What is a Company Auditor Report?

The audit report is a critical deliverable for every organization since it reveals the final outcomes of the whole audit process. Users of financial statements, such as investors, lenders, customers, and others, base their judgments and plans on an enterprise’s audit reports.

An audit report is always important in affecting the perceived value of an audited financial statement. The auditor should exercise caution while providing the audit report since many individuals rely on such findings and make judgments based on them. The report should be provided while being impartial and objective in carrying out the tasks.

Basic Contents Needed in a Company Auditor Report

The audit report’s basic structure as defined via the Standards on Auditing is as follows:

| Heading | Short of Content |

|---|---|

| Title | ‘Independent Auditor’s Report’ should be the title. |

| Addressee | Must specify to whom the report would get furnished. For instance, the members specify that the same would be the liability of the management to prepare the financial statements. For the company, and the Board of Directors. |

| Management’s Responsibility for Financial Statements | |

| Responsibility of Auditor | Specify the obligation of the auditor to elaborate the unbiased view on the financial statements and provide the audit report |

| Opinion | Must need to specify the whole impression taken via the audit of the financial statements for instance the modified opinion, or an unmodified opinion. |

| Additional Reporting Responsibility | If there exists any reporting responsibility then it must be specified. For instance the report on the statutory needs. |

| Basis of Opinion | Specifies the grounds where the view as reported would get achieved. The facts of the grounds must be specified. |

| Place of Signature | The audit report signed by the city |

| Auditor Signature | The audit report will be signed by the engagement partner (auditor) |

| Date of Audit Report | The signed date of the audit report |

How Gen Bal Software is Best for CAs and Tax Professionals in India?

One of the most popular Balance Sheet Software for Chartered Accountants is Gen BAL. The software makes it extremely simple to automatically calculate profit and loss statements in order to quickly prepare balance sheets. It supports the direct import of trial balances from third-party accounting software such as Busy and Tally. Users may also save 3CA/CB files from within the app and upload them afterwards. Apart from sample fund flow and cash flow statements.

Gen BAL may be used to create audit forms, yearly returns, and depreciation calculations. One of our Balance Sheet Software’s biggest features is the ability to import data straight from Tally, Busy, MS Excel, and other popular accounting and tax software. Based on the Trial Balance entered by the user, the software may create balance sheets, profit-loss statistics, trading accounts, and lists automatically.

Steps to View Company Auditor Report Via Gen Bal Software

Step 1:- First Install Gen Balance Sheet Software on your PC and Laptop.

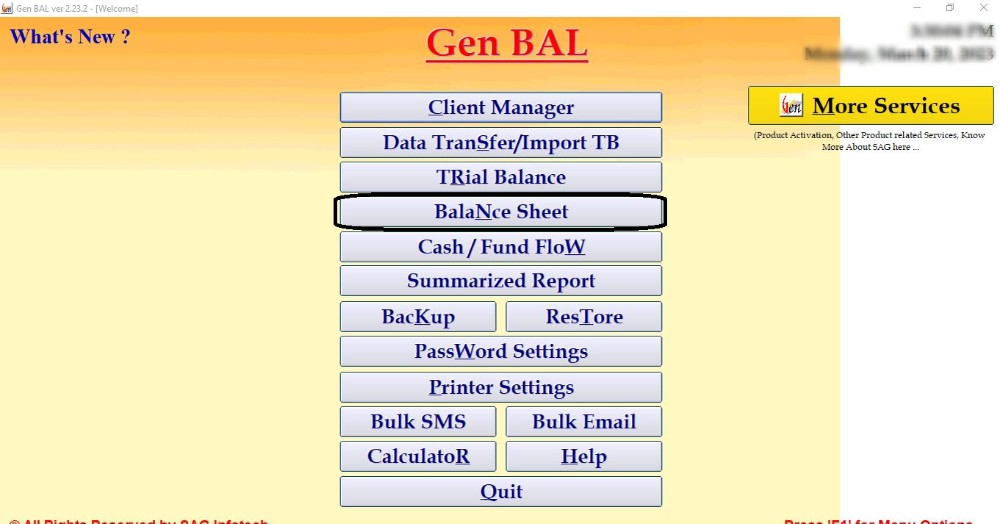

Step 2:- Open the Gen Bal Software and click on Balance Sheet Tab.

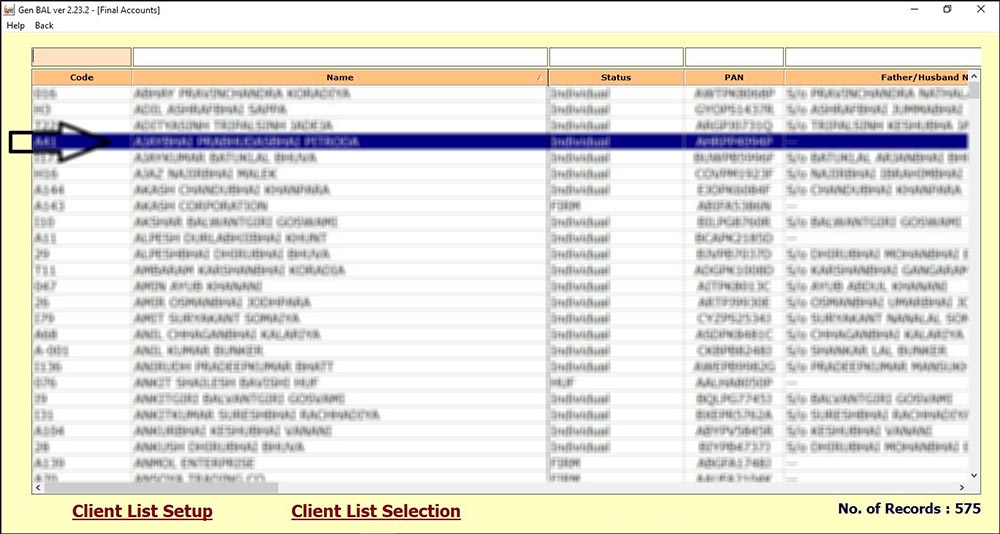

Step 3:- Select the client of which you want to view the Company Audit Report.

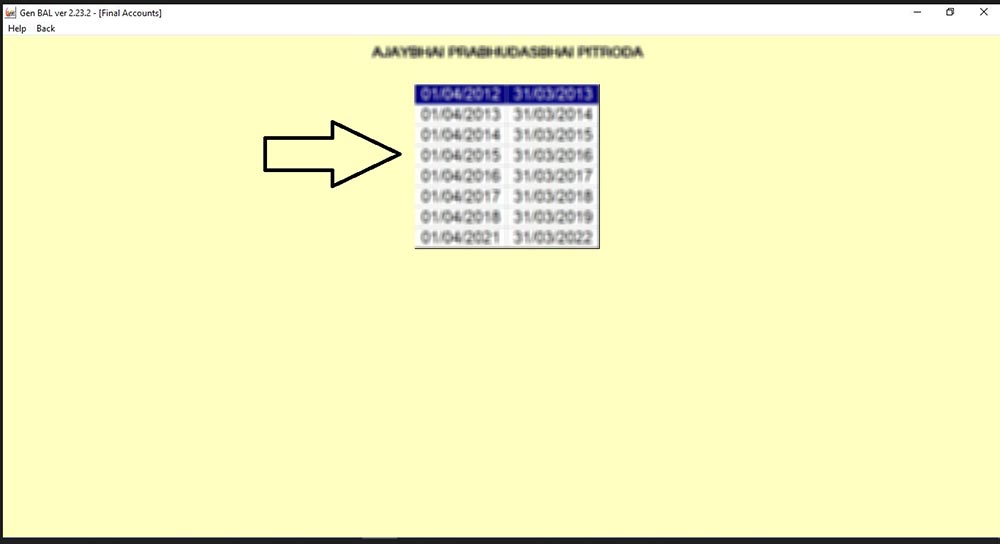

Step 4:- Select the year in which you want to View Company Audit Report.

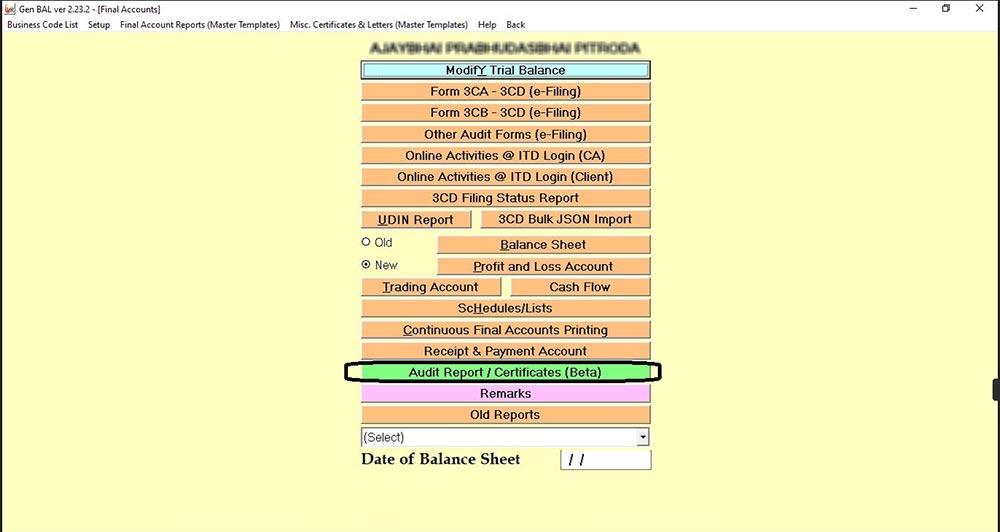

Step 5:- Click on the Audit Report/Certificates (Beta) tab.

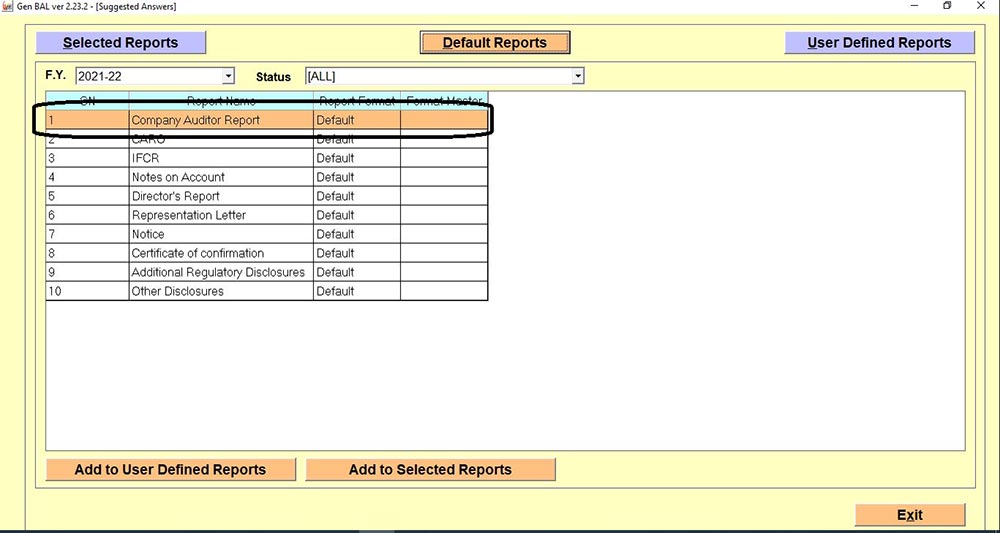

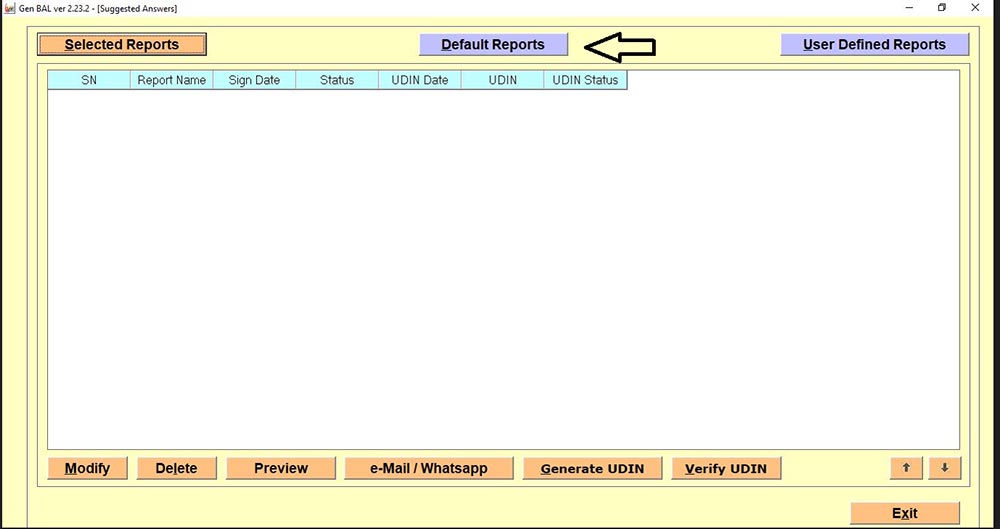

Step 6:- Click on the Default Reports tab.

Step 7:- Click on the Company Audit Report tab and click on Add to Selected Report after going to Selected Report, you can take the printout of the Company Audit Report.