To avoid higher TDS or TCS, the Income Tax Department has reminded taxpayers to link their PAN with Aadhaar till 31 May 2024.

Rs 1000 would be required to be deployed by the individual via the e-filing portal for linking their PAN with their Aadhaar. When you don’t link your PAN with your Aadhaar and wish to check whether your PAN is working or not then one of the methods to verify the same would be through your Form 26AS.

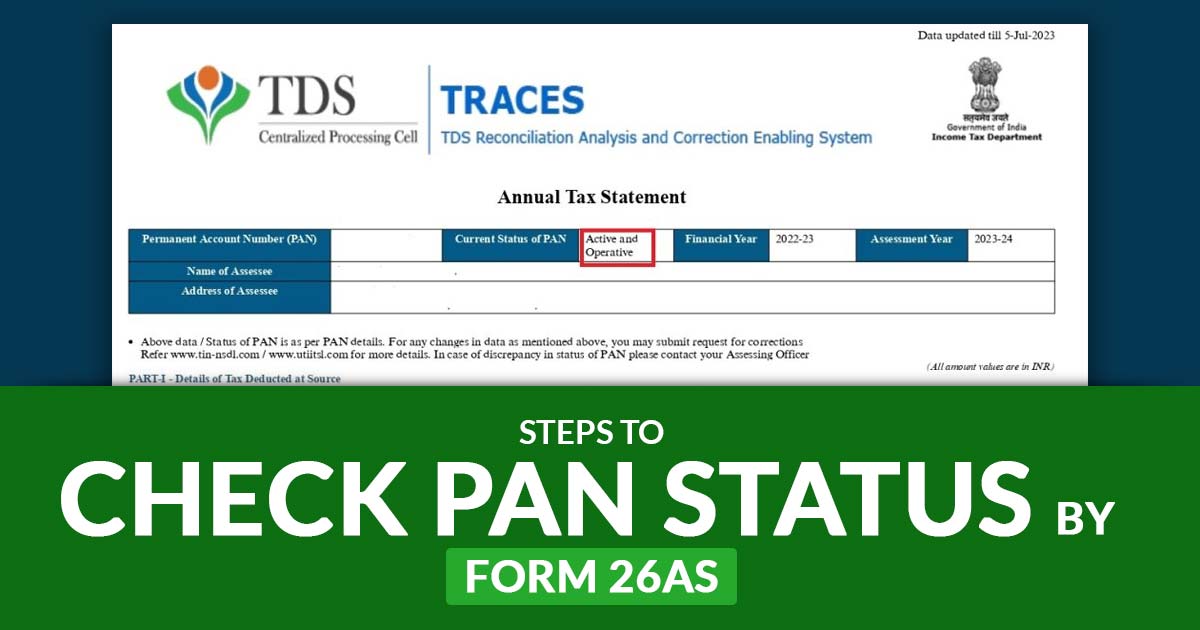

Steps to Check Your PAN Status via Form 26AS

Step 1: Login Income tax portal through the link https://www.incometax.gov.in/iec/foportal/

Step 2: Under the e File tab tap on Income Tax Returns

Step 3: Tap on View Form 26 AS from the list. Confirm the Disclaimer and mark the tick box and tap Proceed

Step 4: Tap on View Tax Credit (Form 26AS/Annual Tax Statement)

Step 5: You may check the PAN’s current status to verify if it is active and operational.

If your PAN is now inactive, it can be made active again in 30 days by notifying the appropriate authority and paying a charge of Rs. 1,000 on the Aadhaar intimation.

“The PAN can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of a fee of Rs.1,000.”

Steps to Check PAN Validity

Step 1: Proceed to the e-filing portal homepage.

Step 2: On the e-filing homepage tap on validating your PAN.

Step 3: Enter your PAN, Full Name, Date of Birth, and Mobile Number (accessible to you), and tap Continue at the time of verifying your PAN page.

Step 4: Enter the 6-digit OTP obtained on the mobile number entered in Step 3 and tap Validate, on the page of verification.

The PAN of assessees who have not provided their Aadhaar as necessary will no longer be active and the following repercussions will apply while this is the case:

- Against these PANs; there will be no reimbursement made.

- For the time that PAN is still inactive, interest on such a return is not due; and

- At a higher rate, TDS/TCS will get deducted/collected as mentioned in the act.

Read Also: Protean & UTIITSL Accept Biometric Authentication for PAN-Aadhar Demographic Mismatches

What is the Method to Check PAN Aadhaar Linking Status?

Step 1: Go to the Income Tax Department’s official website – incometax.gov.in/iec/foportal/

Step 2: Open the Quick Links section and select Link Aadhaar Status

Step 3: Insert your PAN and Aadhaar Card number

Step 4: Tap on the option of ‘View Link Aadhaar Status’

Step 5: The screen will prompt the PAN-Aadhaar link status

The screen will display linked if your PAN card and Aadhaar would get linked and if not then the same shall show the information to link the two cards.