The Central Board of Direct Taxes (CBDT) issued notification no. 35/2025 to widen the tax base and ensure effective monitoring of high-value transactions by revising the Income Tax Rules, 1962.

The newly released Income-tax (11th Amendment) rules, 2025, section 295, read with section 206C of the Income-tax Act, 1961, sellers are now obligated to collect tax at source (TCS) on the sale of several luxury and collectible goods.

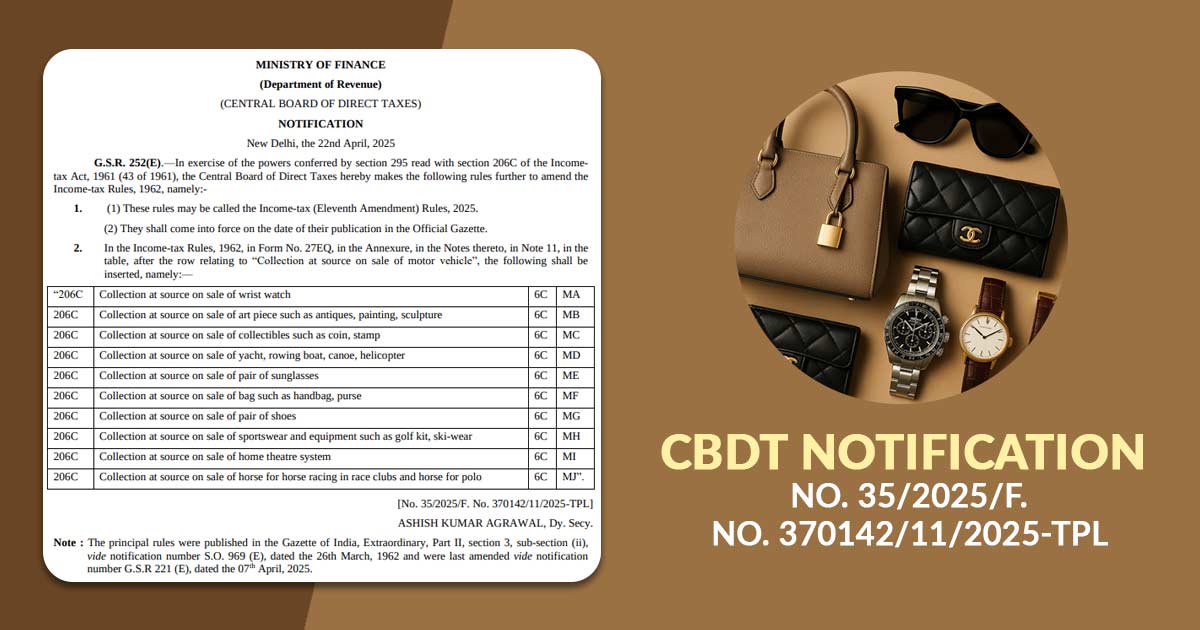

TCS shall be applied on the below-mentioned items for sale, as per the notification [G.S.R. 252(E)]-

- Luxury transport items like yachts, rowing boats, canoes, and helicopters

- Artworks including antiques, paintings, and sculptures

- Wrist watches

- Sunglasses and handbags/purses

- Branded footwear and sports kits, including golf kits and ski-wear

- Home theatre systems

- Horses used for horse racing and polo

- Collectibles such as coins and stamps

Into Form 27EQ, the same amendment has been incorporated and shall come into force from the date of publication in the Official Gazette.

For strict compliance and to draw high-value discretionary spending into the tax net, the same proceeds of the government are seen as the wider strategy. The same measure supports authorities to track wealth effectively and lessen tax evasion in the luxury goods market.

Importance for Sellers and Buyers

Sellers for collecting tax at source from buyers at the applicable rate are now obligated towards the particular goods, which shall be deposited with the income tax department. Appropriate TCS credits are shown in the buyer’s Form 26AS (Annual Statement) is to be ensured for easier tax filings.

Background and Legal Framework

Under Section 295 read with Section 206C of the Income-tax Act, 1961, the notification was issued. Notification G.S.R. 221(E) dated April 7, 2025, revises the rules and is the most updated one.

The notification specifies an amendment in compliance, mandating system-level and operational readiness for TCS filings to be within time and precise for those dealing in luxury and collectible markets.