A revision in the GSTR-9 annual return form has been cited by a tax expert, which has a submission due date of December 31, 2025, for FY 2024-25.

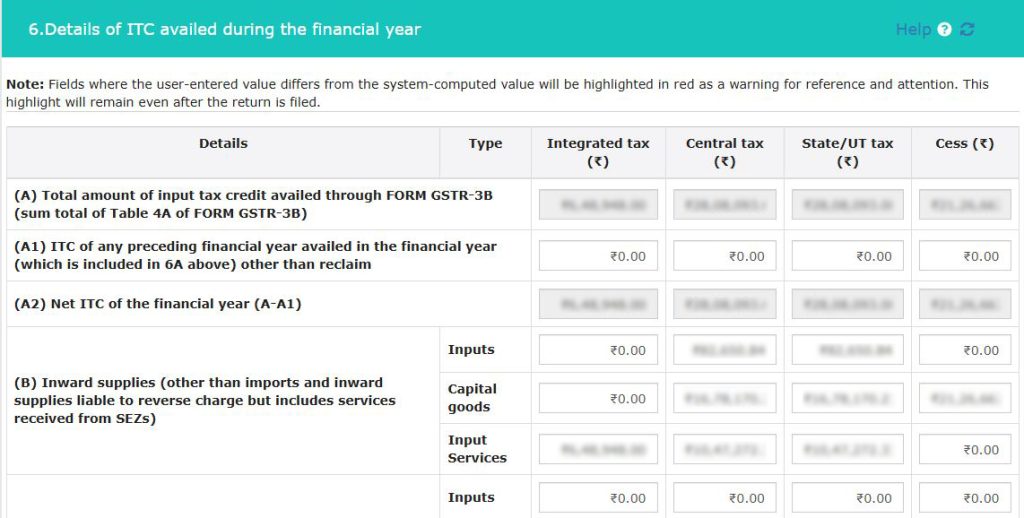

There is a revision in Table 6 that applies only to the GSTR-9 form.

A notable update has been made to GSTR-9 reporting. Two new rows have been added to Table 6 specifically for reporting Input Tax Credit (ITC) related to the previous financial year. under Table 6A1 and Net ITC available under Table 6A2.

This information should ideally align with the data provided in Table 13-12 from the prior year, with exceptions only for rare, borderline cases. Furthermore, specific exemptions for certain tables in the Annual Return have been established for the financial year 2024-25.

The rollout of Table 6A1 in GSTR-9 specifies a measure to rectify the clarity and transparency.

The same new table fills in the earlier data gaps of the ITC claims for previous fiscal years, for which the notices were repeatedly.

Taxpayers via Table 6A1 can specify a precise and reconciled view of their ITC claims, helping the taxpayer and the tax officer at the time of desk reviews. It lessens the possibility of scrutiny or notices and helps reduce litigation costs concerning both time and money.

Taxpayer to take the entire advantage of this development need to ensure their books of accounts and working papers are maintained and correct. The department seems to compare the numbers in Table 12 (reversal of ITC) and 13(for availing ITC) of the previous year return with those reported in the current year Table 6A1 for consistency and verification.

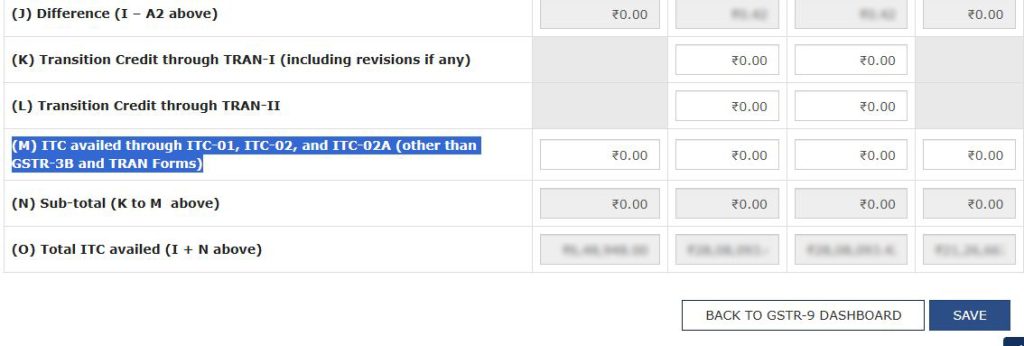

There is also a change in label w.r.t Table 6M, which is now “ITC availed through ITC-01, ITC-02, and ITC-02A (other than GSTR-3B and TRAN Forms)”, previously it was ” Any other ITC availed but not specified above”.

These changes have been introduced through Central Tax Notification No. 13/2025, dated 17th September, in Table 6 of GSTR-9 to streamline the reporting of ITC details.