As per Bombay HC, no tax is to be charged on the transit rent as it is not to be deemed as a revenue receipt. Consequently, no question of tax deduction at source (TDS) is there from the amount leviable via the developer to the tenant. The bench of Justice Rajesh S. Patil has marked that the ordinary meaning of rent would be an amount that the tenant or licensee pays before the landlord.

The Bombay High Court carried that ‘Transit Rent’ is not to be deemed a revenue receipt and is not accountable to be levied to taxed. Consequently, no question of the deduction of TDS from the amount liable to get paid by the developer to the tenant is there.

The bench of Justice Rajesh S. Patil marked that the ordinary meaning of rent is the amount that the tenant or licensee furnishes before the landlord or licensee. In the proceedings, the term used is “transit rent,” which is commonly referred to as a hardship allowance, rehabilitation allowance, or displacement allowance, which is filed via the developer or landlord to the tenant who suffers hardship as of dispossession.

The respondent/developer strived photocopies of the PAN cards of the owners/petitioner to deduct TDS from the amount subjected to get paid as `transit rent.’

The applicant argued that no question of the deduction of TDS from the transit rent is there.

Section 194(I) of the Income Tax Act refers to rent, and in the explanation of the section, the term “rent” is clarified. “Rent” indicates any payment, by whatever name called, under any lease, sub-lease, tenancy, or any other agreement or arrangement for the use of (either separately or together).

No tax is to be imposed on the amounts received by the assessee as hardship compensation, rehabilitation compensation, and for shifting, the court ruled.

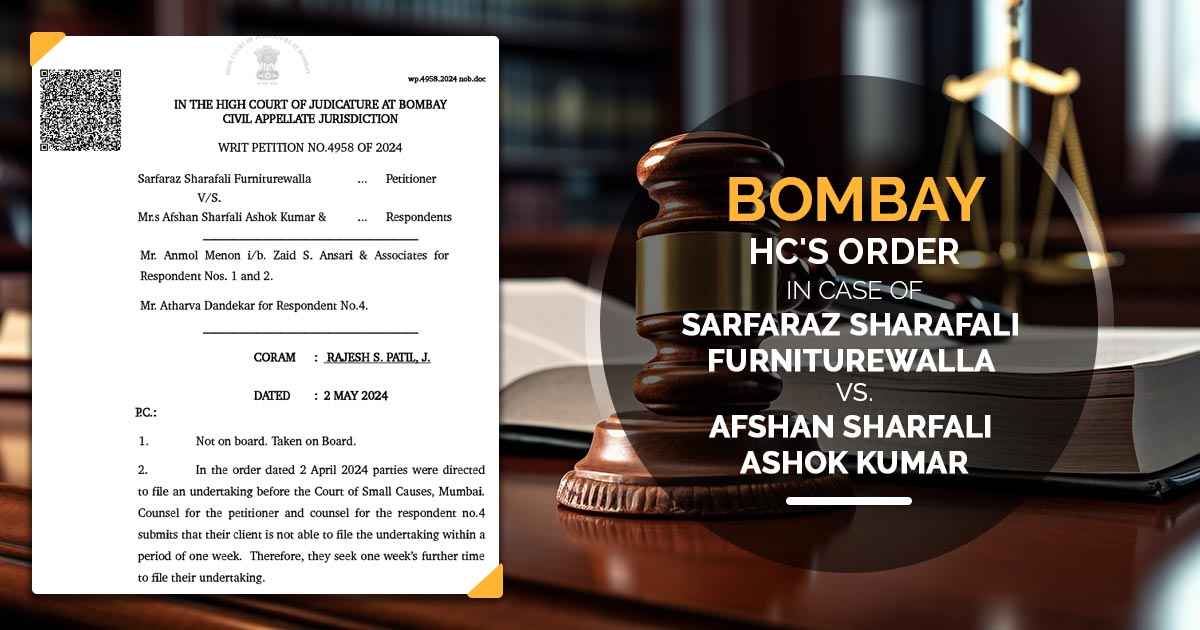

| Case Title | Sarfaraz Sharafali Furniturewalla Vs. Afshan Sharfali Ashok Kumar |

| Case No.: | WRIT PETITION NO.4958 OF 2024 |

| Date | 02.05.2024 |

| Counsel For Petitioner: | Rustom Pardiwala |

| Counsel For Respondent: | Zaid Ansari |

| Bombay High Court | Read Order |