The Bombay High Court on 22nd May 2020 allowed the National Anti-profiteering Authority (NAA)

In this petition, it has been come to know that the respondent-authority Union of India has been seeking information from the petitioner Saphire Foods Pvt. Ltd. since August 6, 2019, and even after several reminders issued time to time by the authority, the petitioner has not submitted the information.

The petitioner responded that some of the information is already submitted but the remaining records and information can be only submitted by them by visiting their office premises. The counsel for the respondent-authority stated, “After all such information is submitted by the petitioner, the authority will take at least 30 days’ time to submit a report,”.

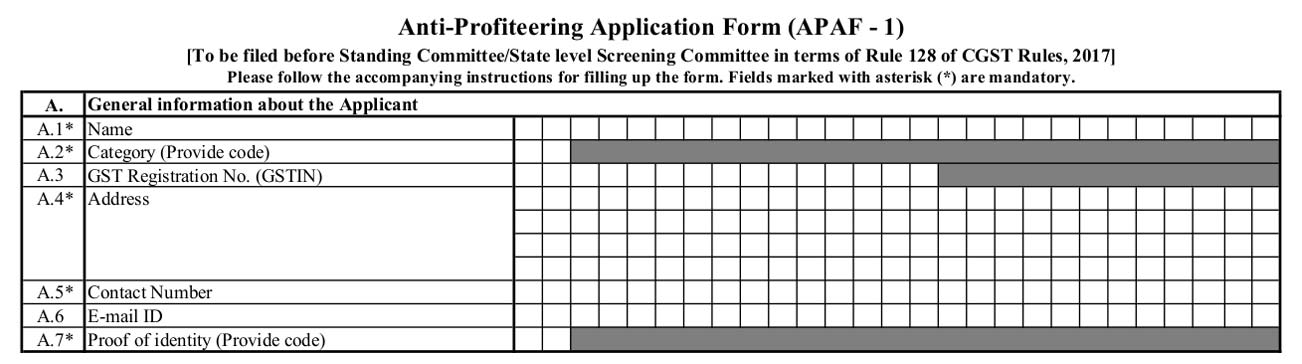

Read Also: How to Fill Anti-Profiteering Complaint of Under GST?

In this petition, the order comes from the division bench of Justice Ajay Ahuja and Justice R.D. Dhanuka and they directed the petitioner to furnish all the remaining and required records and information on or before June 8, 2020. The petitioner also gets the liberty to visit the premises of the petitioner’s office and to gather all required records and information, if any, they can even take the assistance of the necessary staff.

The Bench said that “It is made clear that if any such permission is required to visit the office premises of the petitioner from the concerned police station, such permission shall be granted to the petitioner and its staff with such conditions as it deems fit. It is made clear that no further extension of time would be granted to the petitioner to furnish such information. No coercive steps shall be taken against the petitioner till 10th June 2020 by the respondent no.1 for not furnishing information. After such information is furnished, the respondents shall prepare a report within the time prescribed i.e. up to 30th June 2020.”.