

While quoting the norms of procedure, the department does not consider the buyer, even when it produces a valid bank challan confirming the TDS deposit. It was cited by Standard Operating Procedure (SOP) that rectifying the TDS forms needs the buyer’s written consent, an indemnity bond, and other supporting documents. To rectify the form, the bank is undergoing delays in processing the request of buyer.

Delhi High Court Prefers NRI

NRI with no option left has petitioned before the Delhi High Court for relief. The income tax department in court validated the tax deposit, though it stated that the process cannot be rectified internally without the buyer’s cooperation.

As the deposit TDS was not disputed, the HC questioned the necessity of the buyer’s consent. The department said that any future refund claims of the buyer for the TDS deposited were important to prevent.

But, the court ruled in favour of the NRI, expressing, “In the peculiar facts of this case, we consider it apposite to direct the Revenue to correct the record and reflect the TDS deposited by the buyers to the petitioner’s credit under the return filed in the Form 26QB with effect from the date the amount was deposited.”

The income tax department should compute any NRI refund due, the court said, and must consider all the conflicting orders and communications as replaced.

The Case

- 1998: NRI purchases property in Pune.

- March 2015: Buyer agrees to purchase the property for Rs 2 crore.

- September 2015: Buyer deducts Rs 18.68 lakh TDS and pays the remaining amount to the NRI.

- October 2015: NRI computes tax liability as Rs 1.91 lakh and deposits it as advance tax. No ITR is filed.

- March 2023: U/s 148 Income Tax Department issues a notice.

- March 2025: A tax demand has been raised by the department of Rs 46.8 lakh even after the response of the NRI (Non-resident Indian) and advance tax proof.

The NRI’s tax record showed that they had paid an advance tax of Rs 1.91 lakh. However, it didn’t include the tax that was deducted by the buyer because of a mistake in filing.

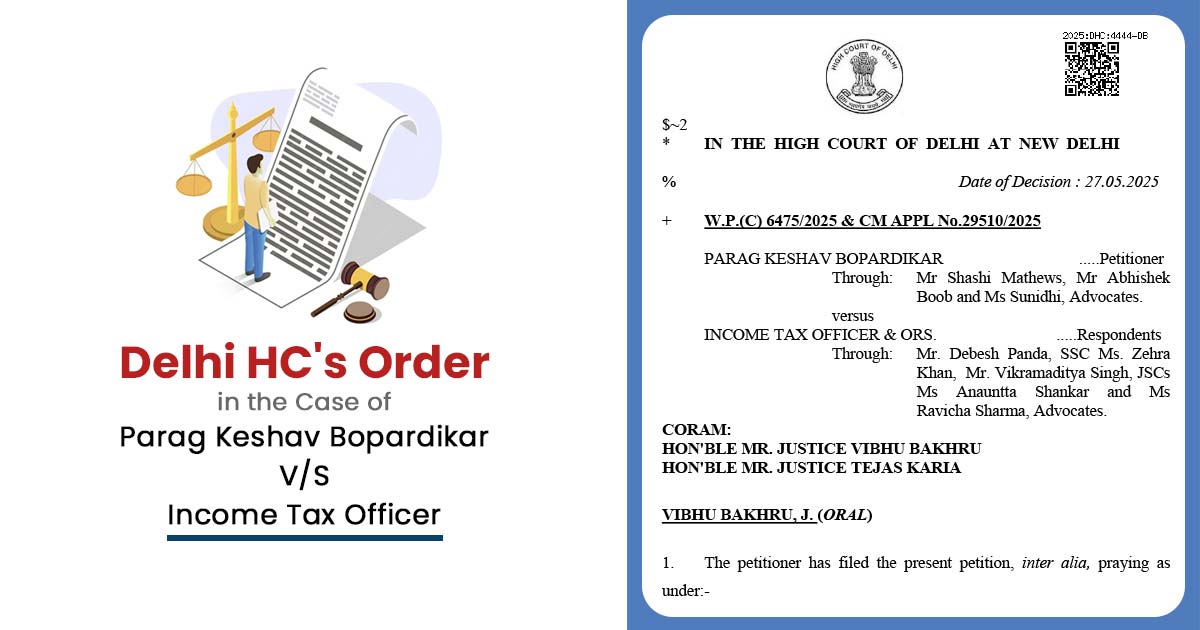

| Case Title | Parag Keshav Bopardikar Vs. Income Tax Officer |

| Case No. | W.P.(C) 6475/2025 & CM APPL No.29510/2025 |

| For Petitioner | Mr Shashi Mathews, Mr Abhishek Boob and Ms Sunidhi |

| For Respondent | Mr. Debesh Panda, Ms. Zehra Khan, Mr. Vikramaditya Singh, Ms Anauntta Shankar and Ms Ravicha Sharma |

| Delhi High Court | Read Order |