The Calcutta High Court supported a decision made by the Income Tax Appellate Tribunal (ITAT) that eliminated an additional charge of over ₹4 crore on a taxpayer’s income during a review of their taxes.

It was ruled by the division bench of Chief Justice TS Sivagnanam and Justice Bivas Pattanayak that the assessing officer had made a mistake in not disposing of the written objection furnished by the taxpayer against the assessment reopening.

It noted that “The duty cast upon the assessing officer is to decide the written objections given by the assessee to the proposed reopening and passing a speaking order and if the order goes against the assessee, the taxpayer has a liberty to challenge the order by filing a writ petition as no other alternative remedy is provided under the provisions of the Income Tax Act, 1961.”

The court was dealing with the plea of the revenue against the ITAT order permitting the taxpayer’s plea and quashing the assessment order u/s 147 for not disposing of the raised objections via the taxpayer.

The decision of Madras High Court in M/s. Home Finders Housing Limited has been quoted by ITAT. The Income Tax Officer (2017) where the reassessment order was set aside and the case was remitted back to the AO for the failure to pass a speaking order on the raised objections via the taxpayer.

The High Court relied on GKN Driveshafts [India] Ltd. vs. ITO (2003) where the Supreme Court specified the procedure for dealing with objections raised against a reassessment notice.

It carried that when a notice u/s 148 of the Income Tax Act is issued then the proper course of measure for the taxpayer is to submit the return and if he wishes the same then to ask for the reasons to issue the notices.

After that, the assessing officer is forced to provide the reasons within a reasonable time. The taxpayers on receipt of the reasons qualified to submit the objections to the issuance of the notice and the assessing officer is forced to dispose of it via passing a speaking order, the Top court carried.

“It is not in dispute that the assessing officer did not follow the procedure laid down by the Hon’ble Court in GKN Driveshafts [India] Ltd. [supra]. Therefore, the learned Tribunal was justified in allowing the assessee’s appeal on the said ground. Thus, we find no ground to interfere with the impugned order,” the High Court held and dismissed the appeal of Revenue.

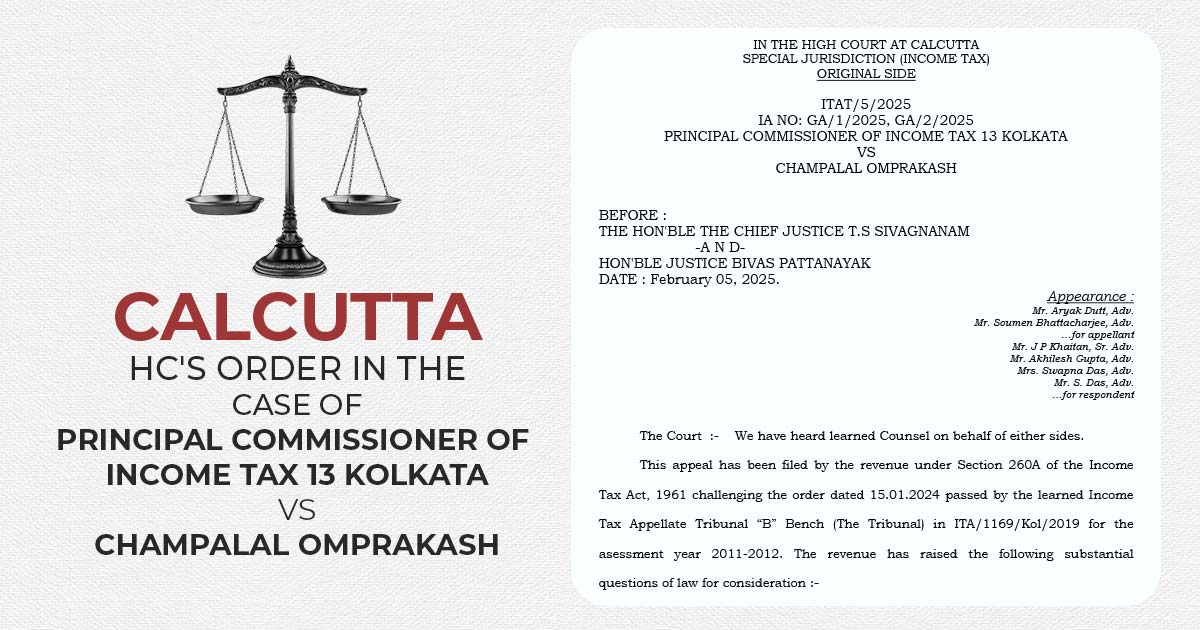

| Case Title | Principal Commissioner Of Income Tax 13 Kolkata Vs Champalal Omprakash |

| Citation | IA NO: GA/1/2025, GA/2/2025 |

| Date | 05.02.2025 |

| Fof The Appearance | Mr. Aryak Dutt, Mr. Soumen Bhattacharjee |

| For the Appellant | Mr J P Khaitan, Mr Akhilesh Gupta, Mrs Swapna Das, Mr S. Das |

| Calcutta High Court | Read Order |