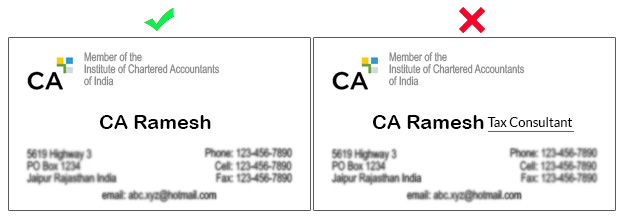

The ICAI has released an important announcement for the Chartered Accountant that the CAs could not mention any other non-acquired designations apart from CA on visiting cards. This decision has been made because the members of ICAI has mentioned various other designations on their visiting card like tax consultant, income tax officer, Company Secretary, CPA, etc which they do not officially possess the field degree or experience.

Even the Chartered Accountant could not mention other designations on their professional document, letterheads and signboards, untill unless they have acquired it as a degree of a university established by law in India or a title indicating membership of the Institute of Chartered Accountant.

Further, an important notice for all the Chartered Accountant members that are given below which is appearing at page no. 154 of the code of Ethics, 2009 under commentary of item (7):

“It is improper for a Chartered Accountant to state on his professional documents that he is an Income-tax Consultant, Cost Accountant, Company Secretary, Cost Consultant or a Management Consultant”.

Moreover, the members of the institute, who are under training or practice and are eligible for Company Secretaries or Cost Accountant should not use their designation on the visiting cards.

Source: http://www.icai.org/new_post.html?post_id=11383&c_id=219